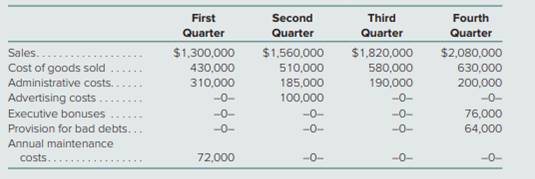

Noventis Corporation prepared the following estimates for the four quarters of the current year:

Additional Information

• First-quarter administrative costs include the $160,000 annual insurance premium.

• Advertising costs paid in the second quarter relate to television advertisements that will be broadcast throughout the entire year.

• No special items affect income during the year.

• Noventis estimates an effective income tax rate for the year of 40 percent.

a. Assuming that actual results do not vary from the estimates provided, determine the amount of net income to be reported each quarter of the current year.

b. Assume that actual results do not vary from the estimates provided except for that in the third quarter, the estimated annual effective income tax rate is revised downward to 38 percent. Determine the amount of net income to be reported each quarter of the current year.

a.

Determine the amount of net income to be reported each quarter of the current year assuming that actual results do not vary from the estimates provided.

Answer to Problem 39P

The amount of net income to be reported each quarter of the current year assuming that actual results do not vary from the estimates provided is $361200, $448,200, $559,200, $679,200 respectively.

Explanation of Solution

Amount of net income to be reported each quarter of the current year:

| Particulars | First quarter | Second quarter | Third quarter | Fourth quarter |

| Sales | $ 1,300,000 | $ 1,560,000 | $ 1,820,000 | $ 2,080,000 |

| Less: | ||||

| Cost of goods sold | $ 430,000 | $ 510,000 | $ 580,000 | $ 630,000 |

| Administrative costs | $ 190,000 | $ 225,000 | $ 230,000 | $ 240,000 |

| Advertising costs | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 |

| Executive bonuses | $ 19,000 | $ 19,000 | $ 19,000 | $ 19,000 |

| Provision for bad debts | $ 16,000 | $ 16,000 | $ 16,000 | $ 16,000 |

| Annual maintenance costs | $ 18,000 | $ 18,000 | $ 18,000 | $ 18,000 |

| Pre-tax income | $ 602,000 | $ 747,000 | $ 932,000 | $ 1,132,000 |

| Less: Income tax | $ 240,800 | $ 298,800 | $ 372,800 | $ 452,800 |

| Net income | $ 361,200 | $ 448,200 | $ 559,200 | $ 679,200 |

Table: (1)

Working note

Calculate insurance premium per quarter

Thus, insurance premium per quarter is $40,000

Calculate administrative expenses for the first quarter

Thus, administrative expenses for the first quarter is $190,000

Insurance premium per quarter is added to the administrative expenses estimates given.

Advertising costs estimates are equally distributed in the four quarters.

Executive bonuses are equally distributed in four quarters.

Provision for bad debts is equally distributed in four quarters.

Annual maintenance costs are equally distributed in four quarters.

b.

Determine the amount of net income to be reported each quarter of the current year assuming that actual results do not vary from the estimates provided except for that in the third quarter, the estimated annual effective income tax rate is revised downward to 38 percent.

Answer to Problem 39P

The amount of net income to be reported each quarter of the current year assuming that actual results do not vary from the estimates provided except for that in the third quarter, the estimated annual effective income tax rate is revised downward to 38 percent is $361200, $448,200, $577,840, $701,840 respectively.

Explanation of Solution

Amount of net income to be reported each quarter of the current year:

| Particulars | First quarter | Second quarter | Third quarter | Fourth quarter |

| Sales | $ 1,300,000 | $ 1,560,000 | $ 1,820,000 | $ 2,080,000 |

| Less: | ||||

| Cost of goods sold | $ 430,000 | $ 510,000 | $ 580,000 | $ 630,000 |

| Administrative costs | $ 190,000 | $ 225,000 | $ 230,000 | $ 240,000 |

| Advertising costs | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 |

| Executive bonuses | $ 19,000 | $ 19,000 | $ 19,000 | $ 19,000 |

| Provision for bad debts | $ 16,000 | $ 16,000 | $ 16,000 | $ 16,000 |

| Annual maintenance costs | $ 18,000 | $ 18,000 | $ 18,000 | $ 18,000 |

| Pre-tax income | $ 602,000 | $ 747,000 | $ 932,000 | $ 1,132,000 |

| Less: Income tax | $ 240,800 | $ 298,800 | $ 354,160 | $ 430,160 |

| Net income | $ 361,200 | $ 448,200 | $ 577,840 | $ 701,840 |

Table: (2)

Income tax rate is 40 percent for first and second quarter and it has changed to 38 percent in the third and fourth quarter.

Want to see more full solutions like this?

Chapter 8 Solutions

ADVANCED ACCOUNTING

- What is the sales volume variance for total revenue?arrow_forwardFernandez Corporation purchased a truck at the beginning of 2025 for $50,000. The truck is estimated to have a salvage value of $2,000 and a useful life of 160,000 miles. It was driven 23,000 miles in 2025 and 31,000 miles in 2026. Compute depreciation expense using the units-of-production method for 2025 and 2026.arrow_forwardexpert of account answerarrow_forward

- provide correct answerarrow_forwardThe following lots of Commodity Z were available for sale during the year. Beginning inventory First purchase Second purchase Third purchase 10 units at $30 25 units at $32 30 units at $34 10 units at $35 The firm uses the periodic inventory system, and there are 20 units of the commodity on hand at the end of the year. What is the ending inventory balance of Commodity Z using the weighted average cost method? a. $620 b. $659 c. $690 d. $655arrow_forwardAssume that three identical units of merchandise were purchased during October, as follows: Units Cost Oct. 5 Purchase 1 $ 5 12 Purchase 1 13 28 Purchase 1 15 Total 3 $33 One unit is sold on October 31 for $28. Using the table provided, determine the cost of goods sold using the weighted average cost method. a. $11 b. $17 c. $13 d. $22arrow_forward

- Boxwood Company sells blankets for $39 each. The following information was taken from the inventory records during May. The company had no beginning inventory on May 1. Boxwood uses a perpetual inventory system.DateBlanketsUnitsCostMay 3Purchase21$1710Sale8 17Purchase36$1920Sale15 23Sale 30Purchase37$20Determine the gross profit for the sale of May 23 using the FIFO inventory costing method.a. $100b. $221c. $95d.$259arrow_forwardGeneral accounting questionarrow_forwardNonearrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning