Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 25E

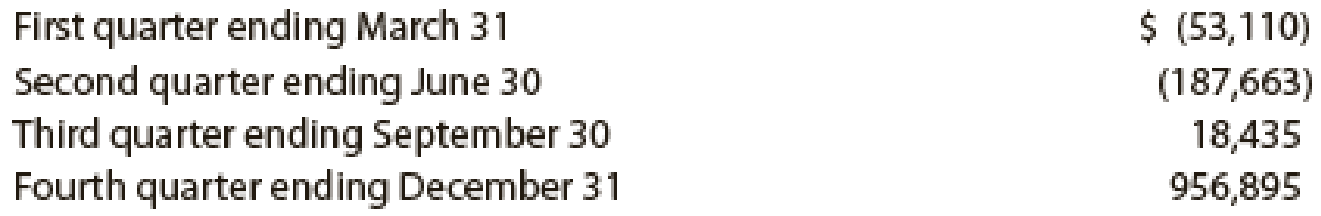

Mattel, Inc., designs, manufactures, and markets toy products worldwide. Mattel’s toys include Barbie® fashion dolls and accessories, Hot Wheels®, and Fisher-Price brands. For a recent year, Mattel reported the following net

Explain why Mattel reported negative net cash flows from operating activities during the first and second quarters and a large positive cash flow for the fourth quarter, with overall net positive cash flow for the year.

Explain why Mattel reported negative net cash flows from operating activities during the first and second quarters and a large positive cash flow for the fourth quarter, with overall net positive cash flow for the year.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Rayburn Corporation has a building that it bought during year 0 for $850,000. It sold the building in year 5. During the time it held the building, Rayburn depreciated it by $100,000. What are the amount and character of the gain or loss Rayburn will recognize on the sale in each of the following alternative situations? Note: Loss amounts should be indicated by a minus sign. Enter NA if a situation is not applicable. Leave no answers blank. Enter zero if applicable. Problem 11-43 Part-a (Static) a. Rayburn receives $840,00

Can you solve this financial accounting question with the appropriate financial analysis techniques?

I need the correct answer to this general accounting problem using the standard accounting approach.

Chapter 8 Solutions

Financial Accounting

Ch. 8 - Prob. 1DQCh. 8 - Why should the employee who handles cash receipts...Ch. 8 - Prob. 3DQCh. 8 - Why should the responsibility for maintaining the...Ch. 8 - Assume that Brooke Miles, accounts payable clerk...Ch. 8 - Prob. 6DQCh. 8 - Prob. 7DQCh. 8 - Prob. 8DQCh. 8 - Prob. 9DQCh. 8 - Prob. 10DQ

Ch. 8 - Prob. 1PEACh. 8 - Prob. 1PEBCh. 8 - Prob. 2PEACh. 8 - Prob. 2PEBCh. 8 - Prob. 3PEACh. 8 - Prob. 3PEBCh. 8 - Prob. 4PEACh. 8 - Prob. 4PEBCh. 8 - Financial data for Otto Company follow: a....Ch. 8 - Prob. 5PEBCh. 8 - Prob. 1ECh. 8 - Prob. 2ECh. 8 - Prob. 3ECh. 8 - Pacific Bank provides loans to businesses in the...Ch. 8 - Prob. 5ECh. 8 - An employee of JHT Holdings, Inc., a trucking...Ch. 8 - Prob. 7ECh. 8 - Prob. 8ECh. 8 - Prob. 9ECh. 8 - Prob. 10ECh. 8 - Prob. 11ECh. 8 - The actual cash received from cash sales was...Ch. 8 - The actual cash received from cash sales was...Ch. 8 - Abbe Co. is a small merchandising company with a...Ch. 8 - Prob. 15ECh. 8 - Prob. 16ECh. 8 - Prob. 17ECh. 8 - Prob. 18ECh. 8 - Prob. 19ECh. 8 - Prob. 20ECh. 8 - Prob. 21ECh. 8 - Prob. 22ECh. 8 - Prob. 23ECh. 8 - Prob. 24ECh. 8 - Mattel, Inc., designs, manufactures, and markets...Ch. 8 - El Dorado Inc. has monthly cash expenses of...Ch. 8 - Prob. 27ECh. 8 - Amicus Therapeutics, Inc., is a biopharmaceutical...Ch. 8 - Prob. 1PACh. 8 - Prob. 2PACh. 8 - Prob. 3PACh. 8 - Prob. 4PACh. 8 - Prob. 5PACh. 8 - Prob. 1PBCh. 8 - Prob. 2PBCh. 8 - Prob. 3PBCh. 8 - Prob. 4PBCh. 8 - Prob. 5PBCh. 8 - Tehra Dactyl is an accountant for Skeds, Inc., a...Ch. 8 - During the preparation of the bank reconciliation...Ch. 8 - Prob. 5CPCh. 8 - Prob. 6CPCh. 8 - Prob. 7CPCh. 8 - Prob. 8CPCh. 8 - Prob. 9CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Fenton Manufacturing Inc. had a variable costing operating income of $128,400 in 2023. Ending inventory decreased during 2023 from 45,000 units to 40,000 units. During both 2022 and 2023, fixed manufacturing overhead was $1,080,000, and 135,000 units were produced. Determine the absorption costing operating income for 2023.arrow_forwardWhat are the total product Costs for the company under variable costing?arrow_forwardQuestion 8-Barrow_forward

- I am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardPlease provide the correct answer to this general accounting problem using valid calculations.arrow_forwardUnder absorption costing the ending inventory for the year would be valued at:arrow_forward

- I am searching for the accurate solution to this financial accounting problem with the right approach.arrow_forwardPlease explain the solution to this financial accounting problem with accurate principles.arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License