Special-Order Decision, Qualitative Aspects

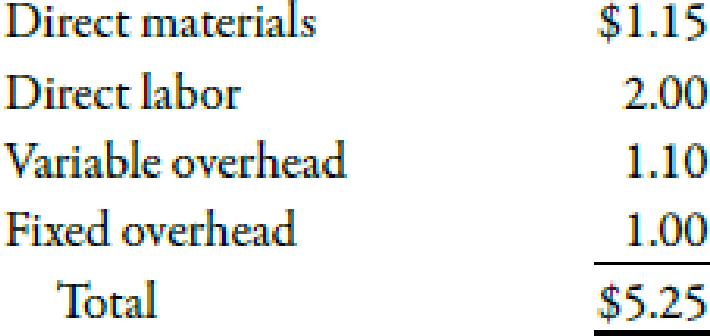

Randy Stone, manager of Specialty Paper Products Company, was agonizing over an offer for an order requesting 5,000 boxes of calendars. Specialty Paper Products was operating at 70% of its capacity and could use the extra business. Unfortunately, the order’s offering price of $4.20 per box was below the cost to produce the calendars. The controller, Louis Barns, was opposed to taking a loss on the deal. However, the personnel manager, Yatika Blaine, argued in favor of accepting the order even though a loss would be incurred. It would avoid the problem of layoffs and would help to maintain the company’s community image. The full cost to produce a box of calendars follows:

Later that day, Louis and Yatika met over coffee. Louis sympathized with Yatikás concerns and suggested that the two of them rethink the special-order decision. He offered to determine relevant costs if Yatika would list the activities that would be affected by a layoff. Yatika eagerly agreed and came up with the following activities: an increase in the state

- Total payroll is $1,460,000 per year.

- Layoff paperwork is $25 per laid-off employee.

- Rehiring and retraining is $150 per new employee.

Required:

- 1. CONCEPTUAL CONNECTION Assume that the company will accept the order only if it increases total profits (without taking the potential layoffs into consideration). Should the company accept or reject the order? Provide supporting computations.

- 2. CONCEPTUAL CONNECTION Consider the new information on activity costs associated with the layoff. Should the company accept or reject the order? Provide supporting computations.

Trending nowThis is a popular solution!

Chapter 8 Solutions

EBK MANAGERIAL ACCOUNTING: THE CORNERST

- Feinan Sports, Inc., manufactures sporting equipment, including weight-lifting gloves. A national sporting goods chain recently submitted a special order for 4,600 pairs of weight-lifting gloves. Feinan Sports was not operating at capacity and could use the extra business. Unfortunately, the orders offering price of 12.80 per pair was below the cost to produce them. The controller was opposed to taking a loss on the deal. However, the personnel manager argued in favor of accepting the order even though a loss would be incurred; it would avoid the problem of layoffs and would help maintain the community image of the company. The full cost to produce a pair of weight-lifting gloves is presented below. No variable selling or administrative expenses would be associated with the order. Non-unit-level activity costs are a small percentage of total costs and are therefore not considered. Required: 1. Assume that the company would accept the order only if it increased total profits. Should the company accept or reject the order? Provide supporting computations. 2. Suppose that Feinan Sports has negotiated with the potential customer, and has determined that it can substitute cheaper materials, reducing direct materials cost by 0.95 per unit. In addition, the companys engineers have found a way to reduce direct labor cost by 0.50 per unit. Should the company accept or reject the order? Provide supporting computations. 3. Consider the personnel managers concerns. Discuss the merits of accepting the order even if it decreases total profits.arrow_forwardFeinan Sports, Inc., manufactures sporting equipment, including weight-lifting gloves. A national sporting goods chain recently submitted a special order for 4,000 pairs of weight-lifting gloves. Feinan Sports was not operating at capacity and could use the extra business. Unfortunately, the order's offering price of $12.70 per pair was below the cost to produce them. The controller was opposed to taking a loss on the deal. However, the personnel manager argued in favor of accepting the order even though a loss would be incurred; it would avoid the problem of layoffs and would help maintain the community image of the company. The full cost to produce a pair of weight-lifting gloves is presented below. Direct materials $ 7.40 Direct labor 3.80 Variable overhead 1.60 Fixed overhead 3.10 $15.90 Total No variable selling or administrative expenses would be associated with the order. Non-unit- level activity costs are a small percentage of total costs and are therefore not considered.…arrow_forwardBert Asiago, a salesperson for Convertco, received an order from a potential new customer for 50,000 units of Convertco’s single product at a price $25 below its regular selling price of $65. Asiago knows that Convertco has the capacity to produce this order without affecting regular sales. He has spoken to Convertco’s controller, Bia Morgan, who has informed Asiago that at the $40 selling price, Convertco will not be covering its variable costs of $42 for the product, and she recommendsthe order not be accepted. Asiago knows that variable costs include his sales commission of $4 per unit. If he accepts a $2 per unit commission, the sale will produce a contribution margin of zero. Asiago is eager to get the new customer because he believes that this could lead to the new customer becoming a regular customer.arrow_forward

- Bert Asiago, a salesperson for Convertco, received an order from a potential new customer for 50,000 units of Convertco’s single product at a price $25 below its regular selling price of $65. Asiago knows that Convertco has the capacity to produce this order without affecting regular sales. He has spoken to Convertco’s controller, Bia Morgan, who has informed Asiago that at the $40 selling price, Convertco will not be covering its variable costs of $42 for the product, and she recommends the order not be accepted. Asiago knows that variable costs include his sales commission of $4 per unit. If he accepts a $2 per unit commission, the sale will produce a contribution margin of zero. Asiago is eager to get the new customer because he believes that this could lead to the new customer becoming a regular customer. Required 1. Determine the contribution margin per unit on the order as determined by the controller. 2. Determine the contribution margin per unit on the order as determined by…arrow_forwardSTARTOM Inc, manufactures sporting equipment, including weight-lifting gloves. Anationalsporting goods chain recently submitted a special order for 4,600 pairs of weight-lifting gloves. STARTOM JnC.was not operating at capacity and couldusethe extra business. Unfortunately, the order's offering price of $12.80 per pair was below the costto produce them. The controller was opposedto takingaloss onthe deal. However, the personnel manager arguedin favor of accepting the order even though a loss would be incurred; it would avoid the problem of layoffs andwouldhelp maintainthe community image of the company. The full costto produce a pair of weight-lifting gloves is presented as follows: Direct materials - S7.50; Direct labor- $3.90; Variable overhead -$1.60; Fixed overhead - $3.10; Total - $16.10. No variable and selling or administrative expenses would be associated with the order. Non-unit level activity costs are a small percentage oftotal costs and are therefore not censidered Assume…arrow_forwardTania Company manufactures watches. A national sporting goods chain recently submitted a special order for 4,000 sport watches. Tania was not operating at capacity and could use the extra business. Unfortunately, the order’s offering price of RM17 per watch was below the cost to produce the watches. The controller did not agree to take a loss on the deal. However, the personnel manager argued in favor of accepting the order even though a loss would be incurred: it would avoid the problems of layoff and would help maintain the community image of the company. The following information is the full cost to produce a sport watch: Rewuired: i) List the relevant costs of the two alternatives of the special order. ii) Propose whether operating income increase or decrease if the order is accepted with calculation details.arrow_forward

- would be no sales commissions on this order; thus, variable selling expenses would be slashed by 75%. However, Polaski Company would have to purchase a speclal machine to engrave the retail chain's name on the 7,000 units. This machine would cost $14,000. Polaski Company has no assurance that the retall chain will purchase additional units in the future. What is the financial advantage (disadvantage) of accepting the special order? (Round your intermediate calculations to 2 decimal places.) 2. Refer to the original data. Assume again that Polaski Company expects to sell only 39,000 Rets through regular channels next year. The U.S. Army would like to make a one-time-only purchase of 7,000 Rets. The Army would pay a fixed fee of $1.80 per Ret, and it would reimburse Polaskl Company for all costs of production (varlable and fixed) associated with the units. Because the army would pick up the Rets with its own trucks, there would be no variable selling expenses associated with this order.…arrow_forwardTania Company manufactures watches. A national sporting goods chain recentlysubmitted a special order for 4,000 sport watches. Tania was not operating at capacityand could use the extra business. Unfortunately, the order’s offering price of RM17 perwatch was below the cost to produce the watches. The controller did not agree to take aloss on the deal. However, the personnel manager argued in favor of accepting theorder even though a loss would be incurred: it would avoid the problems of layoff andwould help maintain the community image of the company. The following informationis the full cost to produce a sport watch:Table 6: Production CostsDetails Unit CostRMDirect materials 6.50Direct labor 5.00Variable overhead 3.25Fixed overhead 2.50Total 17.25 List the relevant costs of the two alternatives of the special order. (ii) Propose whether operating income increase or decrease if the order is acceptedarrow_forwardBert Asiago, as salesperson at Convertco, received an order from a potential new customer for 50,000 units of the company's single product. The price came in at $25 below the regular selling price of $65. Asiago knows that Convertco has the capacity to produce the product without affecting regular sales. He spoke to Bia Morgan, the controller, who informed him that at the $40 selling price, it's $42 of variable costs won't be covered. She recommends rejecting the order. Bert knows that $4 of the $42 per unit in variable cost is due to sales commission. If he accepts a commission of $2 per unit, that will make contribution margin per unit zero. He wants to try this in hopes that a new, regular customer might be obtained. 1. Determine CM/unit per the controller 2. Determine CM/unit under Bert's plan 3. Do you recommend this special order? Why or why not? 4. What other factors should management consider?arrow_forward

- Suppose a loyal customer requested to a special order to buy 100 units at $5.50 per unit. This is a one-time only order, the manufacturing company has the capacity to fill this order, and by filling the order no other regular order will go unfilled. Would you fill this order if you were the manager? Why? Is there an opportunity cost associated with this order? Explain. What would be the per-unit profit or loss for filling this order?arrow_forwardList the relevant costs of the two alternatives of the special order. Propose whether operating income increase or decrease if the order is acceptedwith calculation details.arrow_forwardA manager of Burns Sporting Goods Company is considering accepting an order from an overseas customer. This customer has requested an order for 200,000 dozen golf balls at a price of $22 per dozen. The variable cost to manufacture a dozen golf balls is $18 per dozen. The full cost is $25 per dozen. Burns Sporting Goods Company plant has just enough excess capacity on the second shift to make the overseas order. Given the information, should the order be accepted or rejected? What other considerations should be discussed in the decision? Be sure to provide explanation for your answerarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT