Concept explainers

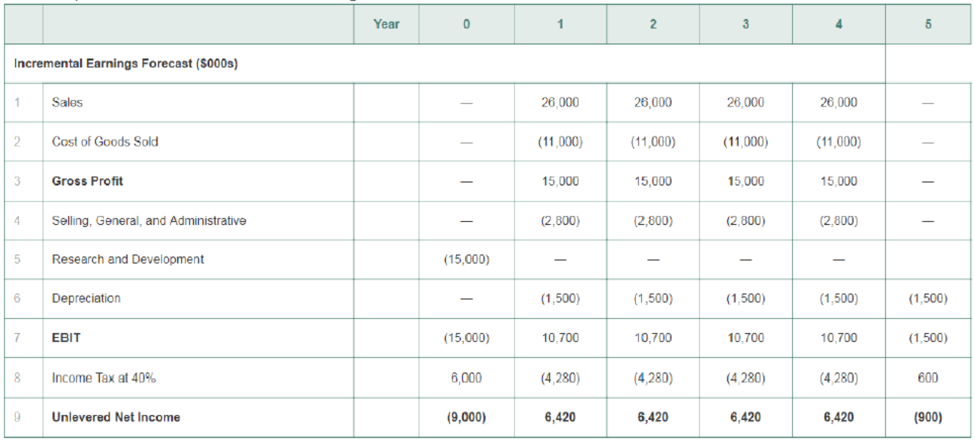

Table 8.1 Spreadsheet HomeNet’s Incremental Earnings

5. After looking at the projections of the HomeNet project, you decide that they are not realistic. It is unlikely that sales will be constant over the four-year life of the project. Furthermore, other companies are likely to offer competing products, so the assumption that the sales price will remain constant is also likely to be optimistic. Finally, as production ramps up, you anticipate lower per unit production costs resulting from economies of scale. Therefore, you decide to redo the projections under the following assumptions: Sales of 50,000 units in year 1 Increasing by 50,000 units per year over the life of the project, a year 1 sales price of $260/unit, decreasing by 10% annually and a year 1 cost of $120/ unit decreasing by 20% annually. In addition, new tax laws allow you to

- a. Keeping the other assumptions that underlie Table 8.1 the same, recalculate unlevered net income (that is, reproduce Table 8.1 under the new assumptions, and note that we are ignoring cannibalization and lost rent).

- b. Recalculate unlevered net income assuming, in addition, that each year 20% of sales comes from customers who would have purchased an existing Cisco router for $100/unit and that this router costs $60/unit to manufacture.

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

- Please make sure you're using the right formula and rounding correctly I have asked this question four times and all the answers have been incorrect.arrow_forwardYou want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Orange Furniture would let you make quarterly payments of $12,540 for 6 years at an interest rate of 1.26 percent per quarter. Your first payment to Orange Furniture would be in 3 months. River Furniture would let you make X monthly payments of $41,035 at an interest rate of 0.73 percent per month. Your first payment to River Furniture would be today. What is X? Input instructions: Round your answer to at least 2 decimal places.arrow_forwardYou want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Silver Leisure would let you make quarterly payments of $3,530 for 7 years at an interest rate of 2.14 percent per quarter. Your first payment to Silver Leisure would be today. Pond Leisure would let you make X monthly payments of $18,631 at an interest rate of 1.19 percent per month. Your first payment to Pond Leisure would be in 1 month. What is X? Input instructions: Round your answer to at least 2 decimal places.arrow_forward

- You plan to retire in 4 years with $659,371. You plan to withdraw $100,000 per year for 12 years. The expected return is X percent per year and the first regular withdrawal is expected in 4 years. What is X? Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do not enter .0986 or 9.86%). Round your answer to at least 2 decimal places. percentarrow_forwardUse the right formula and rounding correctly I have asked this question four times and all the answers have been incorrect.arrow_forwardWhat is the origin of Biblical ethics and how researchers can demonstrate Biblical ethics? How researchers can demonstrate Biblical ethics when conducting a literaturereview? How researchers can demonstrate Biblical ethics when communicating with aresearch team or university committee?arrow_forward

- Equipment is worth $339,976. It is expected to produce regular cash flows of $50,424 per year for 18 years and a special cash flow of $75,500 in 18 years. The cost of capital is X percent per year and the first regular cash flow will be produced today. What is X? Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do not enter 0986 or 9.86%). Round your answer to at least 2 decimal places. percentarrow_forwardYou want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Silver Leisure would let you make quarterly payments of $3,530 for 7 years at an interest rate of 2.14 percent per quarter. Your first payment to Silver Leisure would be today. Pond Leisure would let you make X monthly payments of $18,631 at an interest rate of 1.19 percent per month. Your first payment to Pond Leisure would be in 1 month. What is X? Input instructions: Round your answer to at least 2 decimal places.arrow_forwardYou plan to retire in 4 years with $659,371. You plan to withdraw $100,000 per year for 12 years. The expected return is X percent per year and the first regular withdrawal is expected in 4 years. What is X? Input instructions: Input your answer as the number that appears before the percentage sign. For example, enter 9.86 for 9.86% (do not enter .0986 or 9.86%). Round your answer to at least 2 decimal places. percentarrow_forward

- You want to buy equipment that is available from 2 companies. The price of the equipment is the same for both companies. Gray Media would let you make quarterly payments of $1,430 for 7 years at an interest rate of 1.59 percent per quarter. Your first payment to Gray Media would be today. River Media would let you make monthly payments of $X for 8 years at an interest rate of 1.46 percent per month. Your first payment to River Media would be in 1 month. What is X? Input instructions: Round your answer to the nearest dollar.arrow_forwardYou plan to retire in 8 years with $X. You plan to withdraw $114,200 per year for 21 years. The expected return is 17.92 percent per year and the first regular withdrawal is expected in 9 years. What is X? Input instructions: Round your answer to the nearest dollar. SAarrow_forward69 You plan to retire in 3 years with $911,880. You plan to withdraw $X per year for 18 years. The expected return is 18.56 percent per year and the first regular withdrawal is expected in 3 years. What is X? Input instructions: Round your answer to the nearest dollar.arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning