Concept explainers

Aging of receivables; estimating allowance for doubtful accounts

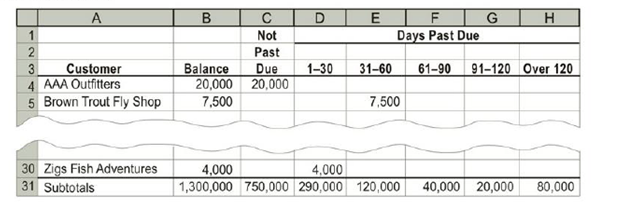

Trophy Fish Company supplies flies and fishing gear to sporting goods stores and outfitters throughout the western United States. The

The following accounts were unintentionally omitted from the aging schedule. Assume all due dates are for the current year except for Wolfe Sports, which is due in the next year.

| Customer | Due Date | Balance |

| Adams Sports & Flies | May 22 | $5,000 |

| Blue Dun Flies | Oct. 10 | 4,900 |

| Cicada Fish Co. | Sept. 29 | 8,400 |

| Deschutes Sports | Oct. 20 | 7,000 |

| Green River Sports | Nov. 7 | 3,500 |

| Smith River Co. | Nov. 28 | 2,400 |

| Western Trout Company | Dec. 7 | 6,800 |

| Wolfe Sports | Jan. 20 | 4,400 |

Trophy Fish has a past history of uncollectible accounts by age category, as follows:

| Age Class | Percent Uncollectible |

| Not past due | 1% |

| 1-30 days past due | 2 |

| 31-60 days past due | 10 |

| 61-90 days past due | 30 |

| 91-120 days past due | 40 |

| Over 120 days past due | 80 |

Instructions

- 1. Determine the number of days past due for each of the preceding accounts.

- 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.

- 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule.

- 4. Assume that the allowance for doubtful accounts for Trophy Fish Company has a debit balance of $3,600 before adjustment on December 31. Journalize the

adjusting entry for uncollectible accounts. - 5. Assume that the adjusting entry in (4) was inadvertently omitted, how would the omission affect the balance sheet and income statement?

Trending nowThis is a popular solution!

Chapter 8 Solutions

Financial & Managerial Accounting

Additional Business Textbook Solutions

Accounting Information Systems (14th Edition)

Essentials of MIS (13th Edition)

MARKETING:REAL PEOPLE,REAL CHOICES

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Financial Accounting, Student Value Edition (5th Edition)

- A company paid $12,000 for a one-year insurance policy on October 1. What amount should be reported as Prepaid Insurance on the December 31 balance sheet? A. $3,000B. $9,000C. $12,000D. $0arrow_forwardNo chatgpt 9. In a perpetual inventory system, what happens when goods are sold?A. Only sales revenue is recordedB. Inventory and cost of goods sold are updated immediatelyC. Inventory is updated at the end of the accounting periodD. Only cost of goods sold is recordedAnswer: Barrow_forward9. In a perpetual inventory system, what happens when goods are sold?A. Only sales revenue is recordedB. Inventory and cost of goods sold are updated immediatelyC. Inventory is updated at the end of the accounting periodD. Only cost of goods sold is recordedneed helparrow_forward

- Can you demonstrate the accurate method for solving this financial accounting question?arrow_forwardWhat effect does recording depreciation expense have on the accounting equation?A. Increases assets and increases equityB. Decreases assets and decreases equityC. Increases liabilities and decreases equityD. No effect on assets or equity No AIarrow_forwardNo ai 9. In a perpetual inventory system, what happens when goods are sold?A. Only sales revenue is recordedB. Inventory and cost of goods sold are updated immediatelyC. Inventory is updated at the end of the accounting periodD. Only cost of goods sold is recordedAnswer: Barrow_forward

- Solve this question with accounting questionarrow_forwardHello tutor solve this situation with accounting questionarrow_forwardWhat effect does recording depreciation expense have on the accounting equation?A. Increases assets and increases equityB. Decreases assets and decreases equityC. Increases liabilities and decreases equityD. No effect on assets or equity helparrow_forward

- What effect does recording depreciation expense have on the accounting equation?A. Increases assets and increases equityB. Decreases assets and decreases equityC. Increases liabilities and decreases equityD. No effect on assets or equityarrow_forwardFinancial accounting questionarrow_forwardCan you demonstrate the proper approach for solving this financial accounting question with valid techniques?arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning