Survey of Accounting - With CengageNOW 1Term

8th Edition

ISBN: 9781337379823

Author: WARREN

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 8.2.2P

Recording payroll and payroll taxes

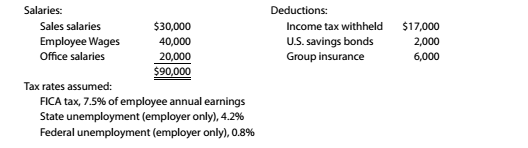

The following information about the payroll for the week ended October 4 was obtained from the records of Simkins Mining Co.:

Instructions

Illustrate the effect on the accounts and financial statements of recording the October 4 payroll.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

None

Abc

Ans

Chapter 8 Solutions

Survey of Accounting - With CengageNOW 1Term

Ch. 8 - A business issued a $5,000, 60-day, 12% note to...Ch. 8 - Which of the following taxes are employers usually...Ch. 8 - Prob. 3SEQCh. 8 - Prob. 4SEQCh. 8 - A corporation has issued 25,000 shares of $100 par...Ch. 8 - For most companies, what two types of transactions...Ch. 8 - When are short-term notes payable issued?Ch. 8 - Prob. 3CDQCh. 8 - Prob. 4CDQCh. 8 - Identify the two distinct obligations incurred by...

Ch. 8 - A corporation issues $40,000,000 of 6% bonds to...Ch. 8 - The following data relate to an $8,000,000,7% bond...Ch. 8 - When should the liability associated with a...Ch. 8 - Prob. 9CDQCh. 8 - Prob. 10CDQCh. 8 - Prob. 11CDQCh. 8 - Prob. 12CDQCh. 8 - Prob. 13CDQCh. 8 - A corporation reacquires 18,000 shares of its Own...Ch. 8 - Prob. 15CDQCh. 8 - Prob. 16CDQCh. 8 - Prob. 17CDQCh. 8 - Prob. 18CDQCh. 8 - Effect of financing on earnings per share BSF Co.....Ch. 8 - Evaluate alternative financing plans Obj. 1 Based...Ch. 8 - Current liabilities Zahn Inc. -told 16.000annual...Ch. 8 - Notes payable Obj. A business issued a 90-day. 7%...Ch. 8 - Compute payroll An employee earns $28 per hour and...Ch. 8 - Prob. 8.6ECh. 8 - Prob. 8.7ECh. 8 - Prob. 8.8ECh. 8 - Bond price CVS Caremark Corp. (CVS) 5-3% bonds due...Ch. 8 - Issuing bonds Cyber Tech Inc. produces and...Ch. 8 - Accrued product warranty Back in Time Inc....Ch. 8 - Accrued product warranty Ford Motor Company (F)...Ch. 8 - Prob. 8.13ECh. 8 - Prob. 8.14ECh. 8 - Issuing par stock On January 29. Quality Marble...Ch. 8 - Issuing stock for assets other than cash Obj.5 On...Ch. 8 - Treasury stock transactions Obj.5 Blue Moon Water...Ch. 8 - Prob. 8.18ECh. 8 - Treasury stock transactions Banff Water Inc....Ch. 8 - Cash dividends The date of declaration, date of...Ch. 8 - Prob. 8.21ECh. 8 - Effect of stock split Audrey's Restaurant...Ch. 8 - Prob. 8.23ECh. 8 - Prob. 8.24ECh. 8 - Prob. 8.1.1PCh. 8 - Prob. 8.1.2PCh. 8 - Prob. 8.1.3PCh. 8 - Recording payroll and payroll taxes The following...Ch. 8 - Recording payroll and payroll taxes The following...Ch. 8 - Recording payroll and payroll taxes The following...Ch. 8 - Recording payroll and payroll taxes The following...Ch. 8 - Bond premium; bonds payable transactions Beaufort...Ch. 8 - Prob. 8.3.2PCh. 8 - Bond premium; bonds payable transactions Beaufort...Ch. 8 - Prob. 8.3.4PCh. 8 - Stock transactions for corporate expansion Vaga...Ch. 8 - Dividends on preferred and common stock Yukon Bike...Ch. 8 - Dividends on preferred and common stock Yukon Bike...Ch. 8 - Prob. 8.5.3PCh. 8 - Prob. 8.1.1MBACh. 8 - Prob. 8.1.2MBACh. 8 - Prob. 8.2.1MBACh. 8 - Prob. 8.2.2MBACh. 8 - Prob. 8.2.3MBACh. 8 - Prob. 8.3.1MBACh. 8 - Prob. 8.3.2MBACh. 8 - Prob. 8.3.3MBACh. 8 - Prob. 8.4MBACh. 8 - Prob. 8.5.1MBACh. 8 - Prob. 8.5.2MBACh. 8 - Prob. 8.6.1MBACh. 8 - Prob. 8.6.2MBACh. 8 - Prob. 8.6.3MBACh. 8 - Stock split Using the data from E8-22. indicate...Ch. 8 - Prob. 8.8.1MBACh. 8 - Prob. 8.8.2MBACh. 8 - Prob. 8.8.3MBACh. 8 - Prob. 8.8.4MBACh. 8 - Prob. 8.8.5MBACh. 8 - Prob. 8.8.6MBACh. 8 - Prob. 8.8.7MBACh. 8 - Prob. 8.8.8MBACh. 8 - Prob. 8.9.1MBACh. 8 - Prob. 8.9.2MBACh. 8 - Prob. 8.9.3MBACh. 8 - Prob. 8.9.4MBACh. 8 - Prob. 8.9.5MBACh. 8 - Prob. 8.9.6MBACh. 8 - Debt and price-earnings ratios Lowe's Companies...Ch. 8 - Prob. 8.10.1MBACh. 8 - Prob. 8.10.2MBACh. 8 - Prob. 8.10.3MBACh. 8 - Prob. 8.10.4MBACh. 8 - Prob. 8.10.5MBACh. 8 - Debt and price-earnings ratios Alphabet (formerly...Ch. 8 - Prob. 8.10.7MBACh. 8 - Prob. 8.10.8MBACh. 8 - Prob. 8.11MBACh. 8 - Prob. 8.1.1CCh. 8 - Prob. 8.1.2CCh. 8 - Prob. 8.2.1CCh. 8 - Prob. 8.2.2CCh. 8 - Prob. 8.3.1CCh. 8 - Issuing stock Sahara Unlimited Inc. began...Ch. 8 - Prob. 8.4CCh. 8 - Prob. 8.5.1CCh. 8 - Financing business expansion You hold a 30% common...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hi expert provide answerarrow_forwardHow much long term debt did the firm have?arrow_forwardWildhorse Windows manufactures and sells custom storm windows for three-season porches. Wildhorse also provides installation service for the windows. The installation process does not involve changes in the windows, so this service can be performed by other vendors. Wildhorse enters into the following contract on July 1, 2025, with a local homeowner. The customer purchases windows for a price of $2,650 and chooses Wildhorse to do the installation. Wildhorse charges the same price for the windows irrespective of whether it does the installation or not. The customer pays Wildhorse $1,988 (which equals the standalone selling price of the windows, which have a cost of $1,230) upon delivery and the remaining balance upon installation of the windows. The windows are delivered on September 1, 2025, Wildhorse completes installation on October 15, 2025, and the customer pays the balance due. (a) Wildhorse estimates the standalone selling price of the installation based on an estimated cost of…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

How JOURNAL ENTRIES Work (in Accounting); Author: Accounting Stuff;https://www.youtube.com/watch?v=Y-_Q3rANyxU;License: Standard Youtube License