Concept explainers

Payroll Accounting and Discussion of Labor Costs

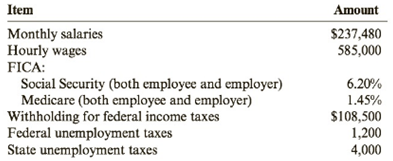

Blitzen

Blitzen will pay both the employer’s taxes and the taxes withheld on April 15.

Required:

1. Prepare the

2. What is the employees' gross pay? What amount does Blitzen pay in excess of gross pay as a result of taxes? ( Note: Provide both an absolute dollar amount and as a percentage of gross pay, rounding to two decimal places.)

3. How much is the employees' net pay as a percentage of total payroll related expenses? ( Note: Round answer to two decimal places.)

4. CONCEPTUAL CONNECTION If another employee can be hired for $60,000 per year, what would be the total cost of this employee to Blitzen?

Trending nowThis is a popular solution!

Chapter 8 Solutions

Cornerstones of Financial Accounting

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardI need help finding the correct solution to this financial accounting problem with valid methods.arrow_forwardCan you solve this financial accounting question with the appropriate financial analysis techniques?arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning