Refer to Exercise 8.24. Del Spencer’s purchases clothing evenly throughout the month. All purchases are on account. On the first of every month, Jana Spencer, Del’s wife, pays for all of the previous month’s purchases. Terms are 2/10, n/30 (i.e., a 2 percent discount can be taken if the bill is paid within 10 days; otherwise, the entire amount is due within 30 days).

The

Required:

- 1. Prepare a cash disbursements schedule for the months of August and September. (Round all cash amounts to the nearest dollar.)

- 2. Now, suppose that Del wants to see what difference it would make to have someone pay for any purchases that have been made three times per month, on the 1st, the 11th, and the 21st. Prepare a cash disbursements schedule for the months of July and August assuming this new payment schedule. (Round all cash amounts to the nearest dollar.)

- 3. Suppose that Jana (who works full-time as a school teacher and is the mother of two small children) does not have time to make payments on two extra days per month and that a temporary employee is hired on the 11th and 21st at $20 per hour, for four hours each of those two days. Is this a good decision? Explain.

Del Spencer is the owner and founder of Del Spencer’s Men’s Clothing Store. Del Spencer’s has its own house charge accounts and has found from past experience that 10 percent of its sales are for cash. The remaining 90 percent are on credit. An aging schedule for

15 percent of credit sales are paid in the month of sale.

65 percent of credit sales are paid in the first month following the sale.

14 percent of credit sales are paid in the second month following the sale.

6 percent of credit sales are never collected.

Credit sales that have not been paid until the second month following the sale are considered overdue and are subject to a 3 percent late charge.

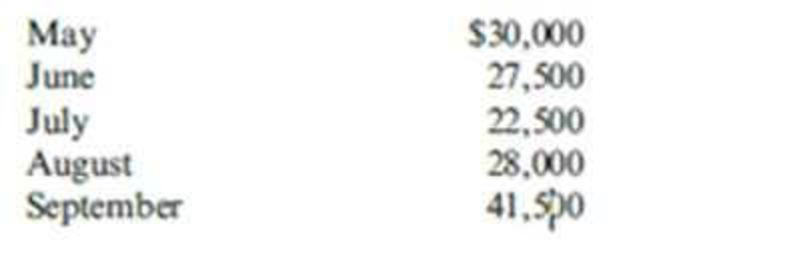

Del Spencer’s has developed the following sales forecast:

Required:

Prepare a schedule of cash receipts for August and September.

1.

Prepare a cash disbursement schedule for the month of August and September.

Explanation of Solution

Schedule of cash payments for purchases: This Schedule is prepared for the estimation of the cash payment for purchase for the period. This includes all probable cash payment.

Budgeted cash disbursement: Budgeted cash disbursements are the cash outflows expected for a budgeted period.

Prepare a cash disbursement schedule for the month of August and September:

| DP Clothing Store | ||

| Schedule of Cash Disbursement | ||

| For the Months of August and September | ||

| Particulars | August | September |

| July: | 7,350 | - |

| 15,000 | ||

| August: | - | 9,147 |

| - | 18,667 | |

| Total cash disbursements | $22,350 | $27,814 |

Table (1)

Working note 1:

Calculate the amount of cash paid for purchases:

For 1/3 of July purchases are paid in August:

For 2/3 July purchases are paid in August:

Working note 2:

Calculate the amount of cash paid for purchases:

For 1/3 of August purchases are paid in September:

For 2/3 August purchases are paid in September:

2.

Prepare a cash disbursement schedule for the month of July and August (if payment made three times per month).

Explanation of Solution

Prepare a cash disbursement schedule for the month of July and August (if payment made three times per month):

| DP Clothing Store | ||

| Schedule of Cash Disbursement | ||

| For the Months of August and September | ||

| Particulars | July | August |

| July 1: | 8,983 | |

| July 11: | 7,350 | |

| July 21: | 7,350 | |

| August 1: | 7,350 | |

| August 11: | 9,147 | |

| August 21: | 9,147 | |

| Total cash disbursements | $23,683 | $25,644 |

Table (2)

Working note 1:

Calculate the amount of cash paid for purchases:

For 1/3 of July purchases are paid in July 1:

For 1/3 of July purchases are paid in July 11:

For 1/3 of July purchases are paid in July 21:

Working note 2:

Calculate the amount of cash paid for purchases:

For 1/3 of August purchases are paid in August 1:

For 1/3 of August purchases are paid in August 11:

For 1/3 of August purchases are paid in August 21:

3.

Explain whether the decision taken by J is good for making the payment.

Explanation of Solution

Explain whether the decision taken by J is good for making the payment:

Yes. It is considered as a good idea. As long as monthly purchases exceed $8,000

Hence, J can temporarily appoint employee who work for 11th and 21st date for four hours at $20 per hour.

Want to see more full solutions like this?

Chapter 8 Solutions

Cornerstones of Cost Management

- The standard materials cost of TimberCraft's product is $60 per unit, based on 15 pounds of raw materials at a standard cost of $4 per pound. During March 20X9, 2,000 units of product were produced, using 30,800 pounds of raw material at a cost of $4.50 per pound. a) The standard cost for materials for March is __. b) The total materials variance for the month is __. c) The materials quantity variance is __. d) The materials price variance is __.arrow_forwardHow much lower would net income be if it used variable costing?arrow_forwardcan you please solve thisarrow_forward

- Please given answer general accounting questionarrow_forwardThe following are selected account balances from Penske Company and Stanza Corporation as of December 31, 2024: Accounts Revenues Cost of goods sold Depreciation expense Investment income Dividends declared Retained earnings, 1/1/24 Current assets Copyrights Royalty agreements Penske $ (700,000) 250,000 150,000 Not given 80,000 (600,000) 400,000 Investment in Stanza Liabilities Common stock Additional paid-in capital Stanza $ (400,000) 100,000 200,000 Ө 60,000 (200,000) 500,000 400,000 900,000 600,000 1,000,000 Not given (500,000) Ө (1,380,000) (600,000) ($20 par) (150,000) (200,000) ($10 par) (80,000) Note: Parentheses indicate a credit balance. On January 1, 2024, Penske acquired all of Stanza's outstanding stock for $680,000 fair value in cash and common stock. Penske also paid $10,000 in stock issuance costs. At the date of acquisition, copyrights (with a six-year remaining life) have a $440,000 book value but a fair value of $560,000. Required: a. As of December 31, 2024, what is…arrow_forwardMCQarrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax CollegePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,