Segmented Income Statement, Management Decision Making

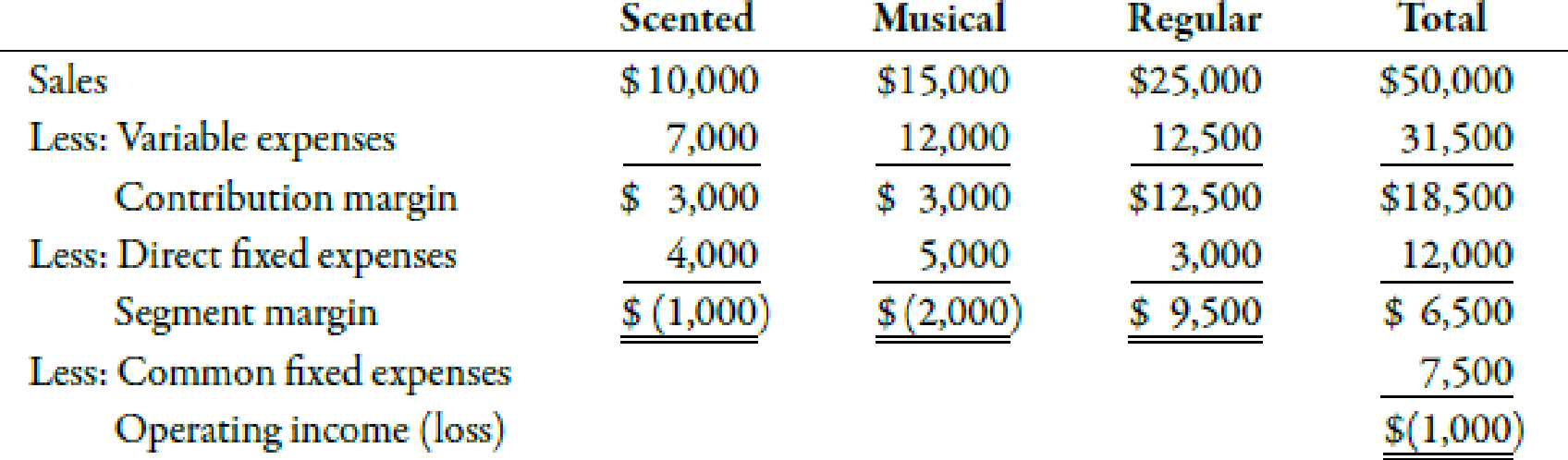

FunTime Company produces three lines of greeting cards: scented, musical, and regular. Segmented income statements for the past year are as follows:

Kathy Bunker, president of FunTime, is concerned about the financial performance of her firm and is seriously considering dropping both the scented and musical product lines. However, before making a final decision, she consults Jim Dorn, FunTime’s vice president of marketing.

Required:

- 1. CONCEPTUAL CONNECTION Jim believes that by increasing advertising by $1,000 ($250 for the scented line and $750 for the musical line), sales of those two lines would increase by 30%. If you were Kathy, how would you react to this information?

- 2. CONCEPTUAL CONNECTION Jim warns Kathy that eliminating the scented and musical lines would lower the sales of the regular line by 20%. Given this information, would it be profitable to eliminate the scented and musical lines?

- 3. CONCEPTUAL CONNECTION Suppose that eliminating either line reduces sales of the regular cards by 10%. Would a combination of increased advertising (the option described in Requirement 1) and eliminating one of the lines be beneficial? Identify the best combination for the firm.

1.

Describe the reaction of Person K on the increase in advertisement expense and sales.

Explanation of Solution

Segmented Income Statement:

Variable costing is used in the preparation of a segmented income statement. In this income statement, the variable expenses are recorded separately from the fixed expenses which are further divided into direct fixed expenses and common expenses.

The following table represents the segmented income statement of Company F:

| Company F | ||||

| Segmented Income Statement | ||||

| For the Previous Year | ||||

| Scented ($) | Musical ($) | Regular ($) | Total ($) | |

| Sales1 | 13,000 | 19,500 | 25,000 | 57,500 |

| Less variable expenses2 | 9,100 | 15,600 | 12,500 | 37,200 |

| Contribution margin | 3,900 | 3,900 | 12,500 | 20,300 |

| Less direct fixed expenses3: | 4,250 | 5,750 | 3,000 | 13,000 |

| Segment margin | (350) | (1,850) | 9,500 | 7,300 |

| Less common fixed expenses: | 7,500 | |||

| Operating income (loss) | (200) | |||

Table (1)

The amount of operating loss is $200. Person K should accept the increase in the direct fixed expense and sales. The overall operating loss before the increase is $1,000 whereas the overall operating loss after the increase is $200. This represents that there is a decrease in the operating loss after an increase in the direct fixed expense and sales.

Working Notes:

1. Calculation of revised sales for scented cards:

Hence, the amount of revised sales for scented cards is $13,000.

Calculation of revised sales for musical cards:

Hence, the amount of revised sales for musical cards is $19,500.

2. Calculation of revised variable expense for scented cards:

Hence, the amount of revised variable expense for scented cards is $9,100.

