Gulf Real Estate Properties

Gulf Real Estate Properties, Inc., is a real estate firm located in southwest Florida. The company, which advertises itself as “expert in the real estate market,” monitors condominium sales by collecting data on location, list price, sale price, and number of days it takes to sell each unit. Each condominium is classified as Gulf View if it is located directly on the Gulf of Mexico or No Gulf View if it is located on the bay or a golf course, near but not on the Gulf. Sample data from the Multiple Listing Service in Naples, Florida, provided recent sales data for 40 Gulf view condominiums and 18 No Gulf view condominiums. Prices are in thousands of dollars. The data are shown in Table 8.7.

Managerial Report

- 1. Use appropriate

descriptive statistics to summarize each of the three variables for the 40 Gulf View condominiums. - 2. Use appropriate descriptive statistics to summarize each of the three variables for the 18 No Gulf View condominiums.

- 3. Compare your summary results. Discuss any specific statistical results that would help a real estate agent understand the condominium market.

- 4. Develop a 95% confidence

interval estimate of the population mean sales price and population mean number of days to sell for Gulf View condominiums. Interpret your results. - 5. Develop a 95% confidence interval estimate of the population mean sales price and population mean number of days to sell for No Gulf View condominiums. Interpret your results.

- 6. Assume the branch manager requested estimates of the mean selling price of Gulf View condominiums with a margin of error of $40,000 and the mean selling price of No Gulf View condominiums with a margin of error of $15,000. Using 95% confidence, how large should the

sample sizes be? - 7. Gulf Real Estate Properties just signed contracts for two new listings: a Gulf View condominium with a list price of $589,000 and a No Gulf View condominium with a list price of $285,000. What is your estimate of the final selling price and number of days required to sell each of these units?

1.

Find the appropriate descriptive statistics for Gulf View condominiums.

Answer to Problem 2CP

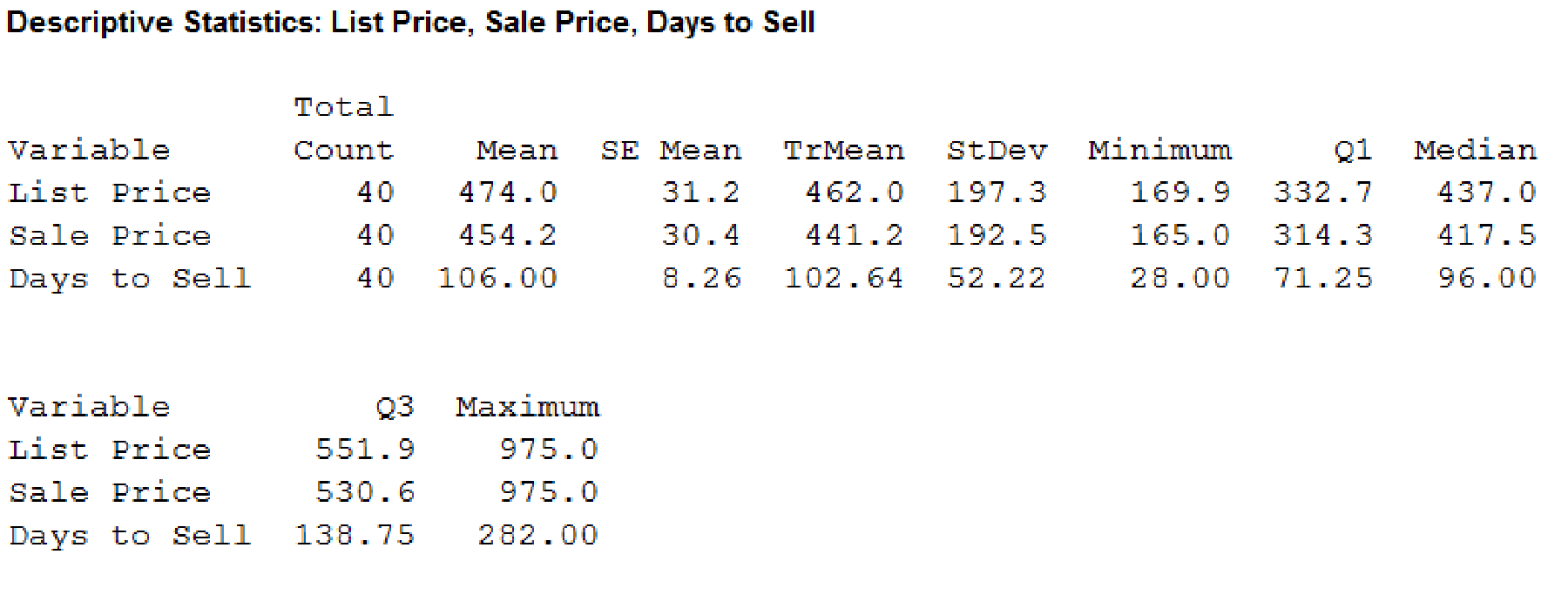

Output using the MINITAB software is given below:

Explanation of Solution

Calculation:

The given information is that the Gulf Real estate properties firm located in the Southwest Florida advertises itself as an “expert in the real estate market”. The data are collected on the sales on a particular location, list price, and the number of days it takes to sell each unit. The condominium is classified as gulf view and no gulf view.

Software Procedure:

Step by step procedure to obtain the descriptive statistics using the MINITAB software:

- Choose Stat > Basic Statistics > Display Descriptive Statistics.

- In Variables enter the columns List Price, Sale Price, and Days to Sell.

- In Statistics select Mean, Median, Trimmed Mean, Standard Deviation, Standard Error Mean, Minimum, Maximum, Quartile 1, Quartile 3, and Total.

- Click OK.

2.

Find the appropriate descriptive statistics for No Gulf View condominiums.

Answer to Problem 2CP

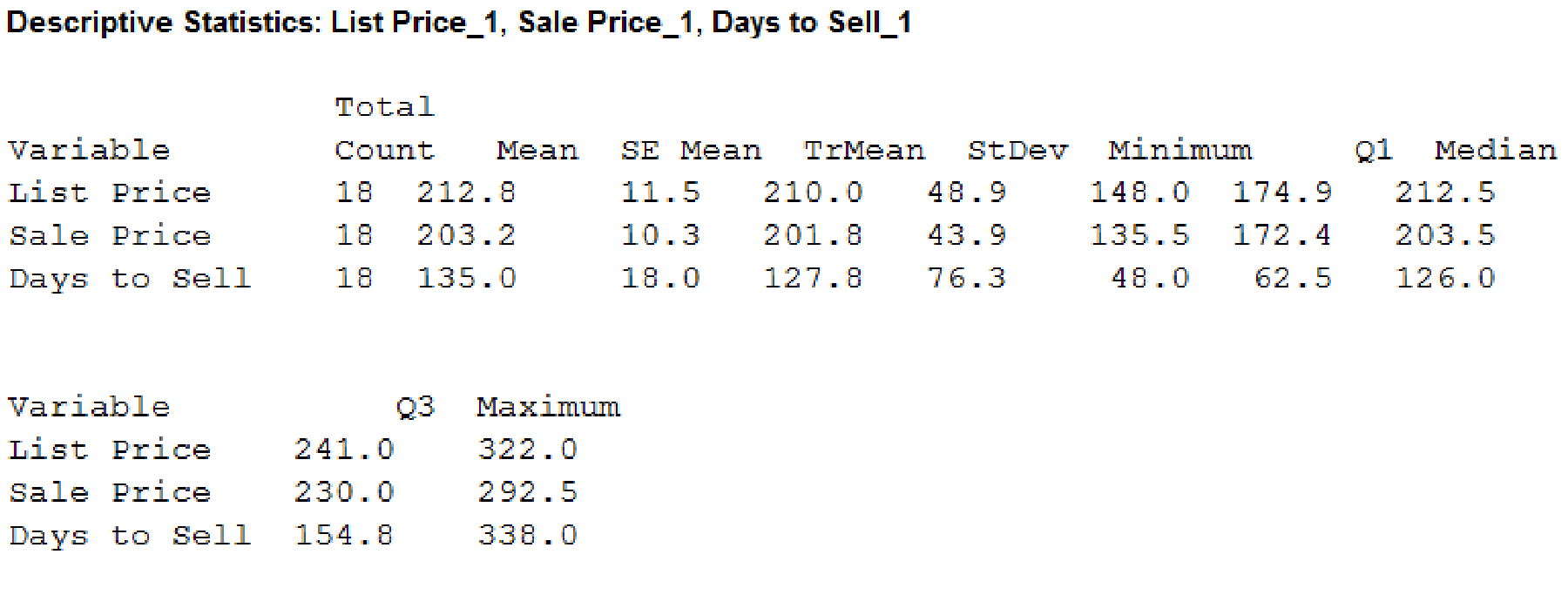

Output using the MINITAB software is given below:

Explanation of Solution

Calculation:

Calculate the appropriate descriptive statistics for No Gulf View condominiums:

Software Procedure:

Step by step procedure to obtain the descriptive statistics using the MINITAB software:

- Choose Stat > Basic Statistics > Display Descriptive Statistics.

- In Variables enter the columns List Price, Sale Price, and Days to Sell.

- In Statistics select Mean, Median, Trimmed Mean, Standard Deviation, Standard Error Mean, Minimum, Maximum, Quartile 1, Quartile 3, and Total.

- Click OK.

3.

Compare the results and explain any particular statistic that results to help the real estate agent to know the condominium market.

Explanation of Solution

Observation:

The mean price for the Gulf View condominium list is $474,000 and the median price is $437,000. The mean price for the No Gulf View condominium list is $21,800 and the median price is $212,500. It reflects that the Gulf View condominiums are most expensive and they are two times of the No Gulf Views.

The mean number of days to sell a condominium of Gulf view is slightly better than the No Gulf view condominium. It indicates that nearly three months will be taken to sell a Gulf View condominium and nearly four months will be taken to sell a No Gulf View condominium.

The most expensive list-price is for a Gulf view condominium and the least expensive list-price is for No Gulf view condominium.

The Gulf view condominiums with mean list price are $474,000 and a mean sale price is $454,200. It is sold on an average of $19,800 and it is 4.2% below list price.

The No Gulf view condominiums with mean list price are $212,800 and a mean sale price is $203,200. It is sold on an average of $9,600 and it is 4.5% below list price.

Gulf view condominiums are more expensive and tend to sell slightly faster than the No Gulf view.

4.

Find the 95% confidence interval for the population mean sales price and the population mean number of days to sell for Gulf view condominiums.

Interpret the results.

Answer to Problem 2CP

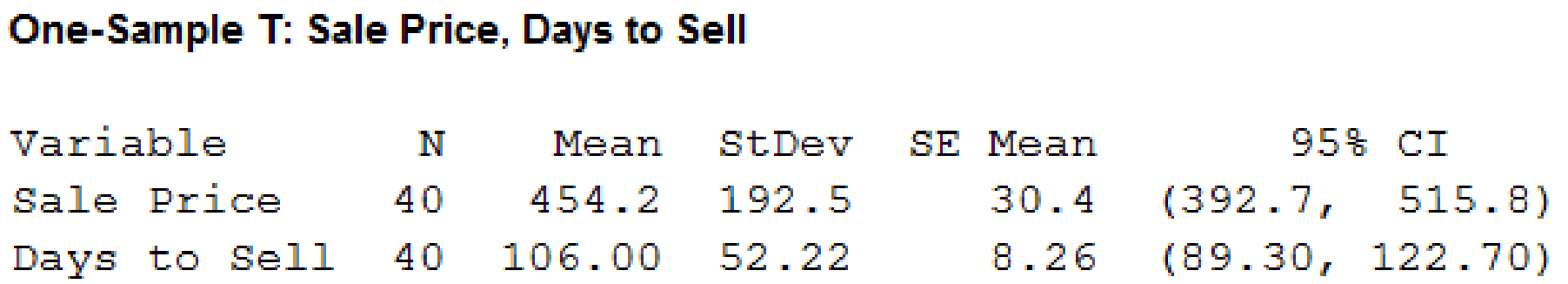

The 95% confidence interval for the population mean sales price for Gulf view condominiums is ($392,700, $515,800) and the population mean number of days to sell for Gulf view condominiums is (89 days, 123 days).

Explanation of Solution

Calculation:

Calculate the 95% confidence interval for the population mean sales price and the population mean number of days to sell for Gulf view condominiums.

Software Procedure:

Step-by-step procedure to obtain the confidence interval using the MINITAB software:

- Choose Stat > Basic Statistics > 1-Sample T.

- In Samples in columns, enter the variable sales price, days to sell.

- Check Options; enter Confidence level as 95%.

- Click OK.

Output using the MINITAB software is given below:

Observation:

The sales price of the Gulf View condominiums is from $392,700 to $515,800 and the days to sell Gulf View condominiums are 89 days to 123 days.

5.

Find the 95% confidence interval for the population mean sales price and the population mean number of days to sell for No Gulf view condominiums.

Interpret the results.

Answer to Problem 2CP

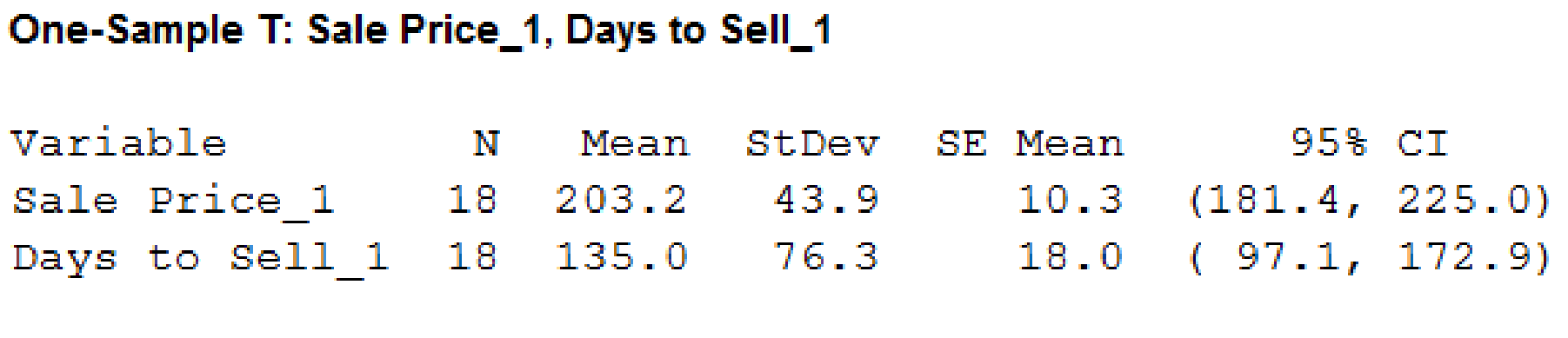

The 95% confidence interval for the population mean sales price for No Gulf view condominiums is ($181,400, $225,000) and the population mean number of days to sell for No Gulf view condominiums is (97 days, 173 days).

Explanation of Solution

Calculation:

Calculate the 95% confidence interval for the population mean sales price and the population mean number of days to sell for No Gulf view condominiums.

Software Procedure:

Step-by-step procedure to obtain the confidence interval using the MINITAB software:

- Choose Stat > Basic Statistics > 1-Sample T.

- In Samples in columns, enter the variable sales price, days to sell.

- Check Options; enter Confidence level as 95%.

- Click OK.

Output using the MINITAB software is given below:

Observation:

The sales price of the No Gulf View condominiums is from $181,400 to $225,000 and the days to sell No Gulf View condominiums are 97 days to 173 days.

6.

Find the sample size for the Gulf view and No Gulf view condominiums for estimating the mean selling price.

Answer to Problem 2CP

The sample size for the Gulf view for estimating the mean selling price is 89 and the sample size for the No Gulf view for estimating the mean selling price is 23.

Explanation of Solution

Calculation:

The sample size for the interval estimate of a population mean is as follows:

From “Table 8.1 value of

For Gulf view condominiums:

From Part (1), the standard deviation for Gulf view selling price is 192.5.

The sample size is as follows:

Thus, the sample size of 89 is required.

For No Gulf view condominiums:

From Part (2), the standard deviation for No Gulf view selling price is 43.9.

The sample size is as follows:

Thus, the sample size of 23 is required.

7.

Find the final selling price and the number of days required to sell each of the unit.

Answer to Problem 2CP

The final selling price and the number of days required to sell each of the unit are $564,262 and 106 days, respectively, for Gulf view condominium.

The final selling price and the number of days required to sell each of the unit are $272,175 and 135 days, respectively, for No Gulf view condominium.

Explanation of Solution

Calculation:

Here, a Gulf view condominium with a list price is $589,000 and a No Gulf view condominium with a list price is $285,000.

From Part (3), the Gulf view condominium is sold on an average of 4.2% below its list price.

The estimated selling price is as follows:

The estimated number of days to sell each of the unit is 106 days.

From Part (3), the No Gulf view condominium is sold on an average of 4.5% below its list price.

The estimated selling price is as follows:

The estimated number of days to sell each of the unit is 135 days.

Want to see more full solutions like this?

Chapter 8 Solutions

CENGAGENOW FOR ANDERSON/SWEENEY/WILLIAM

- Question 2 Parts manufactured by an injection molding process are subjected to a compressive strength test. Twenty samples of five parts each are collected, and the compressive strengths (in psi) are shown in Table 2. Table 2: Strength Data for Question 2 Sample Number x1 x2 23 x4 x5 R 1 83.0 2 88.6 78.3 78.8 3 85.7 75.8 84.3 81.2 78.7 75.7 77.0 71.0 84.2 81.0 79.1 7.3 80.2 17.6 75.2 80.4 10.4 4 80.8 74.4 82.5 74.1 75.7 77.5 8.4 5 83.4 78.4 82.6 78.2 78.9 80.3 5.2 File Preview 6 75.3 79.9 87.3 89.7 81.8 82.8 14.5 7 74.5 78.0 80.8 73.4 79.7 77.3 7.4 8 79.2 84.4 81.5 86.0 74.5 81.1 11.4 9 80.5 86.2 76.2 64.1 80.2 81.4 9.9 10 75.7 75.2 71.1 82.1 74.3 75.7 10.9 11 80.0 81.5 78.4 73.8 78.1 78.4 7.7 12 80.6 81.8 79.3 73.8 81.7 79.4 8.0 13 82.7 81.3 79.1 82.0 79.5 80.9 3.6 14 79.2 74.9 78.6 77.7 75.3 77.1 4.3 15 85.5 82.1 82.8 73.4 71.7 79.1 13.8 16 78.8 79.6 80.2 79.1 80.8 79.7 2.0 17 82.1 78.2 18 84.5 76.9 75.5 83.5 81.2 19 79.0 77.8 20 84.5 73.1 78.2 82.1 79.2 81.1 7.6 81.2 84.4 81.6 80.8…arrow_forwardName: Lab Time: Quiz 7 & 8 (Take Home) - due Wednesday, Feb. 26 Contingency Analysis (Ch. 9) In lab 5, part 3, you will create a mosaic plot and conducted a chi-square contingency test to evaluate whether elderly patients who did not stop walking to talk (vs. those who did stop) were more likely to suffer a fall in the next six months. I have tabulated the data below. Answer the questions below. Please show your calculations on this or a separate sheet. Did not stop walking to talk Stopped walking to talk Totals Suffered a fall Did not suffer a fall Totals 12 11 23 2 35 37 14 14 46 60 Quiz 7: 1. (2 pts) Compute the odds of falling for each group. Compute the odds ratio for those who did not stop walking vs. those who did stop walking. Interpret your result verbally.arrow_forwardSolve please and thank you!arrow_forward

- 7. In a 2011 article, M. Radelet and G. Pierce reported a logistic prediction equation for the death penalty verdicts in North Carolina. Let Y denote whether a subject convicted of murder received the death penalty (1=yes), for the defendant's race h (h1, black; h = 2, white), victim's race i (i = 1, black; i = 2, white), and number of additional factors j (j = 0, 1, 2). For the model logit[P(Y = 1)] = a + ß₁₂ + By + B²², they reported = -5.26, D â BD = 0, BD = 0.17, BY = 0, BY = 0.91, B = 0, B = 2.02, B = 3.98. (a) Estimate the probability of receiving the death penalty for the group most likely to receive it. [4 pts] (b) If, instead, parameters used constraints 3D = BY = 35 = 0, report the esti- mates. [3 pts] h (c) If, instead, parameters used constraints Σ₁ = Σ₁ BY = Σ; B = 0, report the estimates. [3 pts] Hint the probabilities, odds and odds ratios do not change with constraints.arrow_forwardSolve please and thank you!arrow_forwardSolve please and thank you!arrow_forward

- Question 1:We want to evaluate the impact on the monetary economy for a company of two types of strategy (competitive strategy, cooperative strategy) adopted by buyers.Competitive strategy: strategy characterized by firm behavior aimed at obtaining concessions from the buyer.Cooperative strategy: a strategy based on a problem-solving negotiating attitude, with a high level of trust and cooperation.A random sample of 17 buyers took part in a negotiation experiment in which 9 buyers adopted the competitive strategy, and the other 8 the cooperative strategy. The savings obtained for each group of buyers are presented in the pdf that i sent: For this problem, we assume that the samples are random and come from two normal populations of unknown but equal variances.According to the theory, the average saving of buyers adopting a competitive strategy will be lower than that of buyers adopting a cooperative strategy.a) Specify the population identifications and the hypotheses H0 and H1…arrow_forwardYou assume that the annual incomes for certain workers are normal with a mean of $28,500 and a standard deviation of $2,400. What’s the chance that a randomly selected employee makes more than $30,000?What’s the chance that 36 randomly selected employees make more than $30,000, on average?arrow_forwardWhat’s the chance that a fair coin comes up heads more than 60 times when you toss it 100 times?arrow_forward

- Suppose that you have a normal population of quiz scores with mean 40 and standard deviation 10. Select a random sample of 40. What’s the chance that the mean of the quiz scores won’t exceed 45?Select one individual from the population. What’s the chance that his/her quiz score won’t exceed 45?arrow_forwardSuppose that you take a sample of 100 from a population that contains 45 percent Democrats. What sample size condition do you need to check here (if any)?What’s the standard error of ^P?Compare the standard errors of ^p n=100 for ,n=1000 , n=10,000, and comment.arrow_forwardSuppose that a class’s test scores have a mean of 80 and standard deviation of 5. You choose 25 students from the class. What’s the chance that the group’s average test score is more than 82?arrow_forward

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL Functions and Change: A Modeling Approach to Coll...AlgebraISBN:9781337111348Author:Bruce Crauder, Benny Evans, Alan NoellPublisher:Cengage Learning

Functions and Change: A Modeling Approach to Coll...AlgebraISBN:9781337111348Author:Bruce Crauder, Benny Evans, Alan NoellPublisher:Cengage Learning Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt

Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt