Concept explainers

Aging of receivables; estimating allowance for doubtful accounts

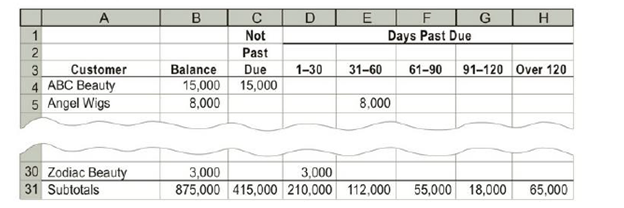

Wig Creations Company supplies wigs and hair care products to beauty salons throughout Texas and the Southwest. The

The following accounts were unintentionally omitted from the aging schedule. Assume all due dates are for the current year except for Visions Hair & Nail, which is due in the next year.

| Customer | Due Date | Balance |

| Arcade Beauty | Aug. 17 | $10,000 |

| Creative Images | Oct. 30 | 8,500 |

| Excel Hair Products | July 3 | 7,500 |

| First Class Hair Care | Sept. 8 | 6,600 |

| Golden Images | Nov. 23 | 3,600 |

| Oh That Hair | Nov. 29 | 1,400 |

| One Stop Hair Designs | Dec. 7 | 4,000 |

| Visions Hair & Nail | Jan. 11 | 9,000 |

Wig Creations has a past history of uncollectible accounts by age category, as follows

| Age Class | Percent Uncollectible |

| Not past due | 1% |

| 1-30 days past due | 4 |

| 31-60 days past due | 16 |

| 61 -90 days past due | 25 |

| 91-120 days past due | 40 |

| Over 120 days past due | 80 |

Instructions

- 1. Determine the number of days past due for each of the preceding accounts.

- 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.

- 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule.

- 4. Assume that the allowance for doubtful accounts for Wig Creations has a credit balance of $7,375 before adjustment on December 31. Journalize the adjustment for uncollectible accounts.

- 5. Assume that the

adjusting entry in (4) was inadvertently omitted, how would the omission affect thebalance sheet and income statement?

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Financial and Managerial Accounting - With CengageNow

Additional Business Textbook Solutions

Horngren's Accounting (12th Edition)

Intermediate Accounting (2nd Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Financial Accounting, Student Value Edition (5th Edition)

FUNDAMENTALS OF CORPORATE FINANCE

- Which principle dictates that a business should report revenue when it is earned and expenses when they are incurred? A. Matching Principle B. Revenue Recognition Principle C. Cost Principle D. Accrual Principle Helparrow_forwardAnswer this all Question step by steparrow_forwardWhat was Lexington corps stockholders equity at December 31?arrow_forward

- ?!arrow_forwardAt the beginning of the year, Alpine Corp.'s liabilities equal $95,000. During the year, assets increased by $25,000, and at the end of the year, assets equal $270,000. Liabilities increased by $40,000 during the year. Calculate the amount of equity at the beginning of the year. A. $250,000 B. $150,000 C. $100,000 D. $175,000arrow_forwardCan you help me with accounting questionsarrow_forward

- A product has a selling price of $63, variable costs of $55, and fixed costs are $72,000. How many units must be sold to break even? A) 3,000 B) 5,000 C) 2,500 D) 9,000 correct answerarrow_forwardWhat is the Crestwood financials' dividend payout ratio of this financial accounting question?arrow_forwardHello tutor please help me with accounting questionsarrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning