Concept explainers

Zippy Inc. manufactures a fuel additive, Surge, which has a stable selling price of $44 per drum. The company has been producing and selling 80,000 drums per month.

In connection with your examination of Zippy’s financial statements for the year ended September 30, management has asked you to review some computations made by Zippy’s cost accountant. Your working papers disclose the following about the company’s operations:

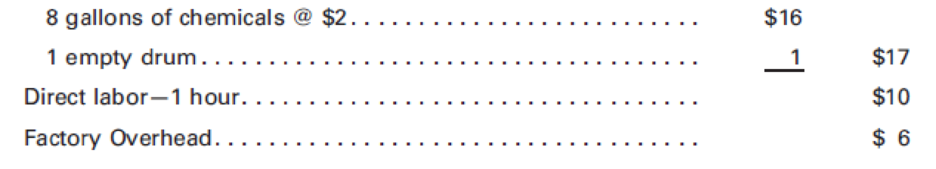

Materials:

Costs and expenses during September:

Chemicals: 645,000 gallons purchased at a cost of $1,140,000; 600,000 gallons used.

Empty drums: 94,000 purchased at a cost of $94,000; 80,000 drums used.

Direct labor: 81,000 hours worked at a cost of $816,480. Factory

Required:

Calculate the following for September, using the formulas on pages 421–422 and 424 (Round unit costs to the nearest whole cent and compute the materials variances for both Surge and for the drums.):

- 1. Materials quantity variance.

- 2. Materials purchase price variance.

- 3. Labor efficiency variance.

- 4. Labor rate variance.

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Principles of Cost Accounting

Additional Business Textbook Solutions

Horngren's Accounting (12th Edition)

Financial Accounting, Student Value Edition (5th Edition)

Marketing: An Introduction (13th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Intermediate Accounting (2nd Edition)

Essentials of MIS (13th Edition)

- Which of the following is an intangible asset? A) InventoryB) CopyrightC) EquipmentD) Accounts Receivablearrow_forwardWhat does a ledger account represent? A) A detailed record of all business transactionsB) A summary of trial balancesC) An individual record for each accountD) The final balance of a financial statement Need help!arrow_forwardWhat is the primary purpose of accounting? A) To generate tax revenueB) To record, summarize, and report financial transactionsC) To determine the market value of assetsD) To manage payrollarrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning