a.

Identify the company which will report the highest amount of net income for Year 1.

a.

Explanation of Solution

Net Income

Net income is the sum total of all the revenues generated in a particular accounting period after deducting cost of goods sold and expenses and losses, such as rent expense, depreciation of that particular accounting period.

Identify the company which will report the highest amount of net income for Year 1.

| Net Income for Year 1 | |||

| Company A (in $) | Company B (in $) | Company C (in $) | |

| Revenue | 30,000 | 30,000 | 30,000 |

| Less: Depreciation expense | 11,600 | 25,600 | 14,500 |

| Net Income | $18,400 | $4,400 | $15,500 |

Table (1)

Working Notes:

Prepare depreciation schedule under straight-line method for Company A.

| Date | Depreciation Rate (B) | Depreciation expense (in $) | |

| Year 1 | 58,000 | 1/5 | 11,600 |

| Year 2 | 58,000 | 1/5 | 11,600 |

| Year 3 | 58,000 | 1/5 | 11,600 |

| Year 4 | 58,000 | 1/5 | 11,600 |

| Year 5 | 58,000 | 1/5 | 11,600 |

Table (2)

Calculate the depreciable cost.

Prepare depreciation schedule under double-declining-balance (DDB) method for Company B.

| Date | Double-Declining-Balance Depreciation Rate (A) | Book Value (Refer note) (in $) (B) | Depreciation expense (in $) |

| Year 1 | 0.40 | 64,000 | 25,600 |

| Year 2 | 0.40 | 38,400 | 15,360 |

| Year 3 | 0.40 | 23,040 | 9,216 |

| Year 4 | 0.40 | 13,824 | 5,530 |

| Year 5 | 0.40 | 8,294 | 2,294 |

Table (3)

Note:

Book value:

The amount of acquisition cost of less

Formula for book value:

Accumulated depreciation:

The total amount of depreciation expense deducted, from the time asset acquired till date, as reported in the account as on a particular date, is referred to as accumulated depreciation.

Formula for accumulated depreciation:

Determine the depreciation rate applied each year.

Useful life = 5 years

Compute depreciation expense on Year 5.

Prepare depreciation schedule under units-of-production method for Company C.

| Date | Depreciation per unit (A) | Number of hours (B) | Depreciation expense (in $) |

| Year 1 | $0.29 | 50,000 | 14,500 |

| Year 2 | $0.29 | 55,000 | 15,950 |

| Year 3 | $0.29 | 40,000 | 11,600 |

| Year 4 | $0.29 | 44,000 | 12,760 |

| Year 5 | $0.29 | 31,000 | 3,190 |

Table (4)

Compute depreciation per unit.

Compute depreciation expense on Year 5.

Hence, the company which will report the highest amount of net income for Year 1 is Company A.

b.

Identify the company which will report the lowest amount of net income for Year 3.

b.

Explanation of Solution

Net Income

Net income is the sum total of all the revenues generated in a particular accounting period after deducting cost of goods sold and expenses and losses, such as rent expense, depreciation of that particular accounting period.

Identify the company which will report the lowest amount of net income for Year 3.

| Net Income for Year 3 | |||

| Company A (in $) | Company B (in $) | Company C (in $) | |

| Revenue | 30,000 | 30,000 | 30,000 |

| Less: Depreciation expense | 11,600 | 9,216 | 11,600 |

| Net Income | $18,400 | $20,784 | $18,400 |

Table (5)

Working Notes:

Prepare depreciation schedule under straight-line method for Company A.

| Date | Depreciable Cost (in $) (A) | Depreciation Rate (B) | Depreciation expense (in $) |

| Year 1 | 58,000 | 1/5 | 11,600 |

| Year 2 | 58,000 | 1/5 | 11,600 |

| Year 3 | 58,000 | 1/5 | 11,600 |

| Year 4 | 58,000 | 1/5 | 11,600 |

| Year 5 | 58,000 | 1/5 | 11,600 |

Table (6)

Calculate the depreciable cost.

Prepare depreciation schedule under double-declining-balance (DDB) method for Company B.

| Date | Double-Declining-Balance Depreciation Rate (A) | Book Value (Refer note) (in $) (B) | Depreciation expense (in $) |

| Year 1 | 0.40 | 64,000 | 25,600 |

| Year 2 | 0.40 | 38,400 | 15,360 |

| Year 3 | 0.40 | 23,040 | 9,216 |

| Year 4 | 0.40 | 13,824 | 5,530 |

| Year 5 | 0.40 | 8,294 | 2,294 |

Table (7)

Note:

Book value:

The amount of acquisition cost of less accumulated depreciation as on a particular date is referred to as book value.

Formula for book value:

Accumulated depreciation:

The total amount of depreciation expense deducted, from the time asset acquired till date, as reported in the account as on a particular date, is referred to as accumulated depreciation.

Formula for accumulated depreciation:

Determine the depreciation rate applied each year.

Useful life = 5 years

Compute depreciation expense on Year 5.

Prepare depreciation schedule under units-of-production method for Company C.

| Date | Depreciation per unit (A) | Number of hours (B) | Depreciation expense (in $) |

| Year 1 | $0.29 | 50,000 | 14,500 |

| Year 2 | $0.29 | 55,000 | 15,950 |

| Year 3 | $0.29 | 40,000 | 11,600 |

| Year 4 | $0.29 | 44,000 | 12,760 |

| Year 5 | $0.29 | 31,000 | 3,190 |

Table (8)

Compute depreciation per unit.

Compute depreciation expense on Year 5.

Hence, the company which will report the lowest amount of net income for Year 3 is Company A and Company C.

c.

Identify the company which will report the highest book value on the December 31, Year 3, balance sheet.

c.

Explanation of Solution

Book value:

The amount of acquisition cost of less accumulated depreciation as on a particular date is referred to as book value.

Formula for book value:

Identify the company which will report the highest book value on the December 31, Year 3, balance sheet.

| Book value on December 31, Year 3 | |||

| Company A (in $) | Company B (in $) | Company C (in $) | |

| Cost | 64,000 | 64,000 | 64,000 |

| Less: Accumulated depreciation | 34,800 | 50,176 | 42,050 |

| Book value | $29,200 | $13,824 | $21,950 |

Table (9)

Working Notes:

Prepare depreciation schedule under straight-line method for Company A.

| Date | Depreciable Cost (in $) (A) | Depreciation Rate (B) | Depreciation expense (in $) | Accumulated depreciation (in $) |

| Year 1 | 58,000 | 1/5 | 11,600 | 11,600 |

| Year 2 | 58,000 | 1/5 | 11,600 | 23,200 |

| Year 3 | 58,000 | 1/5 | 11,600 | 34,800 |

Table (10)

Calculate the depreciable cost.

Prepare depreciation schedule under double-declining-balance (DDB) method for Company B.

| Date | Double-Declining-Balance Depreciation Rate (A) | Book Value (Refer note) (in $) (B) | Depreciation expense (in $) | Accumulated depreciation (in $) |

| Year 1 | 0.40 | 64,000 | 25,600 | 25,600 |

| Year 2 | 0.40 | 38,400 | 15,360 | 40,960 |

| Year 3 | 0.40 | 23,040 | 9,216 | 50,176 |

Table (11)

Note:

Book value:

The amount of acquisition cost of less accumulated depreciation as on a particular date is referred to as book value.

Formula for book value:

Accumulated depreciation:

The total amount of depreciation expense deducted, from the time asset acquired till date, as reported in the account as on a particular date, is referred to as accumulated depreciation.

Formula for accumulated depreciation:

Determine the depreciation rate applied each year.

Useful life = 5 years

Prepare depreciation schedule under units-of-production method for Company C.

| Date | Depreciation per unit (A) | Number of hours (B) | Depreciation expense (in $) | Accumulated depreciation (in $) |

| Year 1 | $0.29 | 50,000 | 14,500 | 14,500 |

| Year 2 | $0.29 | 55,000 | 15,950 | 30,450 |

| Year 3 | $0.29 | 40,000 | 11,600 | 42,050 |

Table (12)

Compute depreciation per unit.

Hence, the company which will report the highest book value on the December 31, Year 3, balance sheet is Company A.

d.

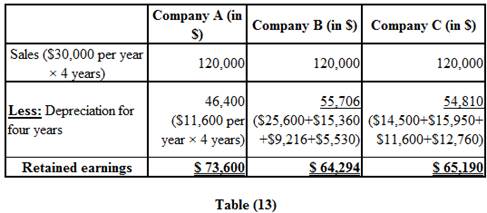

Identify the company which will report the highest amount of

d.

Explanation of Solution

Retained earnings:

The retained earnings statement is that financial statement which shows the amount of net income which is actually retained by the Company on a particular date. These earnings can be utilized by the Company for the reinvestment and to pay its debts.

Hence, the company which will report the highest amount of retained earnings on the December 31, Year 4, balance sheet is Company A. However, the retained earnings for all the companies will be the same at the end of the asset’s five-year life, as the total depreciation over the five year period is the same for all the three companies.

e.

Identify the company which will report the lowest amount of cash flow from operating activities on the Year 3 statement of

e.

Explanation of Solution

Statement of cash flows:

This statement reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as ending balance of cash at the end of reported period.

Cash flows from operating activities:

These refer to the cash received or cash paid in day-to-day operating activities of a company. In this direct method, cash flow from operating activities is computed by using all cash receipts and cash payments during the year.

Depreciation expense is not a

Want to see more full solutions like this?

Chapter 8 Solutions

Fundamental Financial Accounting Concepts

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education