Describe the three major forms of business organizations.

Explanation of Solution

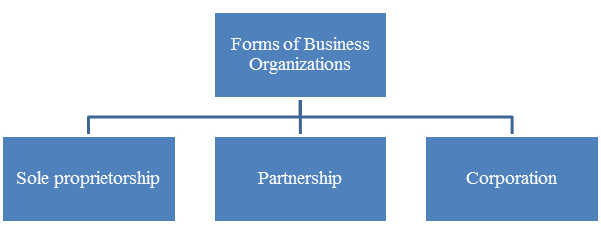

Forms of business organizations:

Sole proprietorship: It is one form of simple business that is owned and maintained by a single person. Obtaining business licence from the local government is required to setup the sole proprietorship. Government provides tax advantages for these firms.

Corporation: Corporation is a form of business organization which is created and organized as per the laws of the state. There is a separate legal entity in this form of business organization that means, it is owned by shareholders and managed by a board of directors. The transfer of ownership and raising funds are easy in this form of organization. No personal legal liability exists among the shareholders.

Want to see more full solutions like this?

Chapter 8 Solutions

Survey Of Accounting

- Can you help me solve this general accounting problem using the correct accounting process?arrow_forwardCan you solve this financial accounting question with the appropriate financial analysis techniques?arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forward

- The stockholders' equity accounts of Grouper Corp. on January 1, 2025, were as follows. Preferred Stock (7%, $100 par noncumulative, 8,500 shares authorized) $510,000 Common Stock ($4 stated value, 510,000 shares authorized) 1,700,000 Paid-in Capital in Excess of Par-Preferred Stock 25,500 Paid-in Capital in Excess of Stated Value-Common Stock 816,000 Retained Earnings 1,169,600 Treasury Stock (8,500 common shares) 68,000 During 2025, the corporation had the following transactions and events pertaining to its stockholders' equity. Feb. 1 Issued 8,500 shares of common stock for $51,000. Mar. 20 Purchased 1,700 additional shares of common treasury stock at $7 per share. Oct. 1 Nov. 1 Dec. 1 Declared a 7% cash dividend on preferred stock, payable November 1. Paid the dividend declared on October 1. Declared a $0.50 per share cash dividend to common stockholders of record on December 15, payable December 31, 2 Dec. 31 Determined that net income for the year was $477,000. Paid the dividend…arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forwardDo fast answer of this general accounting questionarrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College