Concept explainers

Aging of receivables; estimating allowance for doubtful accounts

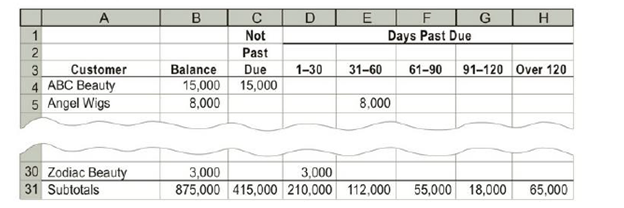

Wig Creations Company supplies wigs and hair care products to beauty salons throughout Texas and the Southwest. The

The following accounts were unintentionally omitted from the aging schedule. Assume all due dates are for the current year except for Visions Hair & Nail, which is due in the next year.

| Customer | Due Date | Balance |

| Arcade Beauty | Aug. 17 | $10,000 |

| Creative Images | Oct. 30 | 8,500 |

| Excel Hair Products | July 3 | 7,500 |

| First Class Hair Care | Sept. 8 | 6,600 |

| Golden Images | Nov. 23 | 3,600 |

| Oh That Hair | Nov. 29 | 1,400 |

| One Stop Hair Designs | Dec. 7 | 4,000 |

| Visions Hair & Nail | Jan. 11 | 9,000 |

Wig Creations has a past history of uncollectible accounts by age category, as follows

| Age Class | Percent Uncollectible |

| Not past due | 1% |

| 1-30 days past due | 4 |

| 31-60 days past due | 16 |

| 61 -90 days past due | 25 |

| 91-120 days past due | 40 |

| Over 120 days past due | 80 |

Instructions

- 1. Determine the number of days past due for each of the preceding accounts.

- 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.

- 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule.

- 4. Assume that the allowance for doubtful accounts for Wig Creations has a credit balance of $7,375 before adjustment on December 31. Journalize the adjustment for uncollectible accounts.

- 5. Assume that the

adjusting entry in (4) was inadvertently omitted, how would the omission affect thebalance sheet and income statement?

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Bundle: Financial & Managerial Accounting, Loose-leaf Version, 14th + Working Papers For Warren/reeve/duchac's Corporate Financial Accounting, 14th + ... Financial & Managerial Accounting,

Additional Business Textbook Solutions

Horngren's Accounting (12th Edition)

Intermediate Accounting (2nd Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Financial Accounting, Student Value Edition (5th Edition)

FUNDAMENTALS OF CORPORATE FINANCE

- At the beginning of the year, Downtown Athletic had an inventory of $200,000. During the year, the company purchased goods costing $800,000. If Downtown Athletic reported ending inventory of $300,000 and sales of $1,050,000, their cost of goods sold and gross profit rate must be ............ The Stacy Company makes and sells a single product, Product R. Budgeted sales for April are $300,000. Gross Margin is budgeted at 30% of sales dollars. If the net income for April is budgeted at $40,000, the budgeted selling and administrative expenses are: - $133,333 - $60,000 - $102,000 - $78,000. CALIN CORPORATION HAS TOTAL CURRENT ASSETS OF $615,000, TOTAL CURRENT LIABILITIES OF $230,000, TOTAL STOCKHOLDERS EQUITY OF $1,183,000, TOTAL PLANT AND EQUIPMENT (NET) OF $958,000, TOTAL ASSETS OF $1,573,000, AND TOTAL LIABILITIES OF $390,000. THE COMPANY'S WORKING CAPITAL ISarrow_forwardHii ticher please given correct answer general Accounting questionarrow_forwardWhat were total sales for the year?? General accountingarrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning