Concept explainers

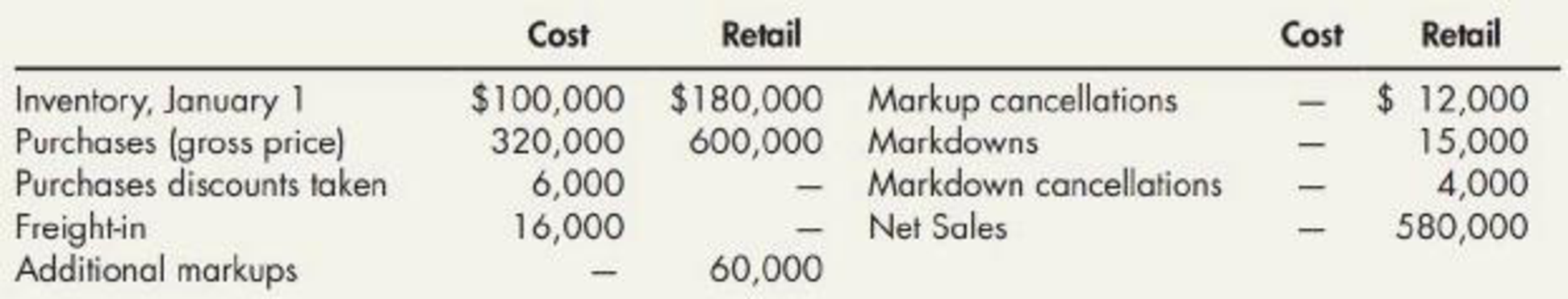

Retail Inventory Method EKC Company uses the retail inventory method. The following information for 2019 is available:

Required:

Compute the cost of the ending inventory under each of the following cost flow assumptions (round the cost-to-retail ratio to 3 decimal places):

- 1. FIFO

- 2. average cost

- 3. LIFO

- 4. lower of cost or market (based on average cost)

1.

Calculate the cost of ending inventory by the retail method using FIFO cost flow.

Explanation of Solution

Retail inventory method: It takes into account all the retail amounts that is, the current selling prices. Under this method, the goods available for sale, at retail is deducted from the sales, at retail to determine the ending inventory, at retail.

Conventional Retail Method: Conventional retail method refers to the estimation of the lower of average cost or market by eliminating the markdowns from the calculation of the cost-to-retail percentage.

In this case, the cost-to-retail percentage will be determined by dividing the goods available for sale at cost by the goods available for at retail (excluding markdowns). Thus, the conventional retail method will always result in lower estimation of ending inventory when the markdowns exist.

FIFO: Under this inventory method, the units that are purchased first are sold first. Thus, it starts from the selling of the beginning inventory, followed by the units purchased in a chronological order of their purchases took place during a particular period.

Calculate the cost of ending inventory by the retail method using FIFO cost flow.

| Ending Inventory - FIFO | ||

| Details | Cost ($) | Retail ($) |

| Purchases | 320,000 | 600,000 |

| Less: Purchases discount taken | (6,000) | 0 |

| Freight -in | 16,000 | 0 |

| Net additional markups | 0 | 48,000 |

| Net markdowns | 0 | (11,000) |

| Goods available for sale after markdowns | 330,000 | 637,000 |

| Add: Beginning inventory | 100,000 | 180,000 |

| Goods available for sale | 430,000 | 817,000 |

| Less: Net sales | (580,000) | |

| Ending inventory at retail | $237,000 | |

| Ending inventory at cost | $122,766 | |

Table (1)

Working note 1:

Calculate the amount of net additional markups.

Working note 2:

Calculate the amount of net additional markdowns.

Working note 3:

Calculate ending inventory at cost.

Step 1: Calculate cost-to-retail ratio.

Step 2: Calculate ending inventory at cost.

Therefore, the cost of ending inventory by the retail method using FIFO cost flow is $122,766.

2.

Calculate the cost of ending inventory by the retail method using average cost flow.

Explanation of Solution

Average cost method: Under this method, the cost of the goods available for sale is divided by the number of units available for sale during a particular period.

Calculate the cost of ending inventory by the retail method using average cost flow.

| Ending Inventory - Average Cost | ||

| Details | Cost ($) | Retail ($) |

| Beginning inventory | 100,000 | 180,000 |

| Purchases | 320,000 | 600,000 |

| Less: Purchases discount taken | (6,000) | 0 |

| Freight -in | 16,000 | 0 |

| Net additional markups | 0 | 48,000 |

| Net markdowns | 0 | (11,000) |

| Goods available for sale after markdowns | 430,000 | 817,000 |

| Less: Net sales | (580,000) | |

| Estimated ending inventory at retail | $237,000 | |

| Estimated ending inventory at cost | $124,662 | |

Table (2)

Working note 1:

Calculate ending inventory at cost.

Step 1: Calculate cost-to-retail ratio.

Step 2: Calculate ending inventory at cost.

Therefore, the cost of ending inventory by the retail method using average cost flow is $124,662.

3.

Calculate the cost of ending inventory by the retail method using LIFO cost flow.

Explanation of Solution

LIFO: Under this inventory method, the units that are purchased last are sold first. Thus, it starts from the selling of the units recently purchased and ending with the beginning inventory.

Calculate the cost of ending inventory by the retail method using LIFO cost flow.

| Ending Inventory - LIFO | ||

| Details | Cost ($) | Retail ($) |

| Beginning inventory | 100,000 | 180,000 |

| Purchases | 320,000 | 600,000 |

| Less: Purchases discount taken | (6,000) | 0 |

| Freight -in | 16,000 | 0 |

| Net additional markups | 0 | 48,000 |

| Net markdowns | 0 | (11,000) |

| Goods available for sale after markdowns | 330,000 | 637,000 |

| Goods available for sale | 430,000 | 817,000 |

| Less: Net sales | (580,000) | |

| Estimated ending inventory at retail | $237,000 | |

| Estimated ending inventory at LIFO cost: | ||

| Beginning layer | 100,000 | |

| New layer | 29,526 | |

| Total cost | $129,526 | |

Table (3)

Working note 1:

Calculate ending inventory at cost for beginning layer:

Step 1: Calculate cost-to-retail ratio (Beginning layer).

Step 2: Calculate ending inventory at cost (Beginning layer).

Working note 2:

Calculate ending inventory at cost for new layer.

Step 1: Calculate cost-to-retail ratio (new layer).

Step 2: Calculate ending inventory at cost (new layer).

Therefore, the cost of ending inventory by the retail method using LIFO cost flow is $129,526.

4.

Calculate the cost of ending inventory by the retail method using lower of cost or market rule.

Explanation of Solution

Lower-of-cost-or-market: The lower-of-cost-or-market (LCM) is a method which requires the reporting of the ending merchandise inventory in the financial statement of a company, either at current market value or at historical cost price of the inventory, whichever is less.

Calculate the cost of ending inventory by the retail method using lower of cost or market rule.

| Ending Inventory - LCM | ||

| Details | Cost ($) | Retail ($) |

| Beginning inventory | 100,000 | 180,000 |

| Purchases | 320,000 | 600,000 |

| Less: Purchases discount taken | (6,000) | 0 |

| Freight -in | 16,000 | 0 |

| Net additional markups | 0 | 48,000 |

| Goods available for sale before markdowns | 430,000 | 828,000 |

| Less: Net markdowns | (11,000) | |

| Net sales | (580,000) | |

| Estimated ending inventory at retail | $237,000 | |

| Estimated ending inventory at cost (LCM) | $123,003 | |

Table (4)

Working note 1:

Calculate ending inventory at cost.

Step 1: Calculate cost-to-retail ratio.

Step 2: Calculate ending inventory at cost.

Therefore, the cost of ending inventory by the retail method using LCM cost flow is $123,003.

Want to see more full solutions like this?

Chapter 8 Solutions

EBK INTERMEDIATE ACCOUNTING: REPORTING

- Suppose Chrysler Motors has 720 million shares outstanding with a share price of $68.25, and $30 billion in debt. If in three years, Chrysler has 750 million shares outstanding trading for $76 per share, how much debt will Chrysler have if it maintains a constant debt-equity ratio?arrow_forwardi want to correct answer is accountingarrow_forwardLet us suppose that the Apex Corporation's total annual sales are 4,800 units, the average inventory level is 400 units, and the annual working days are 320 days. The inventory days of supply (DOS) are____. a. Somewhere between 30 and 31 days. b. 26.67 days. c. 20.38 days. d. None of the above.answerarrow_forward

- A firm is planning for its financing needs and uses the basic fixed-order-quantity inventory model (EOQ). What is the total cost (TC), including purchasing cost, of the inventory given an annual demand of 12,000 units, ordering cost of $40, a holding cost per unit per year of $5, an EOQ of 500 units, and a cost per unit of inventory of $120?arrow_forwardNeed answerarrow_forwardCan you please give me correct answer this financial accounting question?arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,