Calculation of revised variable expense for musical cards:

Hence, the amount of revised variable expense for musical cards is $15,600.

3. Calculation of revised fixed direct expense for scented cards:

Hence, the revised fixed direct expense for scented cards is $4,250.

Calculation of revised fixed direct expense for musical cards:

Hence, the revised fixed direct expense for musical cards is $5,750.

2.

Describe whether it would be beneficial for the company to eliminate the scented and musical lines.

Explanation of Solution

The following table represents the operating income or loss after eliminating scented and musical lines:

| Company F | |

| Segmented Income Statement | |

| For the Previous Year | |

| Regular ($) | |

| Sales1 | 20,000 |

| Less variable expenses2 | 10,000 |

| Contribution margin | 10,000 |

| Less direct fixed expenses: | 3,000 |

| Segment margin | 7,000 |

| Less common fixed expenses: | 7,500 |

| Operating income (loss) | (500) |

Table (2)

The amount of operating loss is $500. If the company eliminates the scented and musical lines, then the sales and variable expenses will get reduced by 20%. The overall operating loss was $1,000 but the revised operating loss after eliminating scented and musical line is $500.

Although the operating loss decreases, still it is not profitable because when the direct fixed expenses of scented and musical lines increase, the operating loss reduces to $200.

Working Notes:

1. Calculation of revised sales:

Hence, the amount of revised sales is $20,000.

2. Calculation of revised variable expense:

Hence, the amount of revised variable expense is $10,000.

3.

Describe whether the combination of an increase in advertising and eliminating either of the lines would be beneficial. Also, identify the best combination.

Explanation of Solution

Since the musical line has the highest segment loss, the line should be eliminated. The following table represents the income statement after eliminating musical lines:

| Company F | |||

| Segmented Income Statement | |||

| For the Previous Year | |||

| Scented ($) | Regular ($) | Total ($) | |

| Sales1 | 13,000 | 22,500 | 35,500 |

| Less variable expenses2 | 9,100 | 11,250 | 20,350 |

| Contribution margin | 3,900 | 11,250 | 15,150 |

| Less direct fixed expenses3: | 4,250 | 3,000 | 7,250 |

| Segment margin | (350) | 8,250 | 7,900 |

| Less common fixed expenses: | 7,500 | ||

| Operating income (loss) | 400 | ||

Table (3)

Therefore, the amount of operating income is $400. The company should consider this type of combination as it is more profitable than any other combination.

Working Notes:

1. Calculation of revised sales for scented cards:

Hence, the amount of revised sales for scented cards is $13,000.

Calculation of revised sales for the regular line:

Hence, the amount of revised sales for the regular line is $22,500.

2. Calculation of revised variable expense for scented cards:

Hence, the amount of revised variable expense for scented cards is $9,100.

Calculation of revised variable expense for the regular line:

Hence, the amount of revised variable expense for the regular line is $11,250.

3. Calculation of revised fixed direct expense for scented cards:

Hence, the revised fixed direct expense for scented cards is $4,250.

Want to see more full solutions like this?

Chapter 8 Solutions

Bundle: Managerial Accounting: The Cornerstone of Business Decision-Making, Loose-Leaf Version, 7th + CengageNOWv2, 1 term (6 months) Printed Access Card

- As of July 1, 2022, the investee had assets with a book value of $3 million and liabilities of $74,400. At the time, Carter held equipment appraised at $364,000 more than book value; it was considered to have a seven-year remaining life with no salvage value. Carter also held a copyright with a five-year remaining life on its books that was undervalued by $972,000. Any remaining excess cost was attributable to an indefinite-lived trademark. Depreciation and amortization are computed using the straight-line method. Burrough applies the equity method for its investment in Carter. Carter's policy is to declare and pay a $1 per share cash dividend every April 1 and October 1. Carter's income, earned evenly throughout each year, was $598,000 in 2022, $639,600 in 2023, and $692,400 in 2024. In addition, Burrough sold inventory costing $91,200 to Carter for $152,000 during 2023. Carter resold $92,000 of this inventory during 2023 and the remaining $60,000 during 2024. Required: a. Determine…arrow_forwardFinancial Accountingarrow_forwardA company has an annual demand for.... please answer the financial accounting questionarrow_forward

- On July 1, 2022, Burrough Company acquired 88,000 of the outstanding shares of Carter Company for $13 per share. This acquisition gave Burrough a 25 percent ownership of Carter and allowed Burrough to significantly influence the investee's decisions. As of July 1, 2022, the investee had assets with a book value of $3 million and liabilities of $74,400. At the time, Carter held equipment appraised at $364,000 more than book value; it was considered to have a seven-year remaining life with no salvage value. Carter also held a copyright with a five-year remaining life on its books that was undervalued by $972,000. Any remaining excess cost was attributable to an indefinite-lived trademark. Depreciation and amortization are computed using the straight-line method. Burrough applies the equity method for its investment in Carter. Carter's policy is to declare and pay a $1 per share cash dividend every April 1 and October 1. Carter's income, earned evenly throughout each year, was $598,000 in…arrow_forwardCompute the materials variances on these financial accounting questionarrow_forwardSolve this general accounting questionarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,