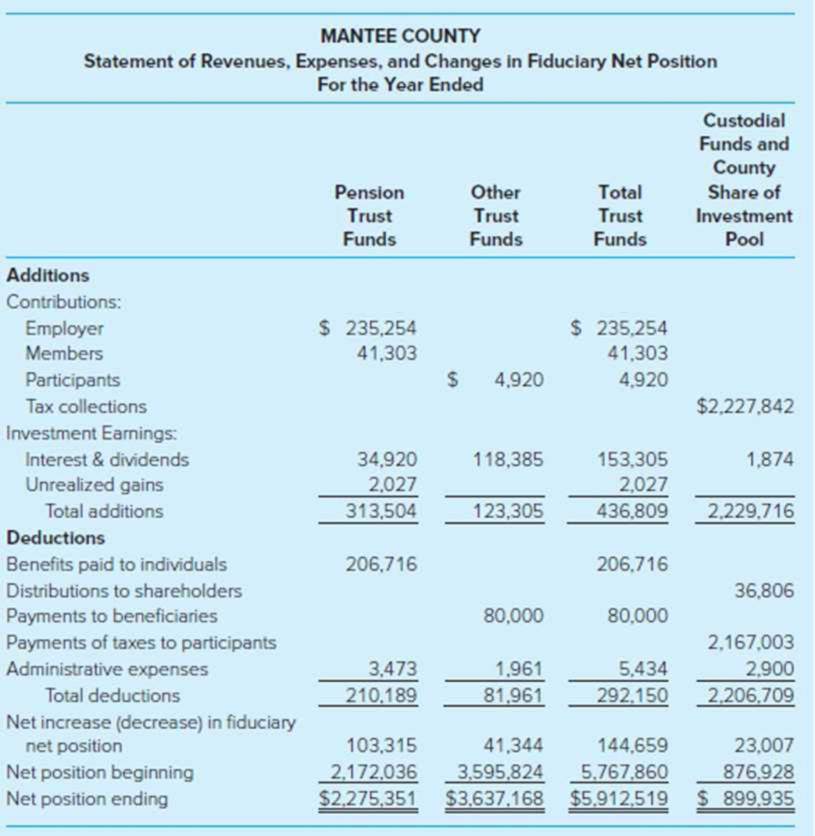

Fiduciary Fund Financial Statements. (LO8-4) Mantee County administers a pension fund and a postretirement benefits fund for some of its workers, an investment trust fund for itself and three other governments, a private-purpose trust fund to award low-income scholarships for students in the tri-county area (the fund has an endowment of $2 million), and a tax custodial fund for itself and four other governments.

Required

This is the first time Mantee County has prepared its operating statement for the fiduciary funds under the GASBS 84 requirements. However, it does not appear to be in conformance with the new standard. Identify the errors in the statement and explain how the errors can be corrected.

Trending nowThis is a popular solution!

Chapter 8 Solutions

ACCT. FOR GOV.&NONPROF. ENTITIES>CUSTOM

- Compute the total cost of work in process for the year on these general accounting questionarrow_forwardDetermine the cost per equivalent unit of conversion on these general accounting questionarrow_forwardCarla Vista Corporation had a projected benefit obligation of $2,890,000 and plan assets of $3,097,000 at January 1, 2025. Carla Vista also had a net actuarial loss of $437,680 in accumulated OCI at January 1, 2025. The average remaining service period of Carla Vista's employees is 7.9 years. Compute Carla Vista's minimum amortization of the actuarial loss. Minimum amortization of the actuarial lossarrow_forward

- Chapter 15 Homework i 10 0.83 points Saved Help Save & Exit Submit Check my work QS 15-8 (Algo) Computing predetermined overhead rates LO P3 A company estimates the following manufacturing costs at the beginning of the period: direct labor, $520,000; direct materials, $216,000; and factory overhead, $141,000. Required: eBook 1. Compute its predetermined overhead rate as a percent of direct labor. 2. Compute its predetermined overhead rate as a percent of direct materials. Ask Complete this question by entering your answers in the tabs below. Print Required 1 Required 2 References Mc Graw Hill Compute its predetermined overhead rate as a percent of direct labor. Overhead Rate Numerator: 1 Denominator: = Overhead Rate = Overhead Rate = 0arrow_forwardhello teacher please solve questions general accountingarrow_forwardCampbell Soup Company reported pension expense of $94 million and contributed $81.5 million to the pension fund. Prepare Campbell's journal entry to record pension expense and funding, assuming campbell has no OCI amounts.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education