1.

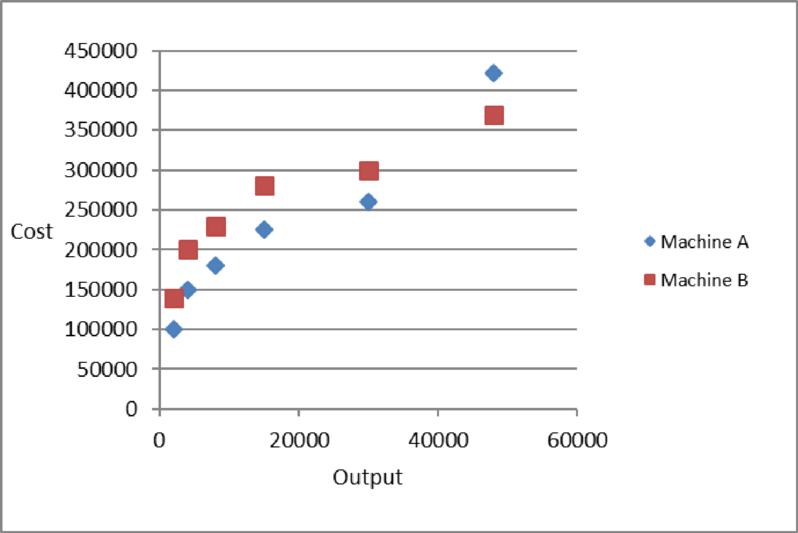

Draw a graph for the two brands of machine.

1.

Explanation of Solution

The data of the graph shows no significant outliers but there is nonlinearity as shown below.

Figure (1)

2&3

Compute cost equation and costs of operating each machine using high-low method.

2&3

Explanation of Solution

Machine A:

Calculate unit variable cost.

Calculate the total cost at 40,000 square yards.

Calculate the total cost at 25,000 square yards.

Calculate the total cost at 60,000 square yards.

Machine B:

Calculate unit variable cost.

Calculate the total cost at 40,000 square yards.

Calculate the total cost at 25,000 square yards.

Calculate the total cost at 60,000 square yards.

4.

Identify the machine to be purchased and the square yard. Describe whether high-low method is useful or not.

4.

Explanation of Solution

The limitations from the preceding analysis and their related conclusion is that the used data models does not present a complete picture on the underlying cost behavior patterns. By observing the inspection of data provided and inspection of the graph, Machine A is preferred to Machine B to an estimated figure of 40,000 units.

The error that is found in the analysis is in using High Low method for the

It can be concluded that the application of a cost estimation method must be used with extreme precautions and the graph serves as an essential tool to identify any potential mistakes.

5.

Comment on the given statement.

5.

Explanation of Solution

In this case, the nature and extent of the effect of the defect on customers and Company H must be considered. The safety of those people is compromised as long as they use the buildings with defective glass. It is the duty of the cost analyst to present a complete report the management regarding the cost associated with each machine. The cost analysis must be in such a manner that the management is able to make an ethical choice in an appropriate manner.

6.

Explain the additional consideration that are important to Company H.

6.

Explanation of Solution

Company H must be fully aware of the import duties and the restrictions for the purchase of such machines apart from the cost of the machines. The manner in which the restrictions and duties affect the cost and availability of the machine must be properly studied. Moreover, exchange rate policies must be kept in special consideration due to their volatility.

Want to see more full solutions like this?

Chapter 8 Solutions

Cost Management

- Please help me solve this financial accounting problem with the correct financial process.arrow_forwardI am trying to find the accurate solution to this financial accounting problem with appropriate explanations.arrow_forwardKennedy Retailers sold $875,000 worth of merchandise, had $95,000 returned, and then the balance was paid during the 3% discount period. How much was Kennedy's net sales? A. $780,000 B. $756,600 C. $848,750 D. $725,550arrow_forward

- I am looking for the correct answer to this accounting problem using valid accounting standards.arrow_forwardCan you solve this financial accounting problem using accurate calculation methods?arrow_forwardPlease explain the solution to this financial accounting problem using the correct financial principles.arrow_forward

- The supervisor at Grace Diner analyzed the weekly food waste report. According to restaurant standards, waste should not exceed 3.5% of weekly food cost. With total food costs of$9,250, actual waste recorded was $397. Management needs the variance from acceptable waste limit to be determined for staff evaluation. Give me currect answerarrow_forwardArgyle Retail reports sales revenue of $485,000 and the cost of goods sold is $297,500. What is the gross profit for the period?arrow_forwardThe supervisor at Grace Diner analyzed the weekly food waste report. According to restaurant standards, waste should not exceed 3.5% of weekly food cost. With total food costs of$9,250, actual waste recorded was $397. Management needs the variance from acceptable waste limit to be determined for staff evaluation.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education