Refer to Exercise 8.29. Suppose Gene determines that next year’s Sales Division activities include the following:

Research—researching current and future conditions in the industry

Shipping—arranging for shipping of mattresses and handling calls from purchasing agents at retail stores to trace shipments and correct errors

Jobbers—coordinating the efforts of the independent jobbers who sell the mattresses

Basic ads—placing print and television ads for the Sleepeze and Plushette lines

Ultima ads—choosing and working with the advertising agency on the Ultima account

Office management—operating the Sales Division office

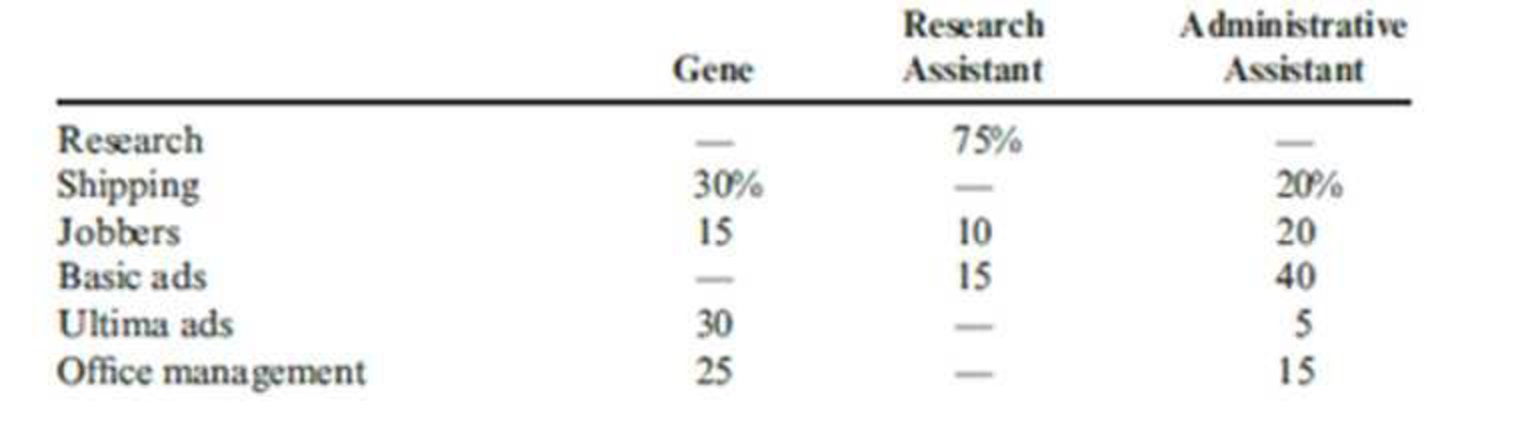

The percentage of time spent by each employee of the Sales Division on each of the above activities is given in the following table:

Additional information is as follows:

- a.

Depreciation on the office equipment belongs to the office management activity. - b. Of the $21,000 for office supplies and other expenses, $5,000 can be assigned to telephone costs which can be split evenly between the shipping and jobbers’ activities. An additional $2,400 per year is attributable to Internet connections and fees, and the bulk of these costs (80 percent) are assignable to research. The remainder is a cost of office management. All other office supplies and costs are assigned to the office management activity.

Required:

- 1. Prepare an activity-based budget for next year by activity. Use the expected level of sales activity.

- 2. On the basis of the budget prepared in Requirement 1, advise Gene regarding actions that might be taken to reduce expenses.

Olympus, Inc., manufactures three models of mattresses: the Sleepeze, the Plushette, and the Ultima.

- a. Salaries for his office (including himself at $65,000, a

marketing research assistant at $40,000, and an administrative assistant at $25,000) are budgeted for $130,000 next year. - b. Depreciation on the offices and equipment is $20,000 per year.

- c. Office supplies and other expenses total $21,000 per year.

- d. Advertising has been steady at $20,000 per year. However, the Ultima is a new product and will require extensive advertising to educate consumers on the unique features of this high-end mattress. Gene believes the company should spend 15 percent of first-year Ultima sales for a print and television campaign.

- e. Commissions on the Sleepeze and Plushette lines are 5 percent of sales. These commissions are paid to independent jobbers who sell the mattresses to retail stores.

- f. Last year, shipping for the Sleepeze and Plushette lines averaged $50 per unit sold. Gene expects the Ultima line to ship for $75 per unit sold since this model features a larger mattress.

Required:

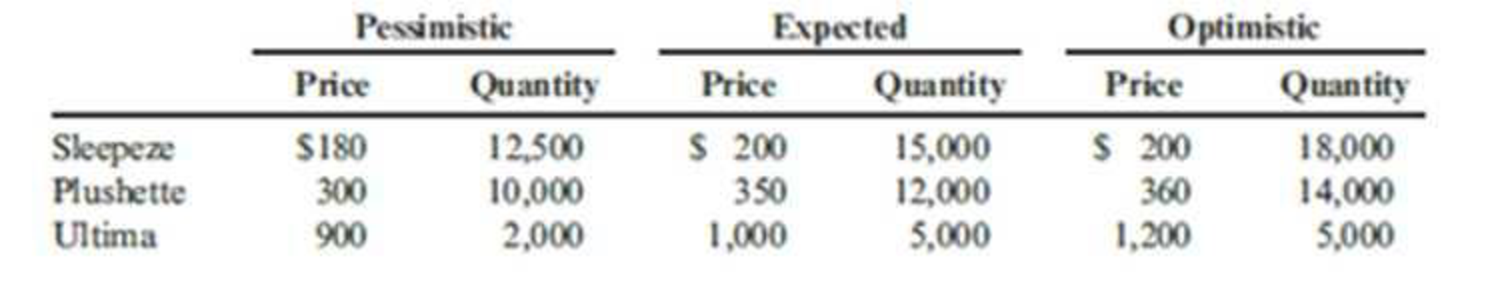

- 1. Suppose that Gene is considering three sales scenarios as follows:

Prepare a revenue budget for the Sales Division for the coming year for each scenario.

- 2. Prepare a flexible expense budget for the Sales Division for the three scenarios above.

Trending nowThis is a popular solution!

Chapter 8 Solutions

EBK CORNERSTONES OF COST MANAGEMENT

- The following transactions of Weber Company occurred during the current year: The company acquired a tract of land in exchange for 1,000 shares of $10 par value common stock. The stock was traded on the New York Stock Exchange at $24 on the date of exchange. The land had a book value on the selling company’s records of $5,000, and it was believed to be worth “anything up to $30,000.” An engine on a truck was replaced. When the truck was purchased 3 years ago, it cost $10,000 and was being depreciated at $2,000 per year. The engine cost $1,000 to replace. The company acquired a tract of land that was believed to have mineral deposits by issuing 500 shares of preferred stock of $50 par value. The preferred stock was rarely traded. The last transaction was 2 months earlier, when 50 shares were sold at $75 per share. The owner of the land was willing to accept cash of $55,000, and an appraisal had shown a value of $60,000. The company purchased a machine with a list price of $8,500 by…arrow_forwardWhat should Davidson record as the cost of the new van on these general accounting question?arrow_forwardCompute the annual rate of return on these financial accounting questionarrow_forward

- FGH Floral Company has a delivery truck that is being sold after 5 years of use. The current book value of the delivery truck is $6,000. If FGH Floral Company sells the delivery truck for $9,000, what is the impact of this transaction? Answerarrow_forwardFinancial Accounting Question please solvearrow_forwardY Company purchased an asset for $73,000 on January 1, Year 1. The asset was expected to have a four-year life and an $8,000 salvage value. What would be the amount of depreciation expense for Year 1 using double-declining balance? Answerarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,