MANAGERIAL ACCOUNTING W/CONNECT CODE

12th Edition

ISBN: 9781264467594

Author: HILTON

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 35P

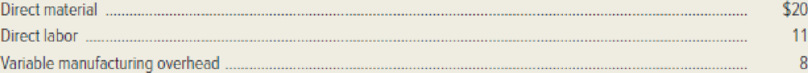

Great Outdoze Company manufactures sleeping bags, which sell for $65 each. The variable costs of production are as follows:

Budgeted fixed

Required:

- 1. Calculate the product cost per sleeping bag under (a) absorption costing and (b) variable costing.

- 2. Prepare operating income statements for the year using (a) absorption costing and (b) variable costing.

- 3. Reconcile reported operating income under the two methods using the shortcut method.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

hello teacher please solve question

hi expert please help me accounting questions

hi expert please help me

Chapter 8 Solutions

MANAGERIAL ACCOUNTING W/CONNECT CODE

Ch. 8 - Briefly explain the difference between absorption...Ch. 8 - Timing is the key in distinguishing between...Ch. 8 - The term direct costing is a misnomer. Variable...Ch. 8 - When inventory increases, will absorption-costing...Ch. 8 - Why do many managers prefer variable costing over...Ch. 8 - Explain why some management accountants believe...Ch. 8 - Prob. 7RQCh. 8 - Why do proponents of absorption costing argue that...Ch. 8 - Why do proponents of variable costing prefer...Ch. 8 - Which is more consistent with cost-volume-profit...

Ch. 8 - Explain how the accounting definition of an asset...Ch. 8 - List and define four types of product quality...Ch. 8 - Explain the difference between observable and...Ch. 8 - Prob. 14RQCh. 8 - What is meant by a products grade, as a...Ch. 8 - Prob. 16RQCh. 8 - Prob. 17RQCh. 8 - Explain three strategies of environmental cost...Ch. 8 - Prob. 19RQCh. 8 - Manta Ray Company manufactures diving masks with a...Ch. 8 - Information taken from Tuscarora Paper Companys...Ch. 8 - Easton Pump Companys planned production for the...Ch. 8 - Pandora Pillow Companys planned production for the...Ch. 8 - Bianca Bicycle Company manufactures mountain bikes...Ch. 8 - Refer to the data given in the preceding exercise...Ch. 8 - Prob. 26ECh. 8 - Prob. 27ECh. 8 - The following costs were incurred by Osaka Metals...Ch. 8 - San Mateo Circuitry manufactures electrical...Ch. 8 - Prob. 31ECh. 8 - Skinny Dippers, Inc. produces nonfat frozen...Ch. 8 - Yellowstone Company began operations on January 1...Ch. 8 - Outback Corporation manufactures tactical LED...Ch. 8 - Great Outdoze Company manufactures sleeping bags,...Ch. 8 - Dayton Lighting Company had operating income for...Ch. 8 - Prob. 37PCh. 8 - Chataqua Can Company manufactures metal cans used...Ch. 8 - Advanced Technologies (AT) produces two...Ch. 8 - Laser News Technology, Inc. manufactures...Ch. 8 - Prob. 42CCh. 8 - Refer to the information given in the preceding...Ch. 8 - Prob. 44C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mead Incorporated began operations in Year 1. Following is a series of transactions and events involving its long-term debt investments in available-for-sale securities. Year 1 January 20 Purchased Johnson & Johnson bonds for $20,500. February 9 Purchased Sony notes for $55,440. June 12 Purchased Mattel bonds for $40,500. December 31 Fair values for debt in the portfolio are Johnson & Johnson, $21,500; Sony, $52,500; and Mattel, $46,350. Year 2 April 15 Sold all of the Johnson & Johnson bonds for $23,500. July 5 Sold all of the Mattel bonds for $35,850. July 22 Purchased Sara Lee notes for $13,500. August 19 Purchased Kodak bonds for $15,300. December 31 Fair values for debt in the portfolio are Kodak, $17,325; Sara Lee, $12,000; and Sony, $60,000. Year 3 February 27 Purchased Microsoft bonds for $160,800. June 21 Sold all of the Sony notes for $57,600. June 30 Purchased Black & Decker bonds for $50,400. August 3 Sold all of the Sara…arrow_forwardWhat is the ending inventory?arrow_forwardMaple industries uses the straight line method solution general accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY