Financing business expansion

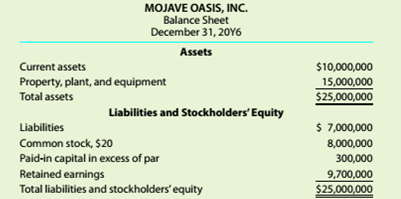

You hold a 30% common stock interest in the family-owned business, a vending machine company. Your sister, who is the manager, has proposed an expansion of plant facilities al an expected cost of $6,000,000. Two alternative plans have been suggested as methods of financing the expansion. Each plan is briefly described as follows:

Plan 1, Issue $6,000,000 of 15-year. 8% notes at face amount.

Plan 2. Issue an additional 100.000 shares of $20 par common stock at $25 per share, and $3,500,000 of 15-year. 8% notes at face amount.

The

Net income has remained relatively constant over the past several years. The expansion program is expected to increase yearly income before bond interest and income tax from $900,000 in the previous year to $1,200,000 for this year. Your sister has asked you. as the company treasurer, to prepare an analysis of each financing plan.

a. Discuss the factors that should be considered in evaluating the two plans.

b. Which plan offers the greater benefit to the present stockholders? Give reasons for your opinion.

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

CengageNOWv2, 1 term Printed Access Card for Warren's Survey of Accounting, 8th

- A supplier offers credit terms of 2/10, net 30, meaning a 2% discount is available if payment is made within 10 days. If a company purchases $12,000 worth of goods and pays within 7 days, calculate the amount paid after applying the discount.arrow_forwardQuestionarrow_forwardKindly help me with accounting questionsarrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College