Concept explainers

a.

To determine: The average

Risk and Return:

The risk and return are two closely related terms. The risk is the uncertainty attached to an event. In case of any investment, there is some amount of risk attached to it as there can be either gain or loss. While return in the financial term is that percentage which represents the profit in an investment.

Higher risk is associated with higher return and lower risk has a probability of lower return. The investor has to face a tradeoff between risk and return in terms of an investment.

Annual Rate of Return:

The annual rate of return refers to that return which is charged or is earned on an investment for a year. This rate is expressed in percentage.

a.

Answer to Problem 22SP

Explanation of Solution

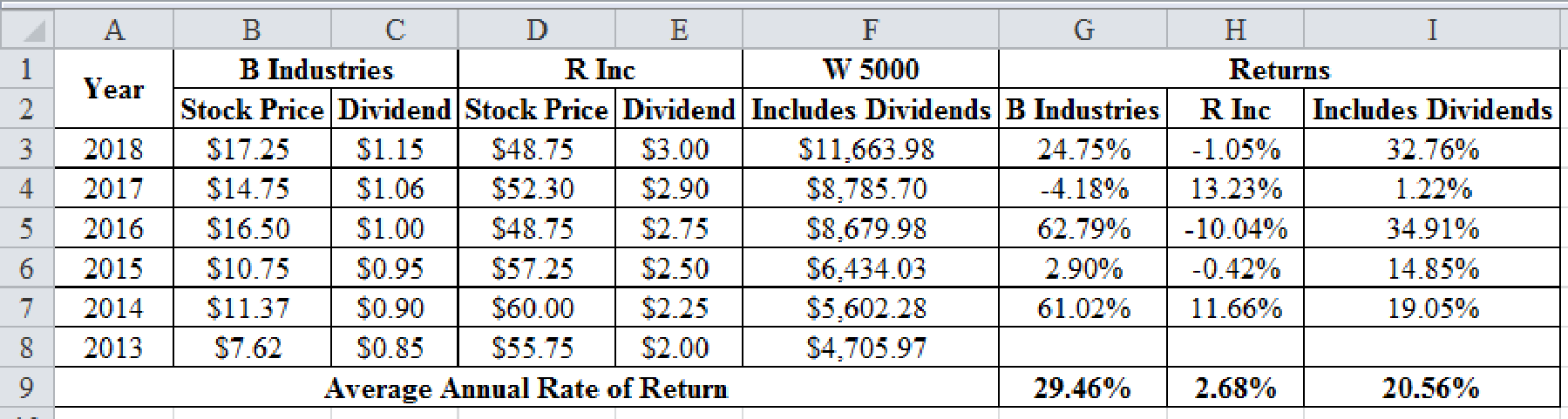

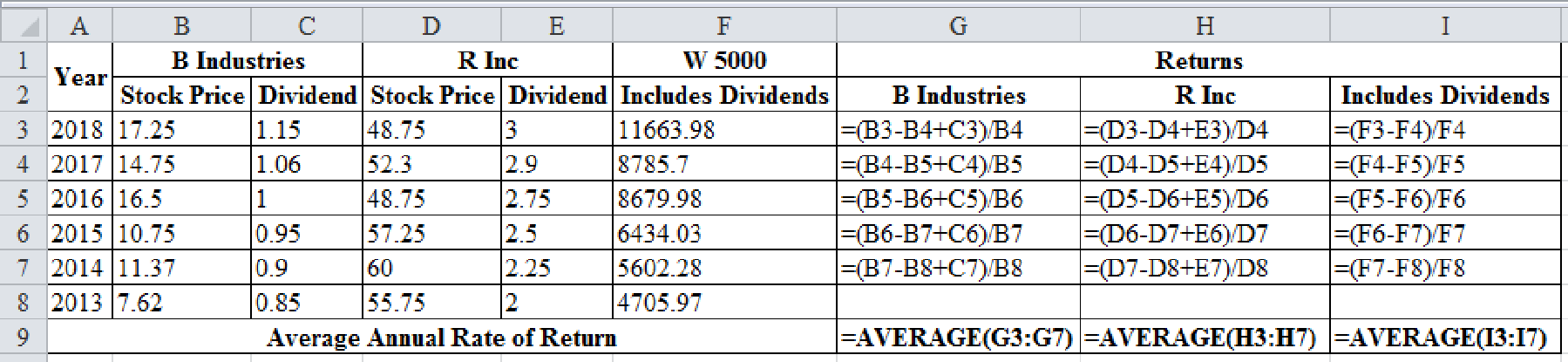

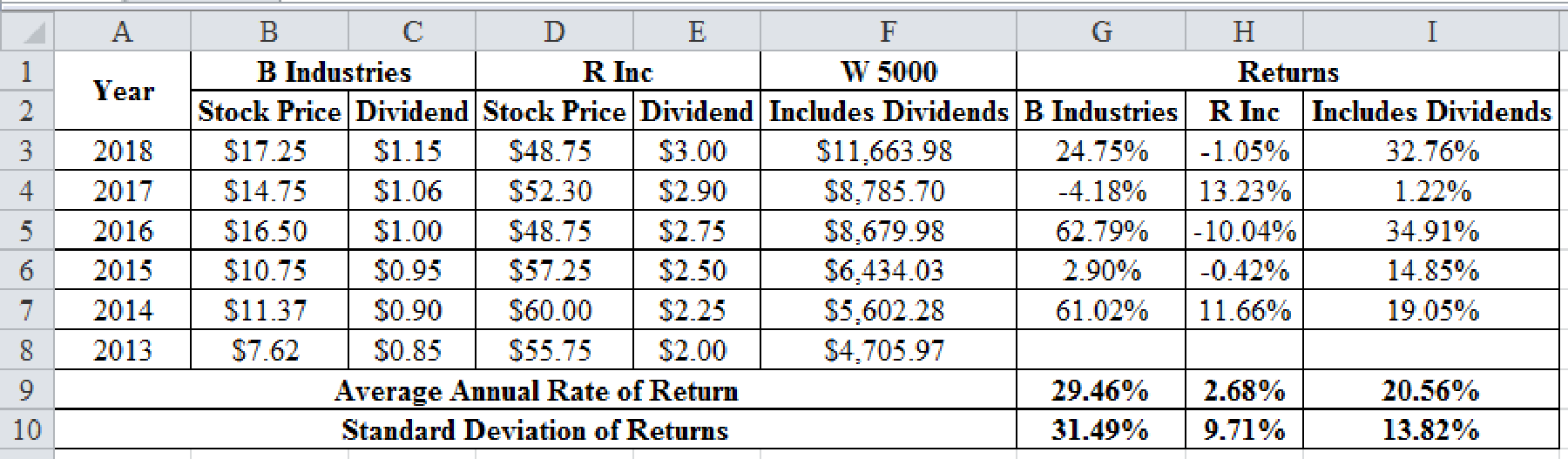

Calculation of annual rates of return in the excel spreadsheet:

Excel Spreadsheet:

Excel Workings:

