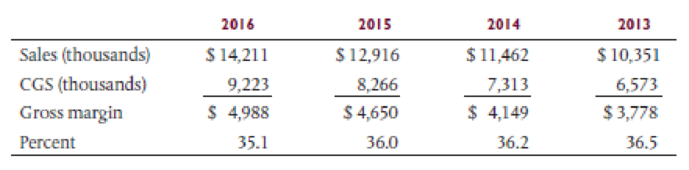

Your comparison of the gross margin percent for Jones Drugs for the years 2013 through 2016 indicates a significant decline. This is shown by the following information:

A discussion with Marilyn Adams, the controller, brings to light two possible explanations. She informs you that the industry gross profit percent in the retail drug industry declined fairly steadily for three years, which accounts for part of the decline. A second factor was the declining percent of the total volume resulting from the pharmacy part of the business. The pharmacy sales represent the most profitable portion of the business, yet the competition from discount drugstores prevents it from expanding as fast as the nondrug items such as magazines, candy, and many other items sold. Adams feels strongly that these two factors are the cause of the decline.

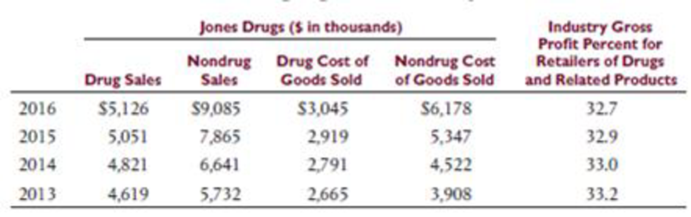

The following additional information is obtained from independent sources and the client's records as a means of investigating the controller's explanations:

Required

- a. Evaluate the explanation provided by Adams. Show calculations to support your conclusions.

- b. Which specific aspects of the client's financial statements require intensive investigation in this audit?

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

EBK AUDITING AND ASSURANCE SERVICES

- Answer? ? Financial accounting questionarrow_forwardGiven answer general Accounting questionarrow_forward3 Read the text below. Choose a word that best fits each gap. Summer is a popular time for vacations, and while some people decide to take a , others plan their trip months in advance. The beginning of the year is a good time for people to start looking at holiday Travel agencies and tour operators both ... a wealth of information on vacation... and different types of holidays. Make sure you have all of your travel... before taking any form of international holiday. Check if your passport is... and, if necessary, that you have a visa. As your departure date gets closer, you can start to plan the details of your journey. If you don't know the language well, it might be... to get a phrase book or a ... Some people enjoy doing extensive... on their destinations, learning about the places of interest and "must-sees".... It's also fun to make a list, so you don't ... important clothes or toiletries. It's also a good idea to buy local ... in advance. Make sure your home and pets are ...…arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning