Pacific Siding Incorporated produces synthetic wood siding used in the construction of residential and commercial buildings. Pacific Siding’s fiscal year ends on March 31, and the weighted-average method is used for the company’s process costing system.

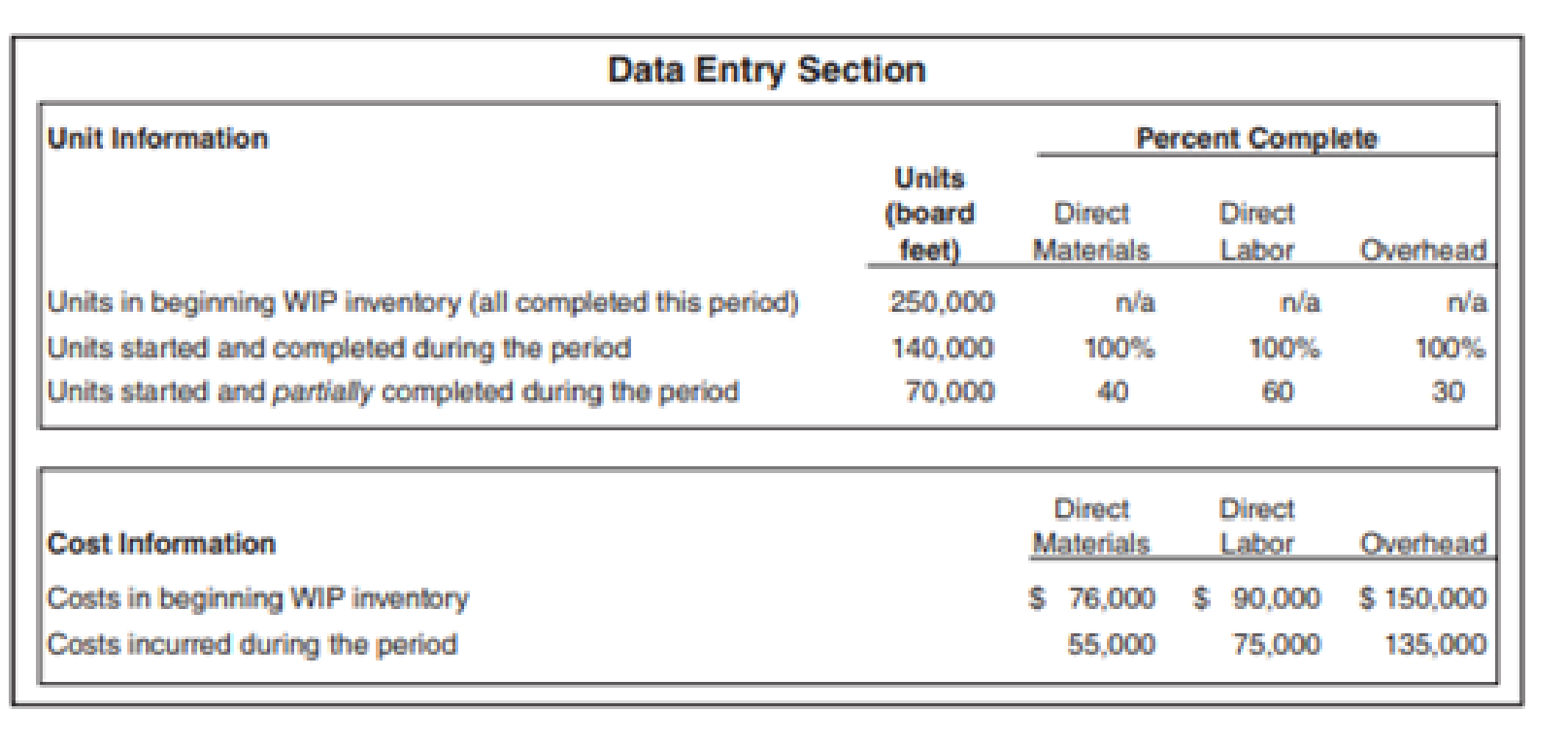

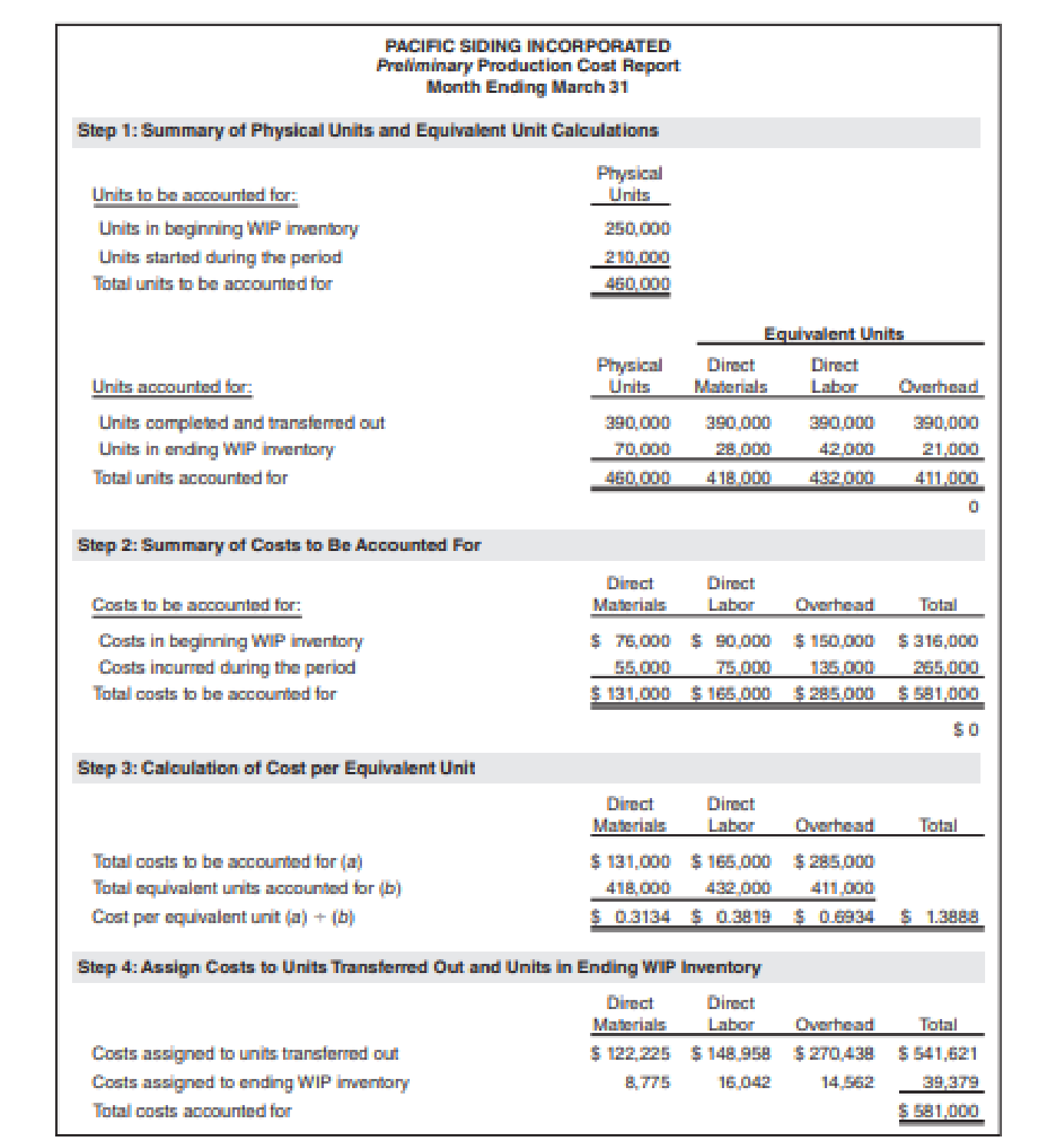

Financial results for the first 11 months of the current fiscal year (through February 28) are well below the expectations of management, owners, and creditors. Halfway through the month of March, the chief executive officer (CEO) and the chief financial officer (CFO) ask the controller to estimate the production results for the month of March in the form of a production cost report (the company has only one production department). This report is shown below.

Armed with the preliminary production cost report for March, and knowing that the company’s production is well below capacity, the CEO and CFO decide to produce as many units as possible for the last half of March, even though sales are not expected to increase any time soon. The production manager is told to push his employees to get as far as possible with production, thereby increasing the percentage of completion for ending WIP inventory. However, since the production process takes three weeks to complete, all of the units produced in the last half of March will be in WIP inventory at the end of March.

Required

- a. Explain how the CEO and CFO expect to increase profit (net income) for the year by boosting production at the end of March. Assume that most

overhead costs are fixed. - b. Using the following assumptions, prepare a revised estimate of production results in the form of a production cost report for the month of March. Assumptions based on the CEO and CFO request to boost production:

- (1) Units started and partially completed during the period will increase to 225,000 (from the initial estimate of 70,000). This is the projected ending WIP inventory at March 31.

- (2) Percentage of completion estimates for units in ending WIP inventory will increase to 80 percent for direct materials, 85 percent for direct labor, and 90 percent for overhead.

- (3) Costs incurred during the period will increase to $95,000 for direct materials, $102,000 for direct labor, and $150,000 for overhead (recall that most overhead costs are fixed).

- (4) All units completed and transferred out during March are sold by March 31.

- c. Compare your new production cost report with the one prepared by the controller. How much do you expect profit to increase as a result of increasing production during the last half of March?

- d. Is the request made by the CEO and CFO ethical? Explain your answer.

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Fundamentals Of Cost Accounting (6th Edition)

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning