Concept explainers

a)

Determine the

a)

Explanation of Solution

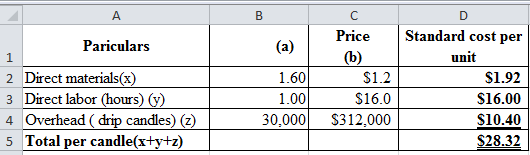

Compute the standard cost per candle:

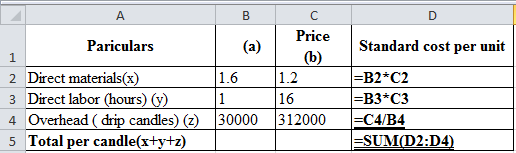

Excel workings:

Table (1)

Excel spread sheet:

Table (2)

b)

Determine the total standard cost per drip candle

b)

Explanation of Solution

Compute the standard cost per candle:

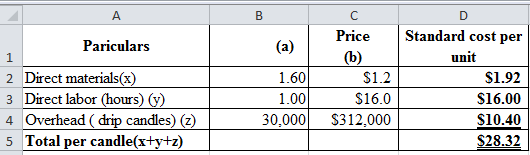

Excel workings:

Table (3)

Excel spread sheet:

Table (4)

Hence, the total standard per drip candle is $28.32.

c)

Determine the actual cost per candle for direct materials, direct labor, and overhead.

c)

Explanation of Solution

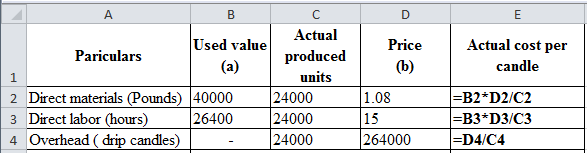

Determine the actual cost per candle for direct materials, direct labor, and overhead:

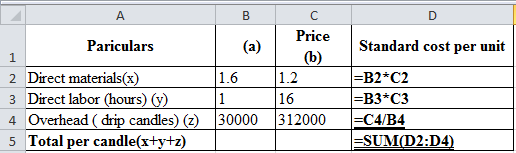

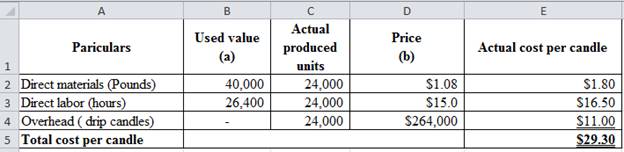

Excel workings:

Table (5)

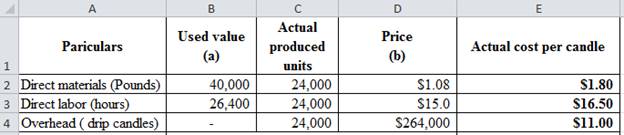

Excel spread sheet:

Table (6)

d)

Determine the total actual cost per drip candle

d)

Explanation of Solution

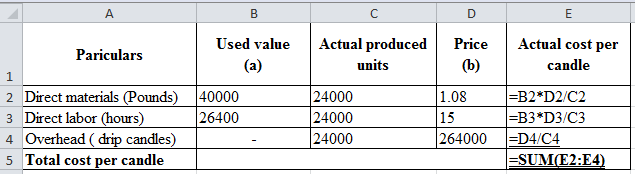

Compute the total actual cost per candle:

Excel workings:

Table (7)

Excel spread sheet:

Table (8)

Hence, the total standard per drip candle is $29.30.

e)

Determine the usage and price variances for direct materials and direct labor and the variance Company R has to investigate and offer the causes for the variance.

e)

Explanation of Solution

Compute the price and usage variance for direct material:

Hence, the material price variance is $4,800 which is a favorable variance that is actual price is less than the standard price.

Hence, the material usage variance is $1,920 which is an unfavorable variance that is actual quantity is less than the standard quantity.

Compute the price and usage variance for direct labor:

Hence, the labor price variance is $26,400 which is a favorable variance that is actual price is less than the standard price.

Hence, the labor usage variance is 38,400 which is an unfavorable variance that is actual hours is more than the standard hours.

The variance Company R has to investigate and offer the causes for the variance:

All the variance is need to be taken for investigation. Investigation must be based on the criteria’s like materiality, capacity to control, and frequency.

Favorable variance denotes that everything is good.

f)

Determine the fixed cost spending and volume variances:

f)

Explanation of Solution

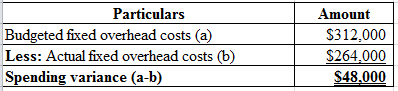

Determine the fixed cost volume variance and spending variance and identify whether it is unfavorable or favorable:

Table (9)

Hence, the spending variance is $48,000 which is favorable variance.

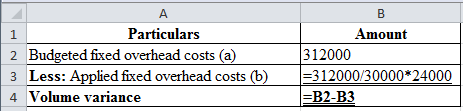

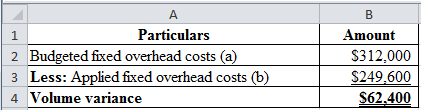

Table (10)

Table (11)

Hence, the volume variance is $62,400 which is unfavorable variance.

The favorable fixed cost spending variance denotes that lesser amount was spend for the overheads than the planned or budgeted one. The unfavorable fixed cost volume variance denotes that very lesser units were produced than planned.

In order to lower the cost per unit the company should use the facilities to produce a high volume

If units were produced lesser than planned then the company will face underutilizing the facilities which indicates an unfavorable volume variance.

g)

The reason why the actual cost per unit and standard cost per unit differs by few cents

g)

Explanation of Solution

The favorable usage and price variances are balance by the fact because the volume variances are unfavorable. Thus, the differences are very minimal.

Want to see more full solutions like this?

Chapter 8 Solutions

Fundamental Managerial Accounting Concepts with Access

- Please provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardI am looking for the correct answer to this financial accounting problem using valid accounting standards.arrow_forwardI am looking for the most effective method for solving this financial accounting problem.arrow_forward

- Subject : Financial accountingarrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forwardCooper Industries disposed of an asset at the end of the sixth year of its estimated life for $12,500 cash. The asset's life was originally estimated to be 8 years. The original cost was $76,000 with an estimated residual value of $6,000. The asset was being depreciated using the straight-line method. What was the gain or loss on the disposal? Helparrow_forward

- Cooper Industries disposed of an asset at the end of the sixth year of its estimated life for $12,500 cash. The asset's life was originally estimated to be 8 years. The original cost was $76,000 with an estimated residual value of $6,000. The asset was being depreciated using the straight-line method. What was the gain or loss on the disposal?arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forwardI need assistance with this financial accounting problem using appropriate calculation techniques.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education