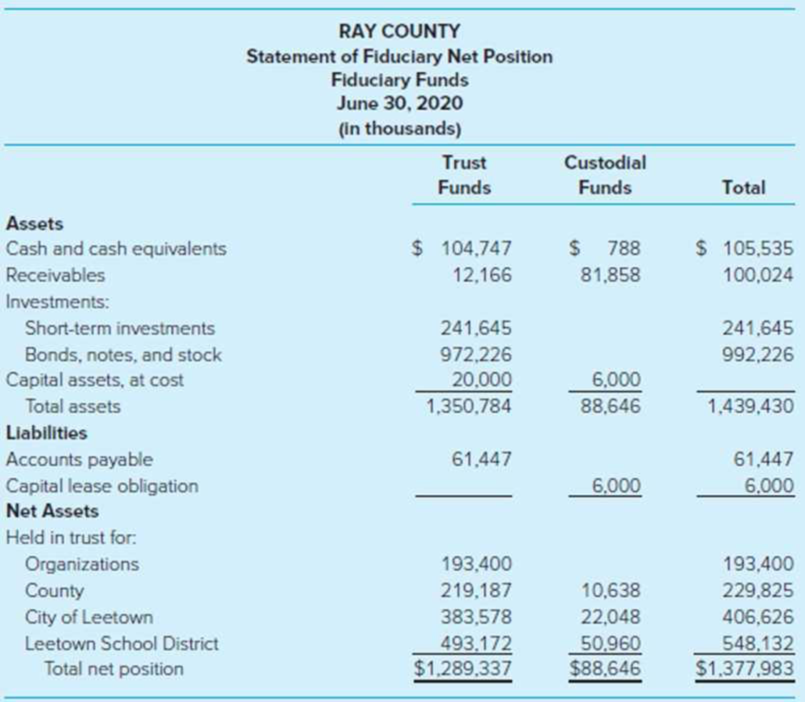

Fiduciary Financial Statements. (LO8-4) Ray County administers a tax custodial fund, an investment trust fund, and a private-purpose trust fund. The tax custodial fund acts as custodian for the county, a city within the county, and the school district within the county. Participants in the investment trust fund are the Ray County General Fund, the city, and the school district. The private-purpose trust is maintained for the benefit of a private organization located within the county. Ray County has prepared the following statement of fiduciary net position.

Required

The statement as presented is not in accordance with GASB standards. Using Illustration A2–10 (recall that the City and County of Denver statements use agency rather than custodial given they were issued prior to the change in terminology) and Illustration 8–6 as examples, identify the errors (problems) in the statement and explain how the errors should be corrected.

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

ACCT GOV.+NFP ENTITIES LOOSELEAF W/CONN.

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education