Concept explainers

Analyzing Allowance for Doubtful

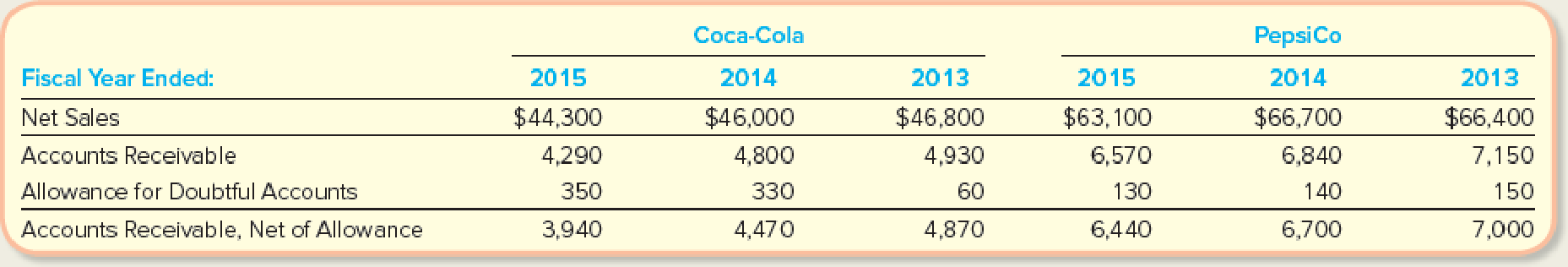

Coca-Cola and PepsiCo are two of the largest and most successful beverage companies in the world in terms of the products that they sell and their receivables management practices. To evaluate their ability to collect on credit sales, consider the following rounded amounts reported in their annual reports (amounts in millions).

Required:

- 1. Calculate the receivables turnover ratios and days to collect for Coca-Cola and PepsiCo for 2015 and 2014. (Round to one decimal place.)

- 2. Which of the companies is quicker to convert its receivables into cash?

1.

Calculate the receivables turnover ratio and days to collect of Company C and Company P for 2015 and 2014.

Explanation of Solution

Accounts receivable turnover: This is the ratio which analyzes the number of times accounts receivables is collected and converted into cash during the period. This ratio gauges the efficacy of collecting receivables. The more times the ratio indicates the more efficient in collecting receivables.

Average days to collect accounts receivable (average collection period): This ratio measures the number of times receivables are collected in the period. This ratio analyzes the period receivables are outstanding. So, this ratio also gauges the efficacy of collecting receivables. Lower the ratio, more efficient the collection of receivables.

Calculate accounts receivables turnover ratio and days to collect for Company C for 2015 as follows:

Thus, the accounts receivables turnover ratio and the number of days to collect the receivables for Company C for the year 2015 are 10.53 times and 34.66 days respectively.

Calculate accounts receivables turnover ratio and days to collect for Company C for 2014 as follows:

Thus, the accounts receivables turnover ratio and the number of days to collect the receivables for Company C for the year 2014 are 9.9 times and 36.9 days respectively.

Calculate accounts receivables turnover ratio and days to collect for Company P for 2015 as follows:

Thus, the accounts receivables turnover ratio and the number of days to collect the receivables for Company P for the year 2015 are 9.6 times and 38 days respectively.

Calculate accounts receivables turnover ratio and days to collect for Company P for 2014 as follows:

Thus, the accounts receivables turnover ratio and the number of days to collect the receivables for Company P for the year 2014 are 9.7 times and 37.63 days respectively.

2.

Identify the company which has quicker ability to convert its receivables into cash in 2015 and 2014.

Explanation of Solution

Identify the company which has quicker ability to convert its receivables into cash in 2015 and 2014.

| Particulars | Company C | Company P | ||

| 2014 | 2015 | 2014 | 2015 | |

| Receivable turnover ratio | 9.9 times | 10.5 times | 9.7 times | 9.6 times |

| Days to collect ratio | 36.9 days | 34.6 days | 37.6 days | 38 days |

Table (1)

A company which has higher receivables turnover ratio and lower days to collect the receivables is considered as the best company in converting its receivables to cash.

In 2014, Company C’s receivables turnover ratio is higher and days to collect is lower in comparison with Company P.

In 2015, Company C’s receivables turnover ratio is higher and days to collect is lower in comparison with Company P.

Therefore, Company C has the quicker ability to convert its receivables into cash in both the years.

Want to see more full solutions like this?

Chapter 8 Solutions

FUND. OF FINANCIAL ACCT. (LL) W/CONNECT

- Cullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forwardGeneral Accounting questionarrow_forwardWhat Is the correct answer A B ?? General Accounting questionarrow_forward

- Cullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forwardAccounting questionarrow_forwardNot need ai solution please correct answer general Accountingarrow_forward

- Accounting questionarrow_forwardMs. Sharon Washton was born 26 years ago in Bahn, Germany. She is the daughter of a Canadian High Commissioner serving in that country. However, Ms. Washton is now working in Prague, Czech Republic. The only income that she earns in the year is from her Prague marketing job, $55,000 annually, and is subject to income tax in Czech Republic. She has never visited Canada. Determine the residency status of Sharon Washtonarrow_forwardAns plzarrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub