Corporate Financial Accounting

14th Edition

ISBN: 9781305653535

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 8, Problem 8.2BPR

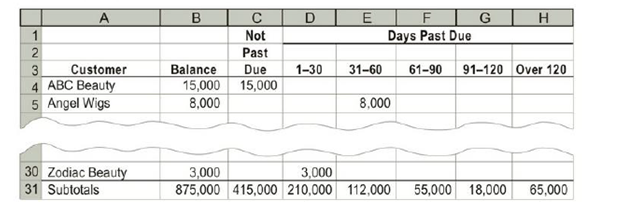

Aging of receivables; estimating allowance for doubtful accounts

Wig Creations Company supplies wigs and hair care products to beauty salons throughout Texas and the Southwest. The

The following accounts were unintentionally omitted from the aging schedule. Assume all due dates are for the current year except for Visions Hair & Nail, which is due in the next year.

| Customer | Due Date | Balance |

| Arcade Beauty | Aug. 17 | $10,000 |

| Creative Images | Oct. 30 | 8,500 |

| Excel Hair Products | July 3 | 7,500 |

| First Class Hair Care | Sept. 8 | 6,600 |

| Golden Images | Nov. 23 | 3,600 |

| Oh That Hair | Nov. 29 | 1,400 |

| One Stop Hair Designs | Dec. 7 | 4,000 |

| Visions Hair & Nail | Jan. 11 | 9,000 |

Wig Creations has a past history of uncollectible accounts by age category, as follows

| Age Class | Percent Uncollectible |

| Not past due | 1% |

| 1-30 days past due | 4 |

| 31-60 days past due | 16 |

| 61 -90 days past due | 25 |

| 91-120 days past due | 40 |

| Over 120 days past due | 80 |

Instructions

- 1. Determine the number of days past due for each of the preceding accounts.

- 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.

- 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule.

- 4. Assume that the allowance for doubtful accounts for Wig Creations has a credit balance of $7,375 before adjustment on December 31. Journalize the adjustment for uncollectible accounts.

- 5. Assume that the

adjusting entry in (4) was inadvertently omitted, how would the omission affect thebalance sheet and income statement?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Problem 3-1B

Identifying adjusting entries with explanations

P1 P2 P3 P4

For journal entries 1 through 12, indicate the explanation that most closely describes it. You can use

explanations more than once.

A.

To record payment of a prepaid expense.

B.

To record this period's use of a prepaid expense.

C.

To record this period's depreciation expense.

D.

To record receipt of unearned revenue.

E.

To record this period's earning of prior unearned revenue.

F.

To record an accrued expense.

G.

To record payment of an accrued expense.

H.

To record an accrued revenue.

I.

To record receipt of accrued revenue.

1.

Interest Receivable

3,500

7. Cash

1,500

Interest Revenue

3,500

Accounts Receivable (from services)

1,500

2.

Salaries Payable

9,000

8. Salaries Expense

7,000

Cash

9,000

Salaries Payable

7,000

3. Depreciation Expense

8,000

9.

Cash

1,000

Accumulated Depreciation.

8,000

Interest Receivable

1,000

4.

Cash

9,000

10.

Unearned Revenue

9,000

Prepaid Rent

Cash

3,000

3,000

5.

Insurance Expense

4,000…

None

Please give me answer accounting

Chapter 8 Solutions

Corporate Financial Accounting

Ch. 8 - What are the three classifications of receivables?Ch. 8 - Dans Hardware is a small hardware store in the...Ch. 8 - What kind of an account (asset, liability, etc.)...Ch. 8 - After the accounts are adjusted and closed at the...Ch. 8 - A firm has consistently adjusted its allowance...Ch. 8 - Which of the two methods of estimating...Ch. 8 - Neptune Company issued a note receivable to...Ch. 8 - Prob. 8DQCh. 8 - The maker of a 240,000, 6%, 90-day note receivable...Ch. 8 - Prob. 10DQ

Ch. 8 - Direct write-off method Journalize the following...Ch. 8 - Allowance method Journalize the following...Ch. 8 - Percent of sales method At the end of the current...Ch. 8 - Analysis of receivables method At the end of the...Ch. 8 - Note receivable Prefix Supply Company received a...Ch. 8 - Prob. 8.1EXCh. 8 - Prob. 8.2EXCh. 8 - Entries for uncollectible accounts, using direct...Ch. 8 - Entries for uncollectible receivables, using...Ch. 8 - Entries to write off accounts receivable Creative...Ch. 8 - Providing for doubtful accounts At the end of the...Ch. 8 - Prob. 8.7EXCh. 8 - Aging of receivables schedule The accounts...Ch. 8 - Estimating allowance for doubtful accounts Evers...Ch. 8 - Adjustment for uncollectible accounts Using data...Ch. 8 - Estimating doubtful accounts Outlaw Bike Co. is a...Ch. 8 - Entry for uncollectible accounts Using the data in...Ch. 8 - Entries for bad debt expense under the direct...Ch. 8 - Entries for bad debt expense under the direct...Ch. 8 - Effect of doubtful accounts on net income During...Ch. 8 - Effect of doubtful accounts on net income Using...Ch. 8 - Entries for bad debt expense under the direct...Ch. 8 - Entries for bad debt expense under the direct...Ch. 8 - Determine due date and interest on notes Determine...Ch. 8 - Entries for notes receivable Valley Designs Issued...Ch. 8 - Entries for notes receivable The series of five...Ch. 8 - Entries for notes receivable, including year-end...Ch. 8 - Entries for receipt and dishonor of note...Ch. 8 - Entries for receipt and dishonor of notes...Ch. 8 - Receivables on the balance sheet List any errors...Ch. 8 - Allowance method entries The following...Ch. 8 - Aging of receivables; estimating allowance for...Ch. 8 - Compare two methods of accounting for...Ch. 8 - Details of notes receivable and related entries...Ch. 8 - Notes receivable entries The following data relate...Ch. 8 - Sales and notes receivable transactions The...Ch. 8 - Allowance method entries The following...Ch. 8 - Aging of receivables; estimating allowance for...Ch. 8 - Compare two methods of accounting for...Ch. 8 - Details of notes receivable and related entries...Ch. 8 - Prob. 8.5BPRCh. 8 - Sales and notes receivable transactions The...Ch. 8 - Continuing Company AnalysisAmazon: Accounts...Ch. 8 - Ralph Lauren: Accounts receivable turnover and...Ch. 8 - Prob. 8.3ADMCh. 8 - Prob. 8.4ADMCh. 8 - Ethics In Action Bud Lighting Co. is a retailer of...Ch. 8 - Communication On January 1, Xtreme Co. began...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please correct answer with accounting and questionarrow_forward???arrow_forward$240 Assume that a company produced 10,000 units and sold 8,000 units during its first year of operations. It has also provided the following information: Particulars Selling price Per unit per year Direct materials $85 Direct labor $57 Variable manufacturing overhead $10 Sales commission $11 Fixed manufacturing overhead P Fixed selling and administrative expense $250,000 If the company's unit product cost under absorption costing is $197, then what is the amount of fixed manufacturing overhead per year?arrow_forward

- Janet Foster bought a computer and printer at Computerland. The printer had a $860 list price with a $100 trade discount and 210210 , n30n30 terms. The computer had a $4,020 list price with a 25% trade discount but no cash discount. On the computer, Computerland offered Janet the choice of (1) paying $150 per month for 17 months with the 18th payment paying the remainder of the balance or (2) paying 6% interest for 18 months in equal payments. Assume Janet could borrow the money for the printer at 6% to take advantage of the cash discount. How much would Janet save? Note: Use 360 days a year. Round your answer to the nearest cent. On the computer, what is the difference in the final payment between choices 1 and 2? Note: Round your answer to the nearest cent.arrow_forwardGeneral accountingarrow_forwardI need Answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounts Receivable and Accounts Payable; Author: The Finance Storyteller;https://www.youtube.com/watch?v=x_aUWbQa878;License: Standard Youtube License