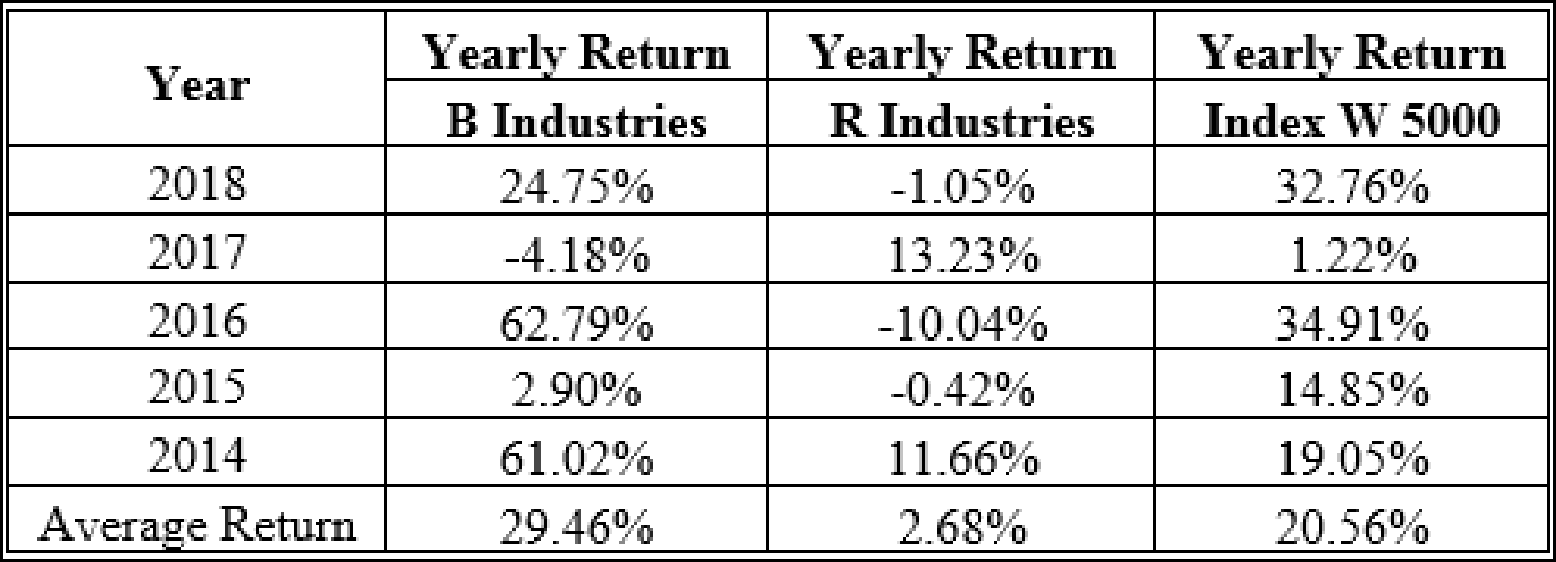

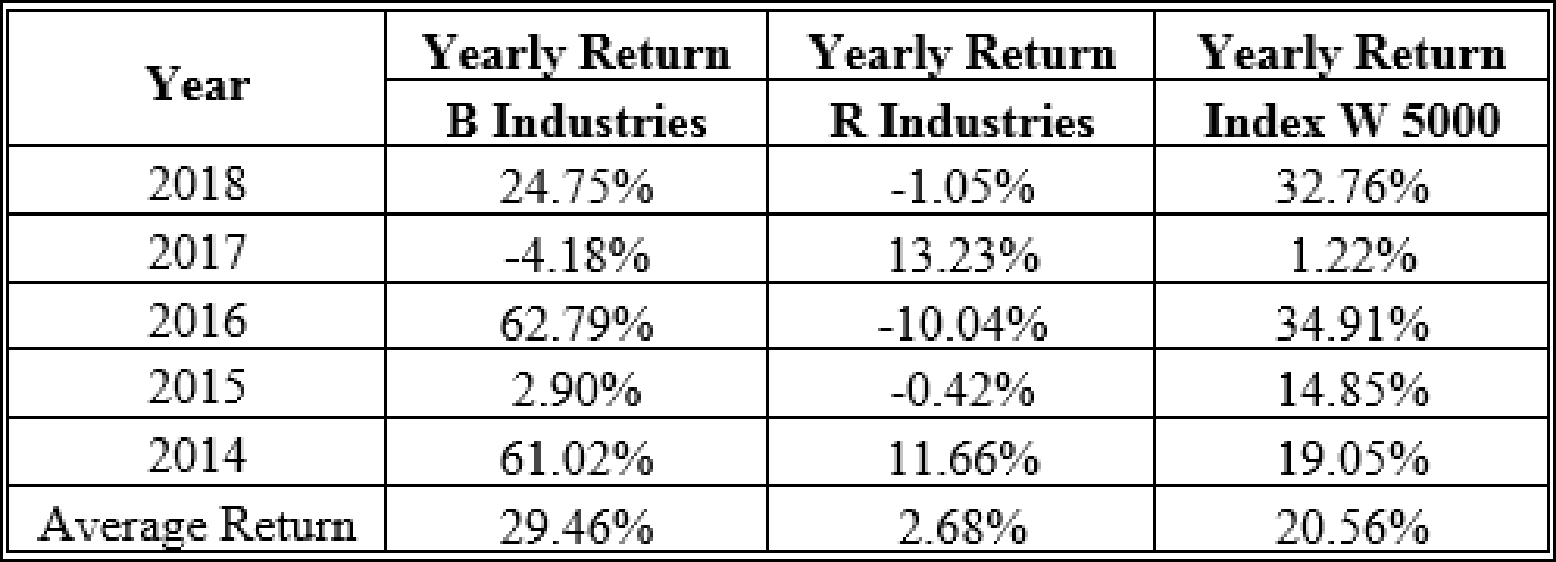

Therefore the yearly returns and average returns are as follows,

b.

To prepare: The standard deviation for the given data.

Standard deviation:

The standard deviation refers to the stand-alone risk associated with the securities. It measures how much a data is dispersed with its standard value. The Greek letter sigma represents the standard deviation.

b.

Answer to Problem 22SP

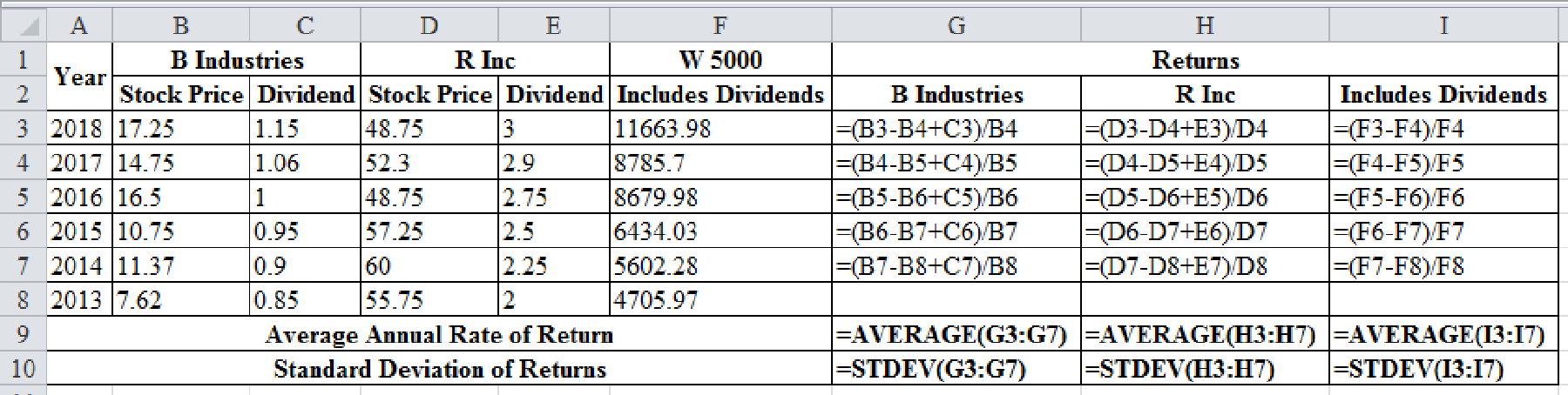

The standard deviation of B industries is 31.49%, R industries are 9.71% and Index W 5000 is 13.82%.

Explanation of Solution

Calculation of standard deviation with a excel spreadsheet:

Excel Spreadsheet:

Excel Workings:

Therefore the standard deviation of B industries is 31.49%, R industries are 9.71% and Index W 5000 is 13.82%.

c.

To determine: The coefficient of variation.

The coefficient of variation:

The coefficient of variation is a tool to determine the risk. It determines the risk per unit of return. It is used for measurement when the expected returns are same for two data.

c.

Answer to Problem 22SP

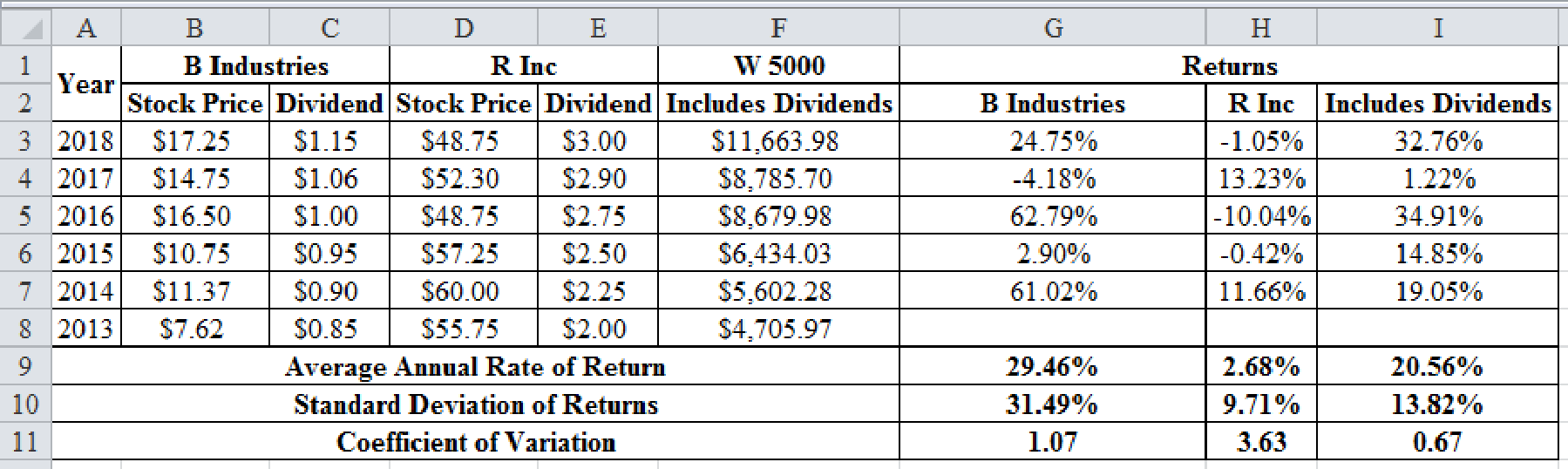

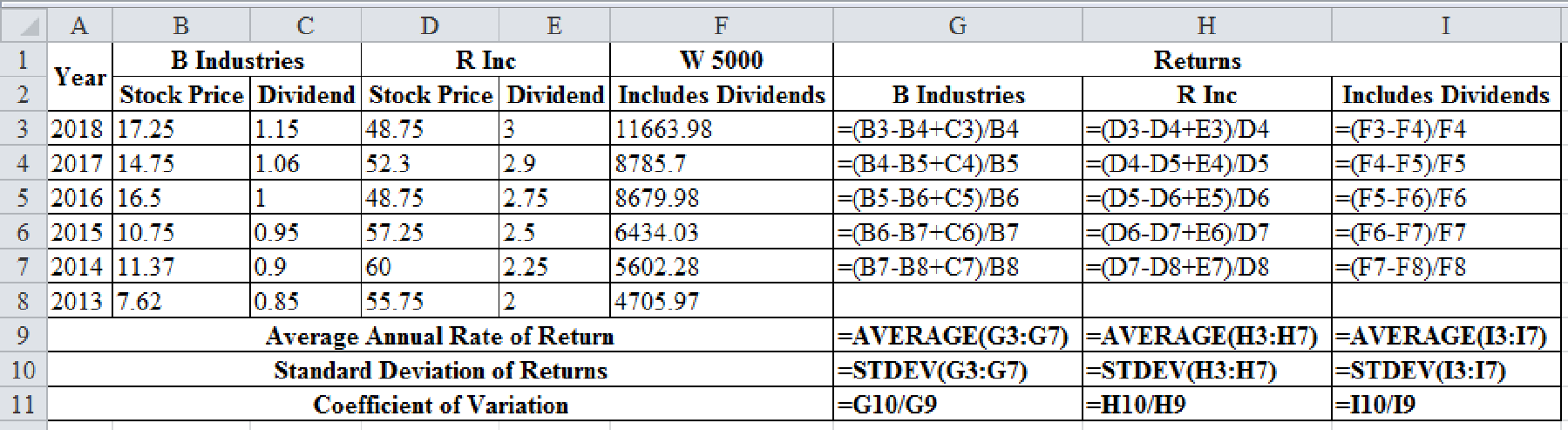

The coefficient of variation of B industries is 1.07, R industries are 3.63 and Index W 5000 is 0.67.

Explanation of Solution

The calculations of the coefficient of variation for the given data is shown below using excel:

Excel Spreadsheet:

Excel Workings:

Therefore the coefficient of variation of B industries is 1.07, R industries are 3.63 and Index W 5000 is 0.67.

d.

To determine: The Sharpe ratio.

d.

Answer to Problem 22SP

The Sharpe ratio of B industries is 0.84, R industries are -0.03 and Index W 5000 is 1.27.

Explanation of Solution

Calculate the Sharpe Ratio for each company:

Therefore the Sharpe ratio of B industries is 0.84, R industries are -0.03 and Index W 5000 is 1.27.

e.

