Concept explainers

Aging of receivables; estimating allowance for doubtful accounts

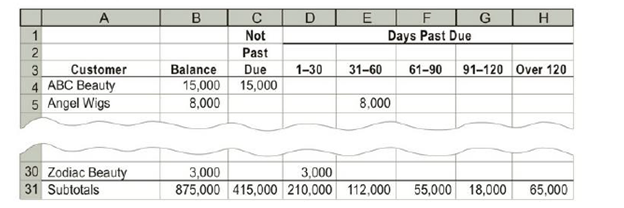

Wig Creations Company supplies wigs and hair care products to beauty salons throughout Texas and the Southwest. The

The following accounts were unintentionally omitted from the aging schedule. Assume all due dates are for the current year except for Visions Hair & Nail, which is due in the next year.

| Customer | Due Date | Balance |

| Arcade Beauty | Aug. 17 | $10,000 |

| Creative Images | Oct. 30 | 8,500 |

| Excel Hair Products | July 3 | 7,500 |

| First Class Hair Care | Sept. 8 | 6,600 |

| Golden Images | Nov. 23 | 3,600 |

| Oh That Hair | Nov. 29 | 1,400 |

| One Stop Hair Designs | Dec. 7 | 4,000 |

| Visions Hair & Nail | Jan. 11 | 9,000 |

Wig Creations has a past history of uncollectible accounts by age category, as follows

| Age Class | Percent Uncollectible |

| Not past due | 1% |

| 1-30 days past due | 4 |

| 31-60 days past due | 16 |

| 61 -90 days past due | 25 |

| 91-120 days past due | 40 |

| Over 120 days past due | 80 |

Instructions

- 1. Determine the number of days past due for each of the preceding accounts.

- 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.

- 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule.

- 4. Assume that the allowance for doubtful accounts for Wig Creations has a credit balance of $7,375 before adjustment on December 31. Journalize the adjustment for uncollectible accounts.

- 5. Assume that the

adjusting entry in (4) was inadvertently omitted, how would the omission affect thebalance sheet and income statement?

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Bundle: Financial & Managerial Accounting, Loose-Leaf Version, 14th + CengageNOWv2, 2 terms Printed Access Card

Additional Business Textbook Solutions

Horngren's Accounting (12th Edition)

Intermediate Accounting (2nd Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Financial Accounting, Student Value Edition (5th Edition)

FUNDAMENTALS OF CORPORATE FINANCE

- Cost account solution needarrow_forwardWe note the following adjusted trial balance totals: Cash $ 21,000 Accounts Receivable $ 20,000 Allowance for Doubtful Accounts $2,000 Merchandise Inventory $ 20,000 Accounts Payable $16,000 Capital $ 3,000 Sales Sales Returns Cost of Goods Sold Other Expenses Gross profit is: a. $56,000 b. $50,000 c. $80,000 d. $74,000 $ 80,000 $ 6,000 $ 24,000 $ 10,000arrow_forwardcorrect answer please general accountingarrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning