a)

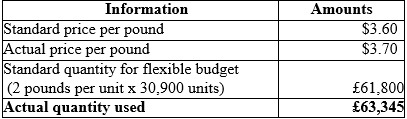

Compute the material variance information:

a)

Explanation of Solution

Compute the material variance information:

Table (1)

b)

Compute the materials price and usage variance and identify whether it is unfavorable or favorable.

b)

Explanation of Solution

Compute the total materials price variances:

Hence the total materials price variances are $6,334.5 which is an unfavorable variance that is actual price is more than the standard price.

Compute the total materials usage variance:

Hence, the total materials usage variances are $5,562 which is an unfavorable variance that is actual quantity is more than the standard.

c)

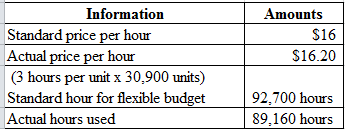

Compute the labor variance information:

c)

Explanation of Solution

Compute the labor variance information:

Table (2)

d)

Determine the labor price and usage variance and identify whether it is unfavorable or favorable.

Given information:

Refer part a) for the table information

d)

Explanation of Solution

Compute the labor price variance:

Hence, the labor price variance is $17,832 which is an unfavorable variance that is actual price is more than the standard price.

Compute the labor usage variance:

Hence, the labor usage variance is $56,640 which is a favorable variance that is actual hours is less than the standard hours.

e)

Determine the predetermined

e)

Explanation of Solution

Calculate the the predetermined overhead rate:

Hence, the predetermined overhead rate is $46.80 per unit.

f)

Compute the fixed cost spending and variance and specify whether it is unfavorable or favorable variance.

f)

Explanation of Solution

Compute the fixed cost spending variance:

Hence, the fixed cost spending variance is $72,000 which is the unfavorable variance that is actual fixed overhead is greater than the budgeted fixed overhead.

Compute the fixed cost volume variance:

Hence, the fixed cost spending variance is $42,120 which is the favorable variance as the company produced more units than actually planned which leads to decrease in fixed cost per unit

g)

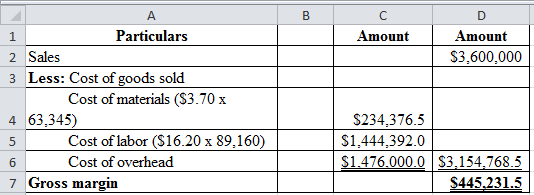

Determine the gross margin of Company W

g)

Explanation of Solution

Determine the gross margin of Company W:

Table (3)

Want to see more full solutions like this?

Chapter 8 Solutions

Fundamental Managerial Accounting Concepts with Access

- Davis Company reported an increase of $350,000 in its accounts receivable during the year 2023. The company's statement of cash flows for 2023 reported $980,000 of cash received from customers. What amount of net sales must Davis have recorded in 2023?arrow_forwardRoosevelt Equipment Ltd. manufactures industrial cranes. The standard for a specific crane model calls for 30 direct labor hours at $22 per direct labor hour. During a recent period, 400 cranes were produced. The labor rate variance was zero, and the labor efficiency variance was $8,800 unfavorable. How many actual direct labor hours were worked?arrow_forwardNolan Industries assigns overhead costs to jobs on the basis of 140% of direct labor costs. The job cost sheet for Job 627 includes $31,200 in direct materials cost and $18,500 in direct labor cost. A total of 2,500 units were produced in Job 627. Required: a. What is the total manufacturing cost assigned to Job 627? b. What is the unit product cost for Job 627?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education