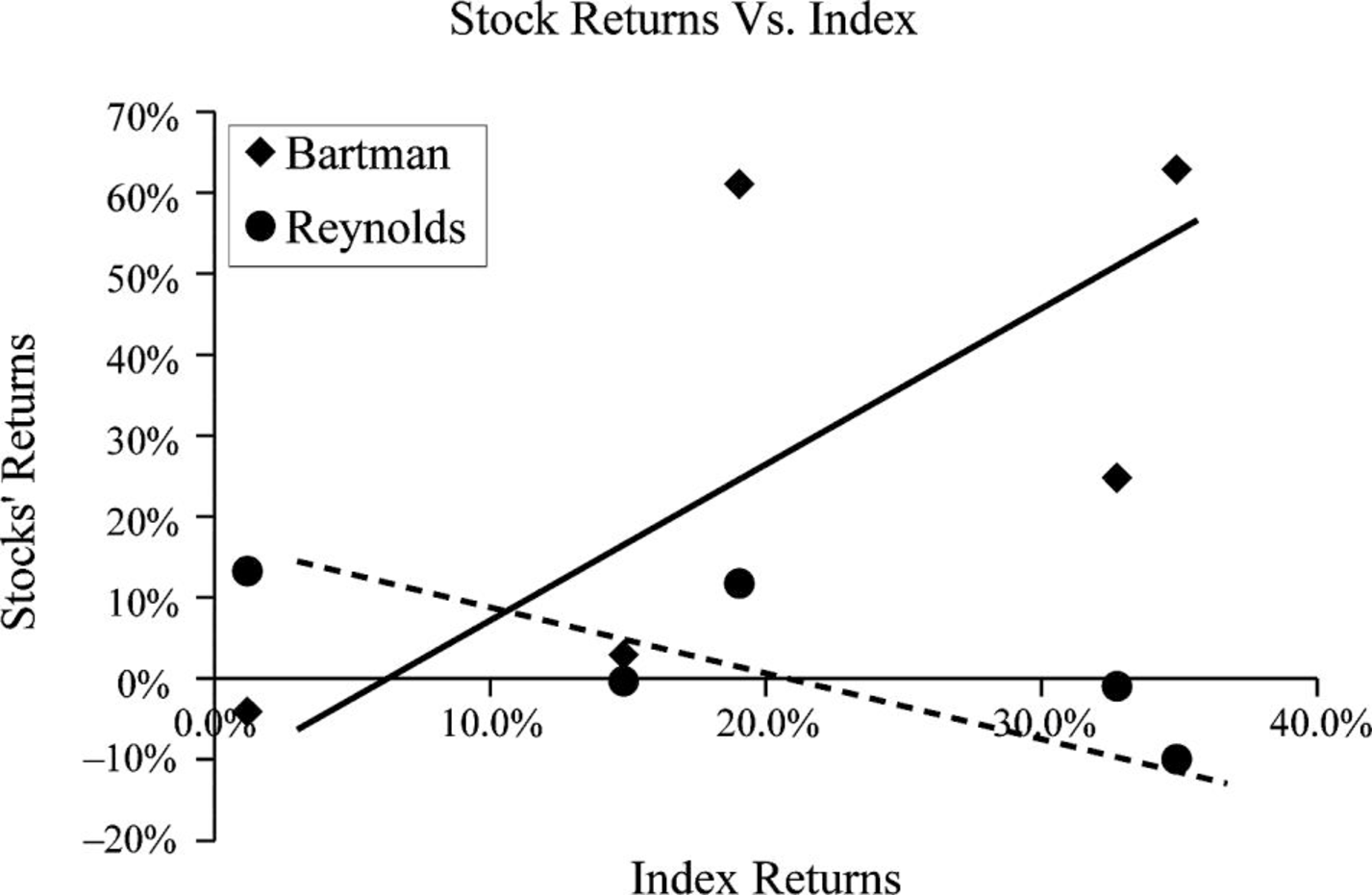

To prepare: A scatter diagram showing the company’s returns and the index returns.

e.

Explanation of Solution

The scatter diagram is as shown below:

Graph (1)

- The blue line represents the B Industries and the red line represents the R Inc. and green lone represents the Index W 5000.

f.

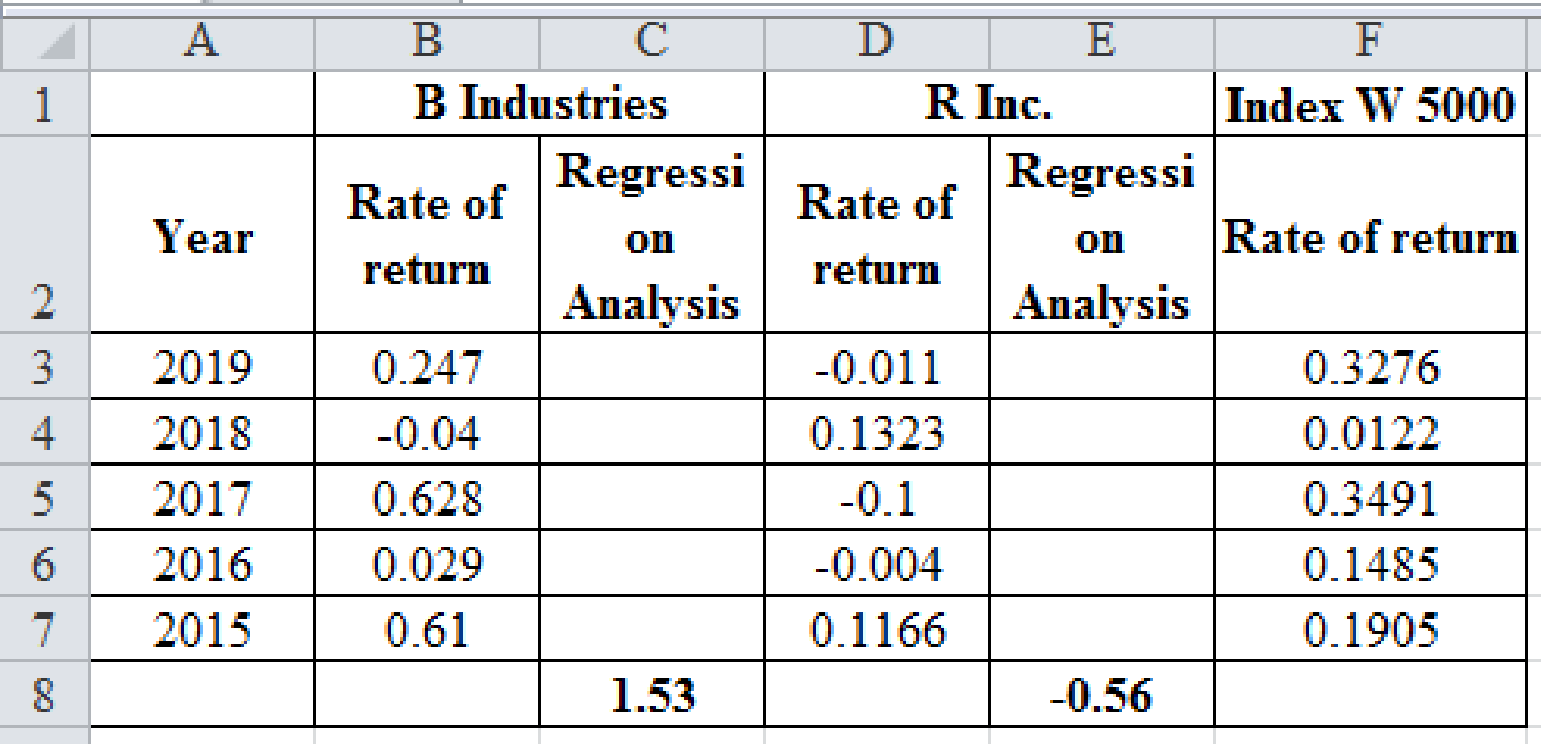

To determine: The beta of the B Industries and R Inc. by running regressions of their returns.

f.

Answer to Problem 22SP

The beta of B industries is 1.53, R industries are -0.56.

Explanation of Solution

The beta of the B Industries, R Inc. and W 5000 by running regressions of their returns is:

Therefore the beta of B industries is 1.53, R industries are -0.56.

g.

To determine: The required returns of the two companies by security market line equation.

g.

Answer to Problem 22SP

The required return of B industries is 13.67%, R industries are -3.26%.

Explanation of Solution

Given,

The risk-free rate is 4.5%.

The expected return on market is 10%.

Calculation of the required return:

Therefore the required return of B industries is 12.97%, R industries are 1.42%.

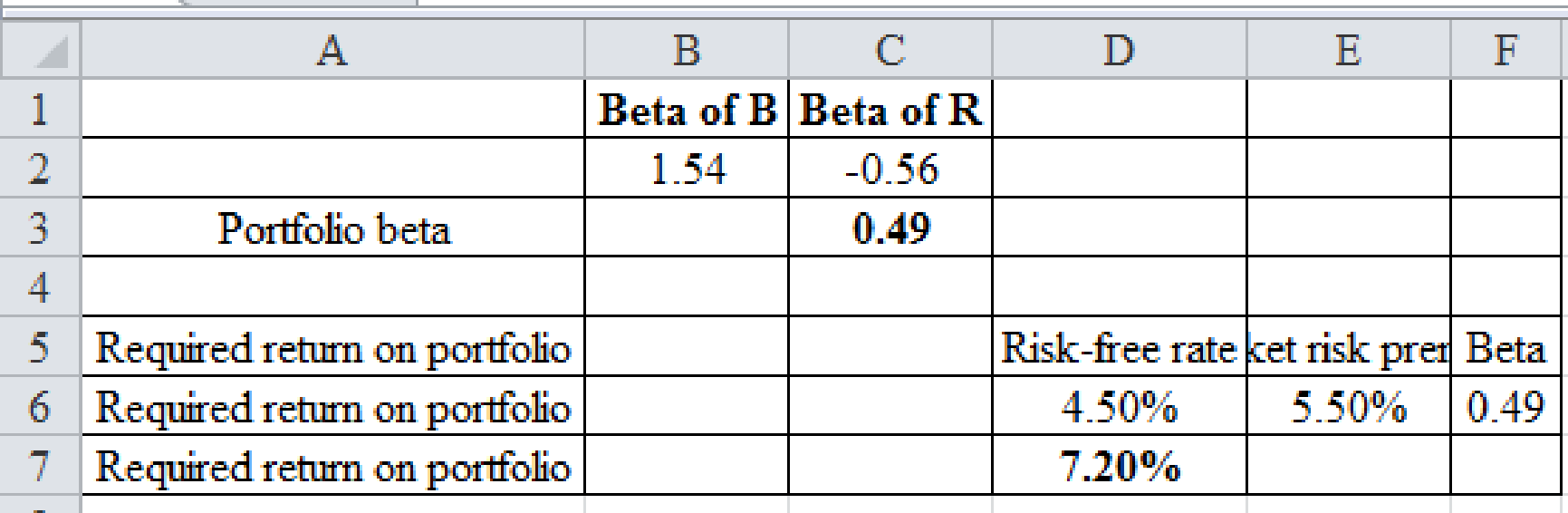

h.

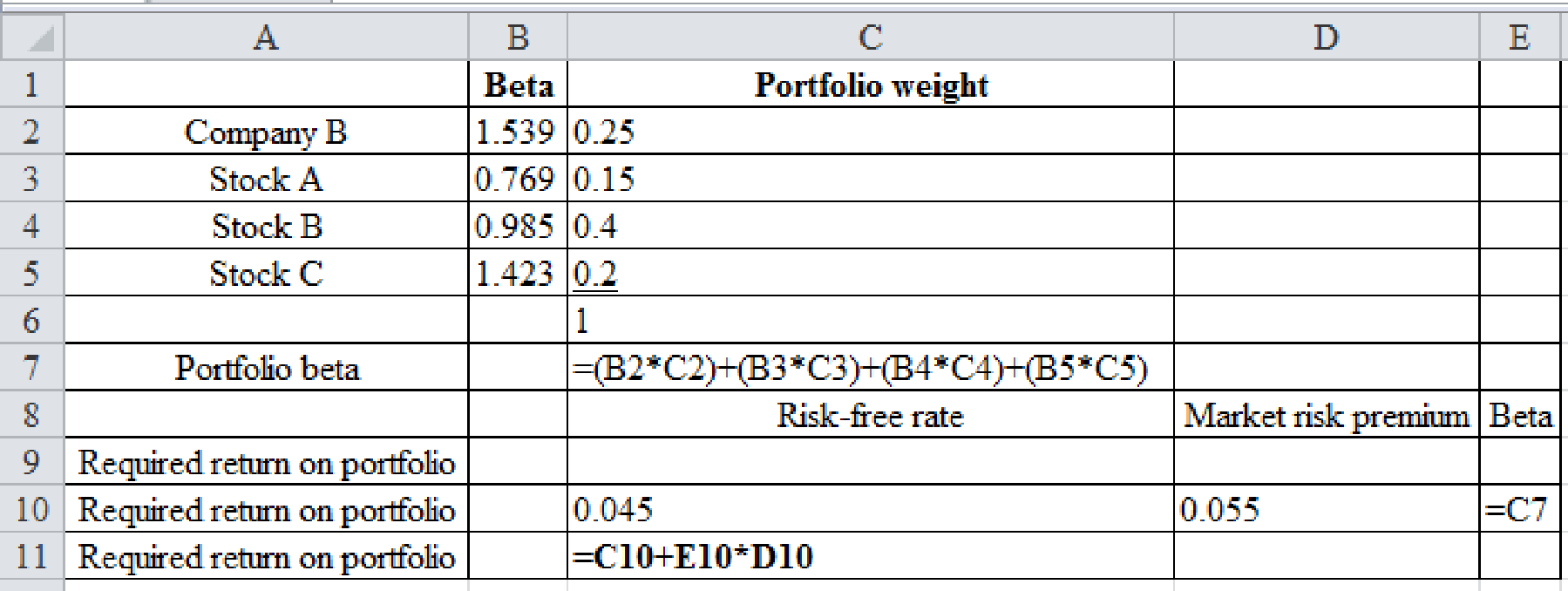

To determine: The beta and the required return for a newly constructed portfolio.

h.

Answer to Problem 22SP

The required return of portfolio is 7.20% and the portfolio beta is 0.49.

Explanation of Solution

Calculation of the beta and the required return for the new portfolio:

Therefore the required return of portfolio is 7.20% and the portfolio beta is 0.49.

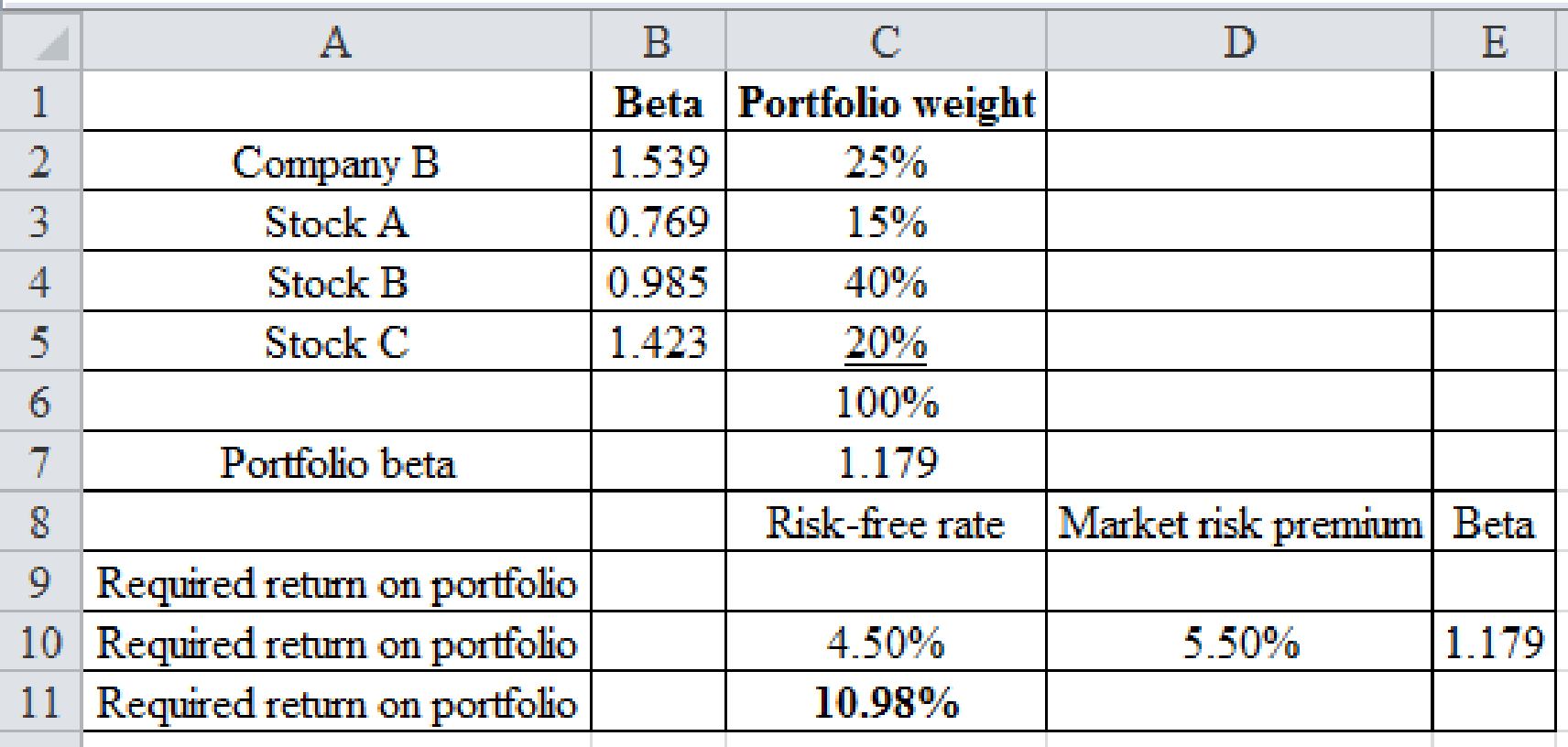

i.

To determine: The new portfolio’s required return.

i.

Answer to Problem 22SP

The new portfolio’s required return is 10.98%.

Explanation of Solution

Calculation of the required return on the portfolio:

Excel Spreadsheet:

Excel Workings:

Therefore the new portfolio’s required return is 10.98%.

Want to see more full solutions like this?

Chapter 8 Solutions

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

- Need the below table filled out for Short-term debt %, Long-term debt $,%, Common equity $,% and Total capital $,%. Market Value Capital Structure Suppose the Schoof Company has this book value balance sheet: Current assets $30,000,000 Current liabilities $20,000,000 Notes payable 10,000,000 Fixed assets 70,000,000 Long-term debt 30,000,000 Common stock (1 million shares) 1,000,000 Retained earnings 39,000,000 Total assets $100,000,000 Total liabilities and equity $100,000,000 The notes payable are to banks, and the interest rate on this debt is 11%, the same as the rate on new bank loans. These bank loans are not used for seasonal financing but instead are part of the company's permanent capital structure. The long-term debt consists of 30,000 bonds, each with a par value of $1,000, an annual coupon interest rate of 6%, and a 15-year maturity. The going rate of interest on new long-term debt, rd, is 12%, and this is the…arrow_forwardNed assistance with Q3 and Q4 below? Cost of Equity The earnings, dividends, and stock price of Shelby Inc. are expected to grow at 6% per year in the future. Shelby's common stock sells for $21 per share, its last dividend was $1.00, and the company will pay a dividend of $1.06 at the end of the current year. Using the discounted cash flow approach, what is its cost of equity? Round your answer to two decimal places. 11.06 % If the firm's beta is 1.3, the risk-free rate is 8%, and the expected return on the market is 11%, then what would be the firm's cost of equity based on the CAPM approach? Round your answer to two decimal places. 11.90% If the firm's bonds earn a return of 9%, then what would be your estimate of rs using the own-bond-yield-plus-judgmental-risk-premium approach? (Hint: Use the mid-point of the risk premium range.) Round your answer to two decimal places. % On the basis of the results of parts a–c, what would be your estimate of Shelby's cost of equity?…arrow_forwardWhat monthly compounded interest rate would Second National Bank need to pay on savings deposits to provide an effective rate of 6.2%?arrow_forward

- Hello tutor this is himlton biotech problem.arrow_forwardYan Yan Corp. has a $2,000 par value bond outstanding with a coupon rate of 4.7 percent paid semiannually and 13 years to maturity. The yield to maturity of the bond is 5.05 percent. What is the dollar price of the bond?arrow_forwardA trip goa quesarrow_forward

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning