1.

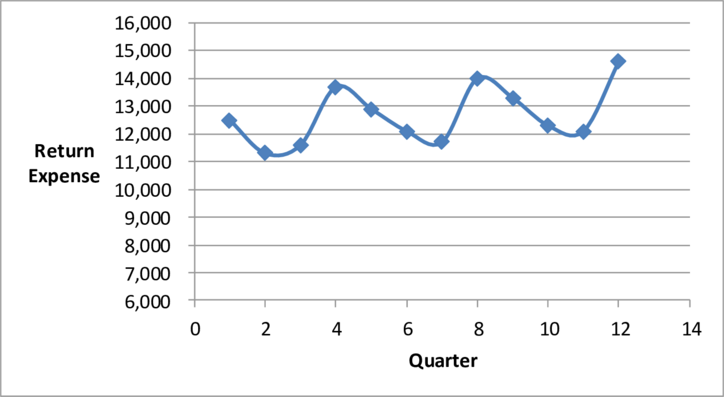

Draw a graph of the data.

1.

Explanation of Solution

Draw a graph of the data.

Figure (1)

2.

Compute quarterly

2.

Explanation of Solution

High-low method:

The graph in part (1) shows that high and low points are last and second data points, so these points develop the estimate of high-low.

Calculate the variable cost.

Calculate the fixed cost.

Compute quarterly prediction for the year 2019.

| 2019 Quarter | Return Expenses |

| 13 | $14,930 |

| 14 | $15,260 |

| 15 | $15,590 |

| 16 | $15,920 |

Table (1)

Note: Shown below is the formula to compute quarterly prediction.

These predictions do not take into account the seasonal variation as shown in the data, it is always useful to take into considerationthe results for a regression analysis as shown in part (3).

3.

Compute the quarterly forecast for 2019 using the results of a regression analysis. Calculate the result of regression analysis and necessary changes to improve the model.

3.

Explanation of Solution

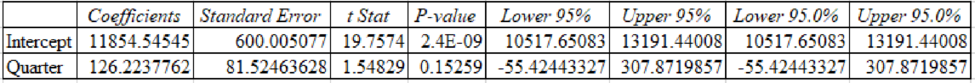

Regression one:

| Regression Statistics | |

| Multiple R | 0.439734422 |

| R Square | 0.193366362 |

| Adjusted R Square | 0.112702998 |

| Standard Error | 974.8928577 |

| Observations | 12 |

Table (2)

| ANOVA | |||||

| df | SS | MS | F | Significance F | |

| Regression | 1 | 2278339.161 | 2278339 | 2.397202 | 0.152593037 |

| Residual | 10 | 9504160.839 | 950416.1 | ||

| Total | 11 | 11782500 | |||

Table (3)

Table (4)

| Regression Predictions | |

| Intercept | $11,855 |

| Coefficient | $126.22 |

Table (5)

| Quarterly Predictions | |

| 13 | $13,496 |

| 14 | $13,622 |

| 15 | $13,748 |

| 16 | $13,875 |

Table (6)

Note: Shown below is to compute rent expense.

Predicted expense for next four quarter using regression analysis:

| Quarter | Regression prediction | |

| 13 | | 13,495.45 |

| 14 | | 13,621.68 |

| 15 | | 13,747.90 |

| 16 | | 13,874.13 |

Table (7)

This shows how the regression model’s prediction differ from that of high-low method.

The above regression one has relatively low R-Squared (0.19) and low t-value for the independent variable, a revision of the regression model is considered. Since, there is visible seasonality in the data, by adding dummy variable it is possible to improve on the regression model with 1s in the periods 4,8, and 12, and 0s in the left-over periods. For the dummy variable the below given regression analysis indications a much higher R-Squared, improved SE and a substantial t-value.

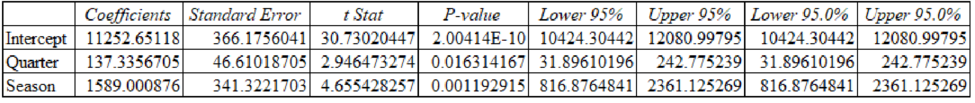

Regression 2:

| Regression Statistics | |

| Multiple R | 0.873681599 |

| R Square | 0.763319537 |

| Adjusted R Square | 0.710723879 |

| Standard Error | 556.6454641 |

| Observations | 12 |

Table (8)

| ANOVA | |||||

| df | SS | MS | F | Significance F | |

| Regression | 2 | 8993812.445 | 4496906.223 | 14.51297616 | 0.00152662 |

| Residual | 9 | 2788687.555 | 309854.1728 | ||

| Total | 11 | 11782500 | |||

Table (9)

Table (10)

Equation for the above regression are:

| Regression Predictions | |

| Intercept | $11,252.65 |

| Coefficient Qtr. | $137.34 |

| Coefficient Season | $1,589 |

Table (11)

The regression prediction for the revised regression:

| Quarterly Predictions | |

| 13 | $14,627 |

| 14 | $13,175 |

| 15 | $13,313 |

| 16 | $15,039 |

Table (12)

The management accountant should depend on the above shown prediction because the second regression has better statistical measures.

4.

Explain how the analysis of costs change, if L Incorporation produces its products in multiple global production facilities to serve the global market.

4.

Explanation of Solution

If L Incorporation produces its products in multiple global production facilities, then the expenses incurred from returns has to be studied by the production facility. Due to various equipment used in manufacturing the DVD players, the cost incurred are likely to differ among the production facility.

Want to see more full solutions like this?

Chapter 8 Solutions

Cost Management

- Quiksilver Company sold 4,480 units in October at a price of $63 per unit. The variable cost is $51 per unit. Calculate the total contribution margin. A. $62,060 B. $73,080 C. $56,000 D. $99,750 E. $ 53,760 helparrow_forwardI want to this question answer for General accounting question not need ai solutionarrow_forwardTaylor Manufacturing had the following results of operations for the past year:arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education