Concept explainers

Flexible

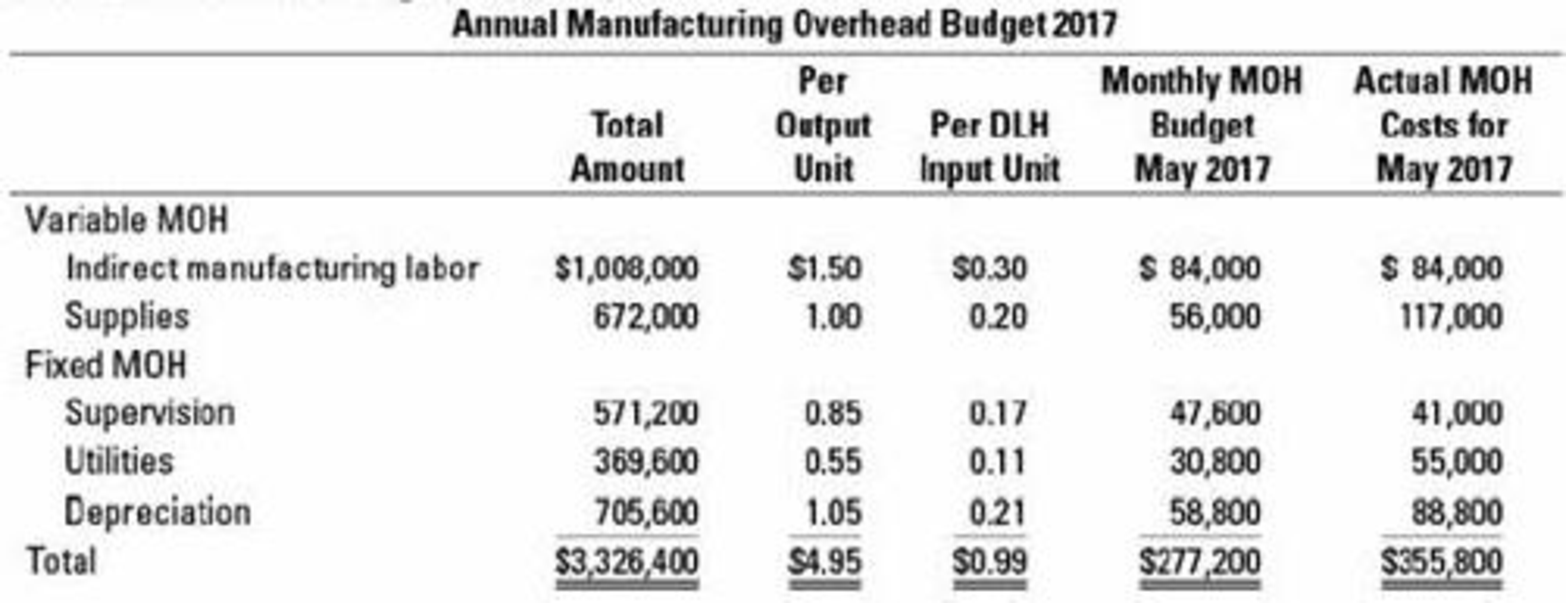

A total of 72;000 output units requiring 321,000 DLH was produced during May 2017. Manufacturing overhead (MOH) costs incurred for May amounted to $355,800. The actual costs, compared with the annual budget and 1/12 of the annual budget, are as follows:

Calculate the following amounts for Wilson Products for May 2017:

- A. Total

manufacturing overhead costs allocated

Required

- B. Variable manufacturing overhead spending variance

- C. Fixed manufacturing overhead spending variance

- D. Variable manufacturing overhead efficiency variance

- E. Production-volume variance

Be sure to identify each variance as favorable (F) or unfavorable (U).

Trending nowThis is a popular solution!

Chapter 8 Solutions

EBK HORNGREN'S COST ACCOUNTING

- P4.1A Record transactions on accrual basis; convert revenue to cash receipts The following selected data are taken from the comparative financial statements of Yankee Curling Club. The club prepares its financial statements using the accrual basis of accounting. September 30 2022 2021 Accounts receivable for member dues $ 15,000 $ 19,000 Unearned sales revenue 20,000 23,000 Service revenue (from member dues) 151,000 135,000 Dues are billed to members based upon their use of the club's facilities. Unearned sales revenues arise from the sale of tickets to events, such as the Skins Game. Instructions (Hint: You will find it helpful to use T-accounts to analyze the following data. You must analyze these data sequentially, as missing information must first be deduced before moving on. Post your journal entries as you progress,…arrow_forwardFlare Enterprises sells a product in a competitive marketplace. Market analysis indicates that its product would probably sell at $60 per unit. Flare management desires a 15% profit margin on sales. Their current full cost for the product is $52 per unit. In order to meet the new target cost, how much will the company have to cut costs per unit, if any? a. $3 b. $4 c. $5 d. $1 provide answer to this financial accounting questionarrow_forwardWhat is the smartphone divisions capital turnover?arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning