Managerial Accounting: Creating Value in a Dynamic Business Environment

11th Edition

ISBN: 9781259727757

Author: HILTON

Publisher: MCG COURSE

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 8, Problem 38P

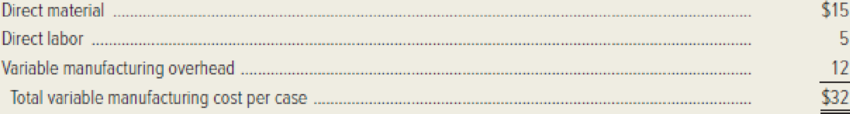

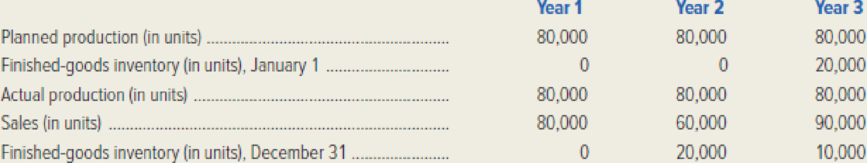

Chataqua Can Company manufactures metal cans used in the food-processing industry. A case of cans sells for $50. The variable costs of production for one case of cans are as follows:

Variable selling and administrative costs amount to $1 per case. Budgeted fixed manufacturing

Actual costs were the same as the budgeted costs.

Required:

- 1. Prepare operating income statements for Chataqua Can Company for its first three years of operations using:

- a. Absorption costing.

- b. Variable costing.

- 2. Reconcile Chataqua Can Company’s operating income reported under absorption and variable costing for each of its first three years of operation. Use the shortcut method.

- 3. Suppose that during Chataqua’s fourth year of operation actual production equals planned production, actual costs are as expected, and the company ends the year with no inventory on hand.

- a. What will be the difference between absorption-costing income and variable-costing income in year 4?

- b. What will be the relationship between total operating income for the four-year period as reported under absorption and variable costing? Explain.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

none

best answer

find operating cash floe. best answer

Chapter 8 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Ch. 8 - Briefly explain the difference between absorption...Ch. 8 - Timing is the key in distinguishing between...Ch. 8 - The term direct costing is a misnomer. Variable...Ch. 8 - When inventory increases, will absorption-costing...Ch. 8 - Why do many managers prefer variable costing over...Ch. 8 - Explain why some management accountants believe...Ch. 8 - Prob. 7RQCh. 8 - Why do proponents of absorption costing argue that...Ch. 8 - Why do proponents of variable costing prefer...Ch. 8 - Which is more consistent with cost-volume-profit...

Ch. 8 - Explain how the accounting definition of an asset...Ch. 8 - List and define four types of product quality...Ch. 8 - Explain the difference between observable and...Ch. 8 - Prob. 14RQCh. 8 - What is meant by a products grade, as a...Ch. 8 - Prob. 16RQCh. 8 - Prob. 17RQCh. 8 - Define the following types of environmental costs:...Ch. 8 - Explain three strategies of environmental cost...Ch. 8 - Manta Ray Company manufactures diving masks with a...Ch. 8 - Information taken from Tuscarora Paper Companys...Ch. 8 - Easton Pump Companys planned production for the...Ch. 8 - Pandora Pillow Companys planned production for the...Ch. 8 - Bianca Bicycle Company manufactures mountain bikes...Ch. 8 - Refer to the data given in the preceding exercise...Ch. 8 - Prob. 26ECh. 8 - Prob. 27ECh. 8 - The following costs were incurred by Osaka Metals...Ch. 8 - San Mateo Circuitry manufactures electrical...Ch. 8 - List three observable and three hidden quality...Ch. 8 - Prob. 31ECh. 8 - Skinny Dippers, Inc. produces nonfat frozen...Ch. 8 - Yellowstone Company began operations on January 1...Ch. 8 - Outback Corporation manufactures tactical LED...Ch. 8 - Great Outdoze Company manufactures sleeping bags,...Ch. 8 - Dayton Lighting Company had operating income for...Ch. 8 - Prob. 37PCh. 8 - Chataqua Can Company manufactures metal cans used...Ch. 8 - Advanced Technologies (AT) produces two...Ch. 8 - Laser News Technology, Inc. manufactures...Ch. 8 - Prob. 42CCh. 8 - Refer to the information given in the preceding...Ch. 8 - Prob. 44C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How much of their social security is included in gross income?arrow_forwardGeneral accountingarrow_forwardRehan Manufacturing's break-even point in units is 1,800. The sales price per unit is $20, and the variable cost per unit is $14. If the company sells 4,200 units, what will net income be?helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Job Costing and Spoilage | Topic 2 | Spoilage, Re-work, and Scrap; Author: Samantha Taylor;https://www.youtube.com/watch?v=VP55_W2oXic;License: CC-BY