1.

Prepare a table to allocate the costs incurred by Company P.

1.

Explanation of Solution

Lump-Sum purchase:

If a company purchases a group of assets collectively and a lump sum amount is paid for such purchase, then it is referred to as basket purchase. The accounting term for this type of acquisition is the lump-sum purchase.

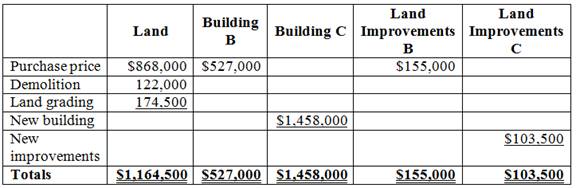

Compute the total cost of the assets as follows:

Table (1)

Prepare a table to allocate the costs incurred by Company P as follows:

| Assets | Fair Market Value (in $) | Percent of total= | Allocation of the purchase price based on the percentage of total |

| Land | 795,200 | 868,000 | |

| Building B | 482,800 | 527,000 | |

| Land Improvements B | 142,000 | 155,000 | |

| Total | $1,420,000 | $1,550,000 |

Table (2)

2.

Prepare a single

2.

Explanation of Solution

Depreciation expense is a non-cash expense, which is recorded on the income statement reflecting the consumption of economic benefits of long-term asset on account of its wear and tear or obsolescence.

Prepare journal entry to record the purchase as follows:

| Date | Account Title and Explanation |

Debit ($) |

Credit ($) |

| January 1, 2017 | Land | 1,164,500 | |

| Land improvements B | 527,000 | ||

| Land Improvements C | 1,458,000 | ||

| Building B | 155,000 | ||

| Building C | 103,500 | ||

| Cash | 3,408,000 | ||

| (To record the costs of lump-sum purchase) |

Table (2)

- Land is an asset account and it is increased. Therefore, debit land account.

- Land Improvements are the asset account and they are increased. Therefore, debit land improvements account.

- Building is an asset account and it is increased. Therefore debit building account.

- Cash is an asset account and it is decreased. Therefore credit cash account.

3.

Prepare the December 31

3.

Explanation of Solution

Prepare the December 31 adjusting entries to record depreciation of the assets for the year 2017 as follows:

Adjusting entry to record the depreciation of Building B for the year 2017:

| Date | Account title and Explanation | Post Ref. |

Debit (In $) |

Credit (In $) |

| December 31, 2017 | Depreciation expense | 28,500 | ||

| | 28,500 | |||

| (To record the depreciation expense) |

Table (3)

Working Note:

Calculate the depreciation expense.

- Depreciation expense is a component of

retained earnings . It decreases the retained earnings. Thus, depreciation expense is debited. - Accumulated depreciation is a contra asset which decreases the value of the asset. Increase in accumulated depreciation decreases the asset’s value. Thus, accumulated depreciation on equipment is credited.

Adjusting entry to record the depreciation of Building C for the year 2017:

| Date | Account title and Explanation | Post Ref. |

Debit (In $) |

Credit (In $) |

| December 31, 2017 | Depreciation expense | 60,000 | ||

| Accumulated depreciation | 60,000 | |||

| (To record the depreciation expense) |

Table (4)

Working Note:

Calculate the depreciation expense.

- Depreciation expense is a component of retained earnings. It decreases the retained earnings. Thus, depreciation expense is debited.

- Accumulated depreciation is a contra asset which decreases the value of the asset. Increase in accumulated depreciation decreases the asset’s value. Thus, accumulated depreciation on equipment is credited.

Adjusting entry to record the depreciation of Land Improvements B for the year 2017:

| Date | Account title and Explanation | Post Ref. |

Debit (In $) |

Credit (In $) |

| December 31, 2017 | Depreciation expense | 31,000 | ||

| Accumulated depreciation | 31,000 | |||

| (To record the depreciation expense) |

Table (5)

Working Note:

Calculate the depreciation expense.

- Depreciation expense is a component of retained earnings. It decreases the retained earnings. Thus, depreciation expense is debited.

- Accumulated depreciation is a contra asset which decreases the value of the asset. Increase in accumulated depreciation decreases the asset’s value. Thus, accumulated depreciation on equipment is credited.

Adjusting entry to record the depreciation of Land Improvements C for the year 2017:

| Date | Account title and Explanation | Post Ref. |

Debit (In $) |

Credit (In $) |

| December 31, 2017 | Depreciation expense | 10,350 | ||

| Accumulated depreciation | 10,350 | |||

| (To record the depreciation expense) |

Table (6)

Working Note:

Calculate the depreciation expense.

- Depreciation expense is a component of retained earnings. It decreases the retained earnings. Thus, depreciation expense is debited.

- Accumulated depreciation is a contra asset which decreases the value of the asset. Increase in accumulated depreciation decreases the asset’s value. Thus, accumulated depreciation on equipment is credited.

Want to see more full solutions like this?

Chapter 8 Solutions

FINANCIAL ACCT.FUND(LL)W/ACCESS>CUSTOM<

- I need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardCan you help me solve this general accounting problem with the correct methodology?arrow_forwardKindly help me with this General accounting questions not use chart gpt please fast given solutionarrow_forward

- Please given correct answer for General accounting question I need step by step explanationarrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease explain the solution to this general accounting problem with accurate explanations.arrow_forward

- Patricia receives $65,000 worth of Nextech, Inc., common stock from her uncle's estate. Early in the year, she receives a $320 cash dividend. Three months later, she received a 3% stock dividend. Near the end of the year, Patricia sells the stock for $68,500. Due to these events only, how much must Patricia include in her gross income for the year?arrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardGriffin Manufacturing has provided the following data for the month of March. The balance in the Finished Goods inventory account at the beginning of the month was $95,200 and at the end of the month was $89,600. The cost of goods manufactured for the month was $428,300. The actual manufacturing overhead cost incurred was $142,700 and the manufacturing overhead cost applied to jobs was $146,500. The adjusted cost of goods sold that would appear on the income statement for March is __.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education