Concept explainers

Calculation of materials and labor variances

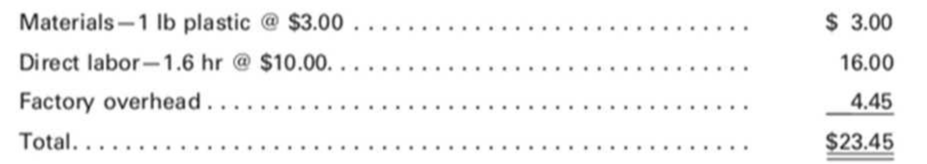

Fritz Corp. manufactures and sells a single product. The company uses a

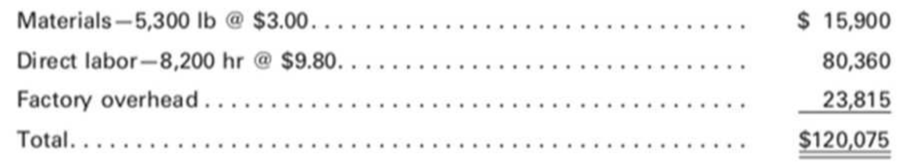

The charges to the manufacturing department for November, when 5,000 units were produced, follow:

The Purchasing department normally buys about the same quantity as is used in production during a month. In November, 5,500 lb were purchased at a price of $2.90 per pound.

Required:

Calculate the following from standard costs for the data given, using the formulas on pages 421–422 and 424:

- 1. Materials quantity variance.

- 2. Materials purchase price variance (at time of purchase).

- 3. Labor efficiency variance.

- 4. Labor rate variance.

- 5. Give some reasons as to why both the materials quantity variance and labor efficiency variance might be unfavorable.

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Principles of Cost Accounting

Additional Business Textbook Solutions

Accounting Information Systems (14th Edition)

Essentials of MIS (13th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Financial Accounting, Student Value Edition (5th Edition)

Business Essentials (12th Edition) (What's New in Intro to Business)

- 1. I want to know how to solve these 2 questions and what the answers are 1. Solar industries has a debt-to-equity ratio of 1.25. Its WACC is 7.8%, and its cost of debt is 4.7%. The corporate tax rate is 21%. a. What is the company’s cost of equity capital?b. What is the company’s unlevered cost of equity capital?c. What would be the cost of equity if the D/E ratio were 2? What if it were 1? 2. Therap software company is trying to determine its optimal capital structure. The company’s current capital structure consists of 35% debt and 65% common equity; however, the treasurer believes that the firm should use more debt. Currently, the company’s cost of equity capital is 9%, which is determined by CAPM. What would be Therap’s estimated cost of equity capital if they change their capital structure to 50% debt? Risk-free rate is 3%, market index returns 11%, and the Therap’s tax rate is 25%.arrow_forwardCompute the company's gross profit percentage for this financial accounting questionarrow_forwardWhat is the year 1 cash flow for this project on these financial accounting question?arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,