Special-Order Decision, Qualitative Aspects

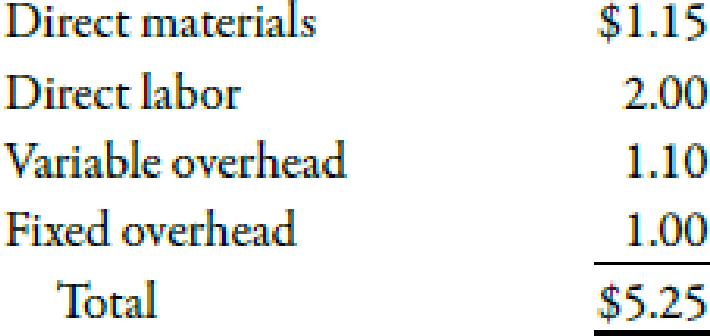

Randy Stone, manager of Specialty Paper Products Company, was agonizing over an offer for an order requesting 5,000 boxes of calendars. Specialty Paper Products was operating at 70% of its capacity and could use the extra business. Unfortunately, the order’s offering price of $4.20 per box was below the cost to produce the calendars. The controller, Louis Barns, was opposed to taking a loss on the deal. However, the personnel manager, Yatika Blaine, argued in favor of accepting the order even though a loss would be incurred. It would avoid the problem of layoffs and would help to maintain the company’s community image. The full cost to produce a box of calendars follows:

Later that day, Louis and Yatika met over coffee. Louis sympathized with Yatikás concerns and suggested that the two of them rethink the special-order decision. He offered to determine relevant costs if Yatika would list the activities that would be affected by a layoff. Yatika eagerly agreed and came up with the following activities: an increase in the state

- Total payroll is $1,460,000 per year.

- Layoff paperwork is $25 per laid-off employee.

- Rehiring and retraining is $150 per new employee.

Required:

- 1. CONCEPTUAL CONNECTION Assume that the company will accept the order only if it increases total profits (without taking the potential layoffs into consideration). Should the company accept or reject the order? Provide supporting computations.

- 2. CONCEPTUAL CONNECTION Consider the new information on activity costs associated with the layoff. Should the company accept or reject the order? Provide supporting computations.

Trending nowThis is a popular solution!

Chapter 8 Solutions

Cengagenowv2, 1 Term Printed Access Card For Mowen/hansen/heitger?s Managerial Accounting: The Cornerstone Of Business Decision-making, 7th

- No WRONG ANSWERarrow_forwardSuppose Chrysler Motors has 720 million shares outstanding with a share price of $68.25, and $30 billion in debt. If in three years, Chrysler has 750 million shares outstanding trading for $76 per share, how much debt will Chrysler have if it maintains a constant debt-equity ratio? Answer this Questionarrow_forwardBased on this informationarrow_forward

- Hi expert please give me answer general accounting questionarrow_forwardSuppose Chrysler Motors has 720 million shares outstanding with a share price of $68.25, and $30 billion in debt. If in three years, Chrysler has 750 million shares outstanding trading for $76 per share, how much debt will Chrysler have if it maintains a constant debt-equity ratio?arrow_forwardAnsarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub