Gulf Real Estate Properties

Gulf Real Estate Properties, Inc., is a real estate firm located in southwest Florida. The company, which advertises itself as “expert in the real estate market,” monitors condominium sales by collecting data on location, list price, sale price, and number of days it takes to sell each unit. Each condominium is classified as Gulf View if it is located directly on the Gulf of Mexico or No Gulf View if it is located on the bay or a golf course, near but not on the Gulf. Sample data from the Multiple Listing Service in Naples, Florida, provided recent sales data for 40 Gulf view condominiums and 18 No Gulf view condominiums. Prices are in thousands of dollars. The data are shown in Table 8.7.

Managerial Report

- 1. Use appropriate

descriptive statistics to summarize each of the three variables for the 40 Gulf View condominiums. - 2. Use appropriate descriptive statistics to summarize each of the three variables for the 18 No Gulf View condominiums.

- 3. Compare your summary results. Discuss any specific statistical results that would help a real estate agent understand the condominium market.

- 4. Develop a 95% confidence

interval estimate of the populationmean sales price and population mean number of days to sell for Gulf View condominiums. Interpret your results. - 5. Develop a 95% confidence interval estimate of the population mean sales price and population mean number of days to sell for No Gulf View condominiums. Interpret your results.

- 6. Assume the branch manager requested estimates of the mean selling price of Gulf View condominiums with a margin of error of $40,000 and the mean selling price of No Gulf View condominiums with a margin of error of $15,000. Using 95% confidence, how large should the

sample sizes be? - 7. Gulf Real Estate Properties just signed contracts for two new listings: a Gulf View condominium with a list price of $589,000 and a No Gulf View condominium with a list price of $285,000. What is your estimate of the final selling price and number of days required to sell each of these units?

1.

Find the appropriate descriptive statistics for Gulf View condominiums.

Answer to Problem 2CP

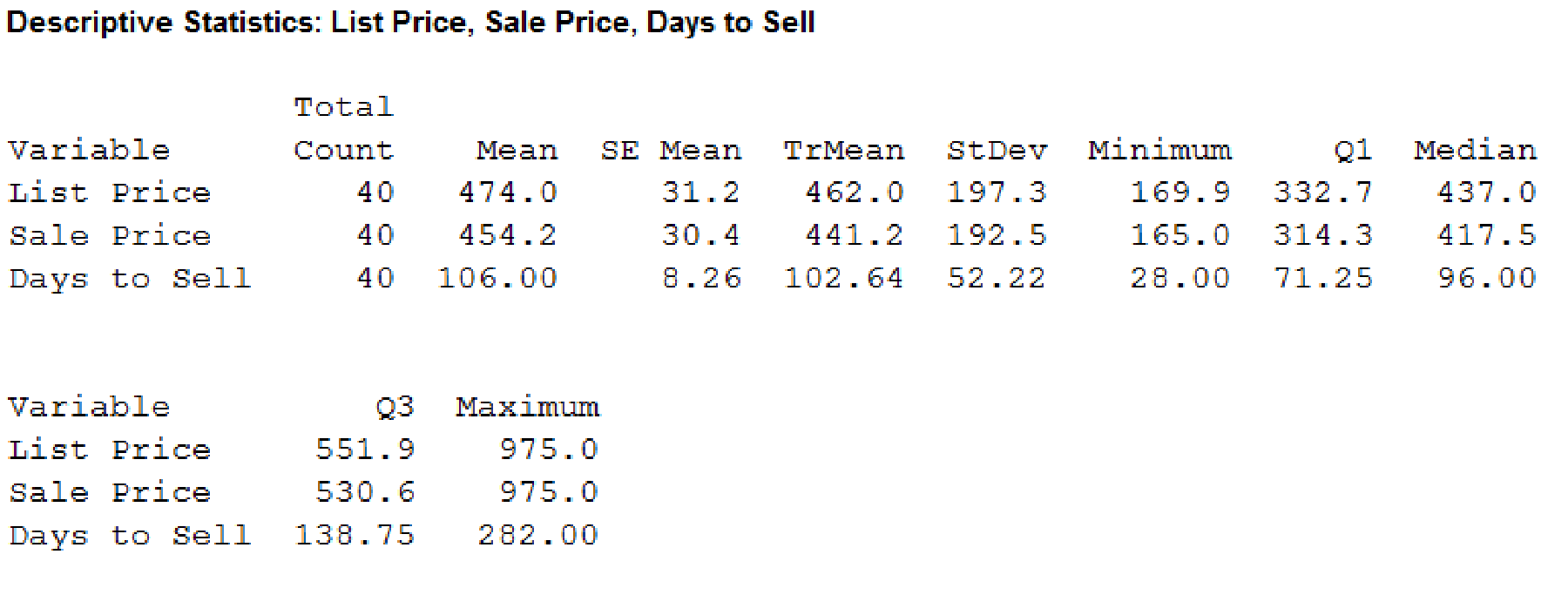

Output using the MINITAB software is given below:

Explanation of Solution

Calculation:

The given information is that the Gulf Real estate properties firm located in the Southwest Florida advertises itself as an “expert in the real estate market”. The data are collected on the sales on a particular location, list price, and the number of days it takes to sell each unit. The condominium is classified as gulf view and no gulf view.

Software Procedure:

Step by step procedure to obtain the descriptive statistics using the MINITAB software:

- Choose Stat > Basic Statistics > Display Descriptive Statistics.

- In Variables enter the columns List Price, Sale Price, and Days to Sell.

- In Statistics select Mean, Median, Trimmed Mean, Standard Deviation, Standard Error Mean, Minimum, Maximum, Quartile 1, Quartile 3, and Total.

- Click OK.

2.

Find the appropriate descriptive statistics for No Gulf View condominiums.

Answer to Problem 2CP

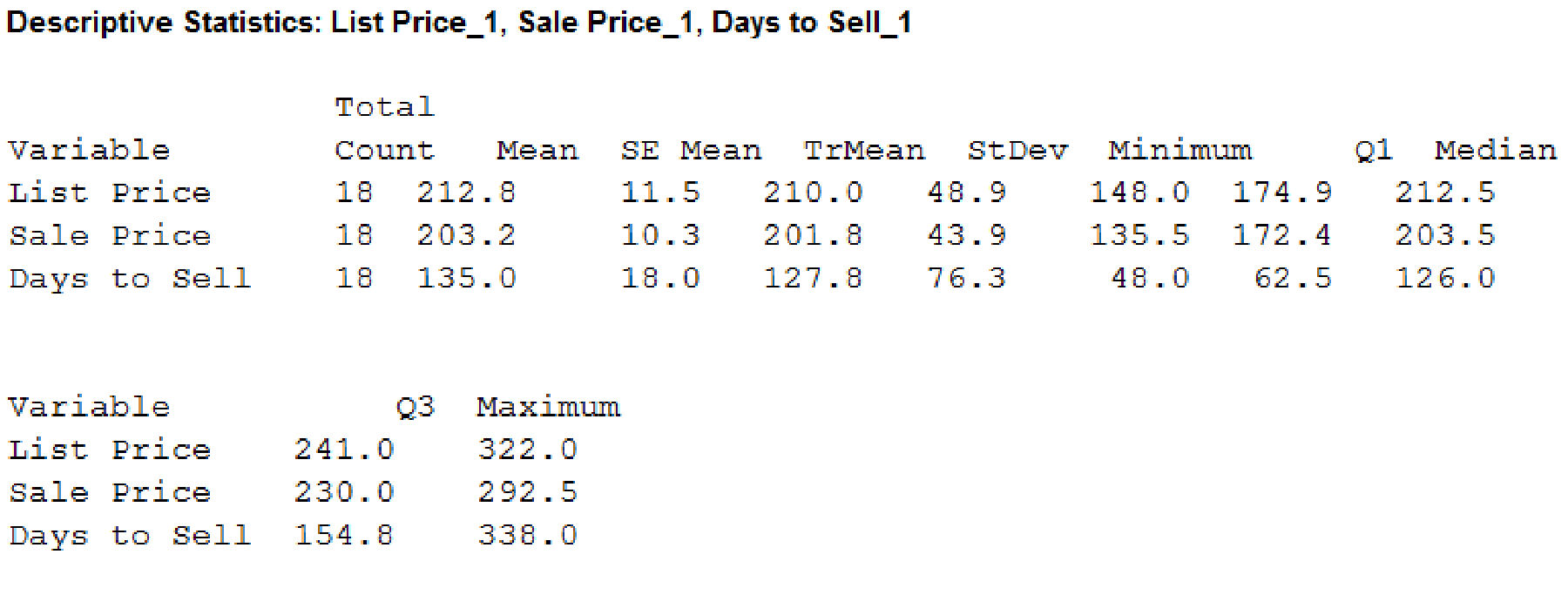

Output using the MINITAB software is given below:

Explanation of Solution

Calculation:

Calculate the appropriate descriptive statistics for No Gulf View condominiums:

Software Procedure:

Step by step procedure to obtain the descriptive statistics using the MINITAB software:

- Choose Stat > Basic Statistics > Display Descriptive Statistics.

- In Variables enter the columns List Price, Sale Price, and Days to Sell.

- In Statistics select Mean, Median, Trimmed Mean, Standard Deviation, Standard Error Mean, Minimum, Maximum, Quartile 1, Quartile 3, and Total.

- Click OK.

3.

Compare the results and explain any particular statistic that results to help the real estate agent to know the condominium market.

Explanation of Solution

Observation:

The mean price for the Gulf View condominium list is $474,000 and the median price is $437,000. The mean price for the No Gulf View condominium list is $21,800 and the median price is $212,500. It reflects that the Gulf View condominiums are most expensive and they are two times of the No Gulf Views.

The mean number of days to sell a condominium of Gulf view is slightly better than the No Gulf view condominium. It indicates that nearly three months will be taken to sell a Gulf View condominium and nearly four months will be taken to sell a No Gulf View condominium.

The most expensive list-price is for a Gulf view condominium and the least expensive list-price is for No Gulf view condominium.

The Gulf view condominiums with mean list price are $474,000 and a mean sale price is $454,200. It is sold on an average of $19,800 and it is 4.2% below list price.

The No Gulf view condominiums with mean list price are $212,800 and a mean sale price is $203,200. It is sold on an average of $9,600 and it is 4.5% below list price.

Gulf view condominiums are more expensive and tend to sell slightly faster than the No Gulf view.

4.

Find the 95% confidence interval for the population mean sales price and the population mean number of days to sell for Gulf view condominiums.

Interpret the results.

Answer to Problem 2CP

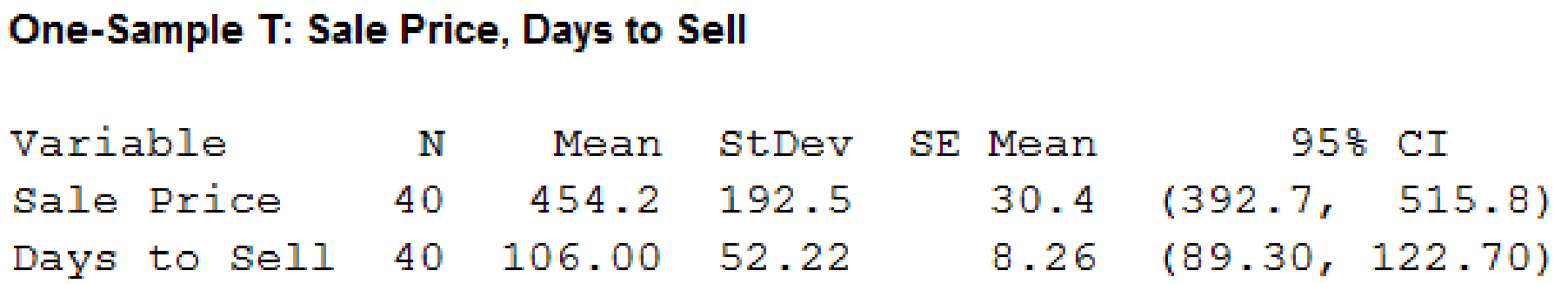

The 95% confidence interval for the population mean sales price for Gulf view condominiums is ($392,700, $515,800) and the population mean number of days to sell for Gulf view condominiums is (89 days, 123 days).

Explanation of Solution

Calculation:

Calculate the 95% confidence interval for the population mean sales price and the population mean number of days to sell for Gulf view condominiums.

Software Procedure:

Step-by-step procedure to obtain the confidence interval using the MINITAB software:

- Choose Stat > Basic Statistics > 1-Sample T.

- In Samples in columns, enter the variable sales price, days to sell.

- Check Options; enter Confidence level as 95%.

- Click OK.

Output using the MINITAB software is given below:

Observation:

The sales price of the Gulf View condominiums is from $392,700 to $515,800 and the days to sell Gulf View condominiums are 89 days to 123 days.

5.

Find the 95% confidence interval for the population mean sales price and the population mean number of days to sell for No Gulf view condominiums.

Interpret the results.

Answer to Problem 2CP

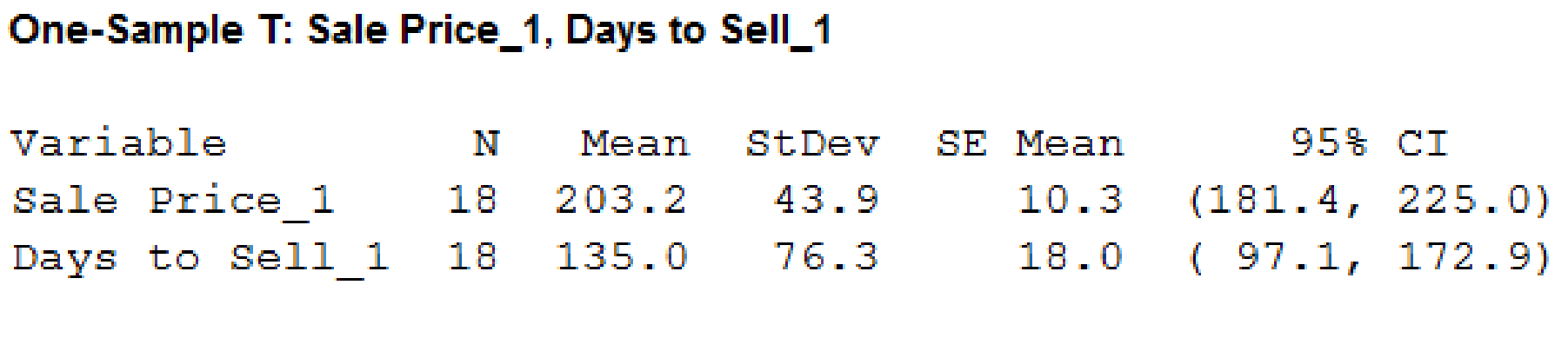

The 95% confidence interval for the population mean sales price for No Gulf view condominiums is ($181,400, $225,000) and the population mean number of days to sell for No Gulf view condominiums is (97 days, 173 days).

Explanation of Solution

Calculation:

Calculate the 95% confidence interval for the population mean sales price and the population mean number of days to sell for No Gulf view condominiums.

Software Procedure:

Step-by-step procedure to obtain the confidence interval using the MINITAB software:

- Choose Stat > Basic Statistics > 1-Sample T.

- In Samples in columns, enter the variable sales price, days to sell.

- Check Options; enter Confidence level as 95%.

- Click OK.

Output using the MINITAB software is given below:

Observation:

The sales price of the No Gulf View condominiums is from $181,400 to $225,000 and the days to sell No Gulf View condominiums are 97 days to 173 days.

6.

Find the sample size for the Gulf view and No Gulf view condominiums for estimating the mean selling price.

Answer to Problem 2CP

The sample size for the Gulf view for estimating the mean selling price is 89 and the sample size for the No Gulf view for estimating the mean selling price is 23.

Explanation of Solution

Calculation:

The sample size for the interval estimate of a population mean is as follows:

From “Table 8.1 value of

For Gulf view condominiums:

From Part (1), the standard deviation for Gulf view selling price is 192.5.

The sample size is as follows:

Thus, the sample size of 89 is required.

For No Gulf view condominiums:

From Part (2), the standard deviation for No Gulf view selling price is 43.9.

The sample size is as follows:

Thus, the sample size of 23 is required.

7.

Find the final selling price and the number of days required to sell each of the unit.

Answer to Problem 2CP

The final selling price and the number of days required to sell each of the unit are $564,262 and 106 days, respectively, for Gulf view condominium.

The final selling price and the number of days required to sell each of the unit are $272,175 and 135 days, respectively, for No Gulf view condominium.

Explanation of Solution

Calculation:

Here, a Gulf view condominium with a list price is $589,000 and a No Gulf view condominium with a list price is $285,000.

From Part (3), the Gulf view condominium is sold on an average of 4.2% below its list price.

The estimated selling price is as follows:

The estimated number of days to sell each of the unit is 106 days.

From Part (3), the No Gulf view condominium is sold on an average of 4.5% below its list price.

The estimated selling price is as follows:

The estimated number of days to sell each of the unit is 135 days.

Want to see more full solutions like this?

Chapter 8 Solutions

Modern Business Statistics with Microsoft Office Excel (with XLSTAT Education Edition Printed Access Card)

- Question 2: When John started his first job, his first end-of-year salary was $82,500. In the following years, he received salary raises as shown in the following table. Fill the Table: Fill the following table showing his end-of-year salary for each year. I have already provided the end-of-year salaries for the first three years. Calculate the end-of-year salaries for the remaining years using Excel. (If you Excel answer for the top 3 cells is not the same as the one in the following table, your formula / approach is incorrect) (2 points) Geometric Mean of Salary Raises: Calculate the geometric mean of the salary raises using the percentage figures provided in the second column named “% Raise”. (The geometric mean for this calculation should be nearly identical to the arithmetic mean. If your answer deviates significantly from the mean, it's likely incorrect. 2 points) Starting salary % Raise Raise Salary after raise 75000 10% 7500 82500 82500 4% 3300…arrow_forwardI need help with this problem and an explanation of the solution for the image described below. (Statistics: Engineering Probabilities)arrow_forwardI need help with this problem and an explanation of the solution for the image described below. (Statistics: Engineering Probabilities)arrow_forward

- 310015 K Question 9, 5.2.28-T Part 1 of 4 HW Score: 85.96%, 49 of 57 points Points: 1 Save of 6 Based on a poll, among adults who regret getting tattoos, 28% say that they were too young when they got their tattoos. Assume that six adults who regret getting tattoos are randomly selected, and find the indicated probability. Complete parts (a) through (d) below. a. Find the probability that none of the selected adults say that they were too young to get tattoos. 0.0520 (Round to four decimal places as needed.) Clear all Final check Feb 7 12:47 US Oarrow_forwardhow could the bar graph have been organized differently to make it easier to compare opinion changes within political partiesarrow_forwardDraw a picture of a normal distribution with mean 70 and standard deviation 5.arrow_forward

- What do you guess are the standard deviations of the two distributions in the previous example problem?arrow_forwardPlease answer the questionsarrow_forward30. An individual who has automobile insurance from a certain company is randomly selected. Let Y be the num- ber of moving violations for which the individual was cited during the last 3 years. The pmf of Y isy | 1 2 4 8 16p(y) | .05 .10 .35 .40 .10 a.Compute E(Y).b. Suppose an individual with Y violations incurs a surcharge of $100Y^2. Calculate the expected amount of the surcharge.arrow_forward

- 24. An insurance company offers its policyholders a num- ber of different premium payment options. For a ran- domly selected policyholder, let X = the number of months between successive payments. The cdf of X is as follows: F(x)=0.00 : x < 10.30 : 1≤x<30.40 : 3≤ x < 40.45 : 4≤ x <60.60 : 6≤ x < 121.00 : 12≤ x a. What is the pmf of X?b. Using just the cdf, compute P(3≤ X ≤6) and P(4≤ X).arrow_forward59. At a certain gas station, 40% of the customers use regular gas (A1), 35% use plus gas (A2), and 25% use premium (A3). Of those customers using regular gas, only 30% fill their tanks (event B). Of those customers using plus, 60% fill their tanks, whereas of those using premium, 50% fill their tanks.a. What is the probability that the next customer will request plus gas and fill the tank (A2 B)?b. What is the probability that the next customer fills the tank?c. If the next customer fills the tank, what is the probability that regular gas is requested? Plus? Premium?arrow_forward38. Possible values of X, the number of components in a system submitted for repair that must be replaced, are 1, 2, 3, and 4 with corresponding probabilities .15, .35, .35, and .15, respectively. a. Calculate E(X) and then E(5 - X).b. Would the repair facility be better off charging a flat fee of $75 or else the amount $[150/(5 - X)]? [Note: It is not generally true that E(c/Y) = c/E(Y).]arrow_forward

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill

Glencoe Algebra 1, Student Edition, 9780079039897...AlgebraISBN:9780079039897Author:CarterPublisher:McGraw Hill Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL

Holt Mcdougal Larson Pre-algebra: Student Edition...AlgebraISBN:9780547587776Author:HOLT MCDOUGALPublisher:HOLT MCDOUGAL Functions and Change: A Modeling Approach to Coll...AlgebraISBN:9781337111348Author:Bruce Crauder, Benny Evans, Alan NoellPublisher:Cengage Learning

Functions and Change: A Modeling Approach to Coll...AlgebraISBN:9781337111348Author:Bruce Crauder, Benny Evans, Alan NoellPublisher:Cengage Learning Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt

Big Ideas Math A Bridge To Success Algebra 1: Stu...AlgebraISBN:9781680331141Author:HOUGHTON MIFFLIN HARCOURTPublisher:Houghton Mifflin Harcourt