Concept explainers

Exercise 8-13 Recording and reporting

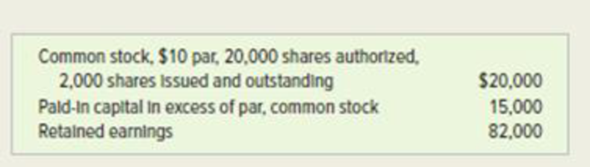

The following information pertains to JAE Corp. at January 1, 2018:

JAE Corp. completed the following transactions during 2018:

- 1. Issued 3,000 shares of $10 par common stock for $25 per share.

- 2. Repurchased 500 shares of its own common stock for $26 per share.

- 3. Resold 200 shares of treasury stock for $30 per share.

Required

- a. How many shares of common stock were outstanding at the end of the period?

- b. How many shares of common stock had been issued at the end of the period?

- c. Organize the transactions data in accounts under the

accounting equation. - d. Prepare the stockholders’ equity section of the

balance sheet reflecting these transactions. Include the number of shares authorized, issued, and outstanding in the description of the common stock.

a)

Ascertain the total number of outstanding shares at the end of the period.

Explanation of Solution

Common stock: These are the ordinary shares that a corporation issues to the investors in order to raise funds. In return, the investors receive a share of profit from the profits earned by the corporation in the form of dividend.

Ascertain the total number of outstanding shares at the end of the period:

| Common Stock | Outstanding |

| Beginning Number of Shares | 2,000 |

| Issued during 2016 | 3,000 |

| Less: Repurchased as Treasury Stock | (500) |

| Resold Treasury Stock | 200 |

| Ending number of shares | 4,700 |

Table (1)

Therefore, the total number of outstanding shares at the end of the period is 4,700 shares.

b)

Ascertain the total number of issued shares at the end of the period.

Explanation of Solution

Ascertain the total number of issued shares at the end of the period:

| Common Stock | Issued |

| Beginning Number of Shares | 2,000 |

| Issued during 2016 | 3,000 |

| Ending Number of Shares | 5,000 |

Table (2)

Therefore, the total number of issued shares at the end of the period is 5,000 shares.

c)

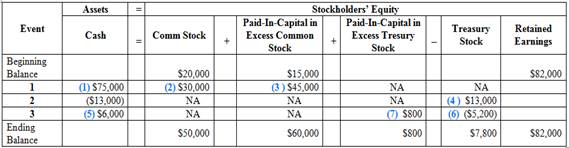

Organize the transactions data in accounts under the accounting equation.

Explanation of Solution

Organize the transactions data in accounts under the accounting equation:

Table (3)

Working note:

(1) Calculate the value of cash received from the issuance of common stock:

(2) Calculate the value of common stock issued at par value:

(3) Calculate the value of paid-in capital in excess of par value:

(4) Calculate the value of treasury stock:

(5) Calculate the value of cash received from the resold of treasury stock:

(6) Calculate the value of treasury stock resold at original cost:

(7) Calculate the value of paid-in capital in excess of cost, TS:

d)

Prepare the stockholder’s equity section of the balance sheet.

Explanation of Solution

Stockholders’ Equity Section: Stockholder’s equity section is the section of the balance sheet that shows the available balance stockholders’ equity as on reported date at the end of the financial year.

Prepare the stockholder’s equity section of the balance sheet:

| Stockholders’ Equity | $ | $ |

| Common Stock, $10 par value, 20,000 shares authorized, 5,000 shares issued, and 4,700 shares outstanding | 50,000 | |

| Paid-In Capital in Excess of Par, Common | 60,000 | |

| Paid-In Capital in Excess of Cost, TS | 800 | |

| Total Paid-In Capital | 110,800 | |

| Add: Retained Earnings | 82,000 | |

| Less: Treasury Stock | (7,800) | |

| Total Stockholders’ Equity | 185,000 |

Table (6)

Therefore, the total value of stockholder’s equity at the end of the year is $185,000.

Want to see more full solutions like this?

Chapter 8 Solutions

Survey Of Accounting

- Can you solve this general accounting question with accurate accounting calculations?arrow_forwardAndrews Corporation manufactures CropGuard. Each container of the product contains 45 pounds of direct materials. 12% of the materials are lost during manufacturing. The budget allows direct materials to be purchased at $5.25 per pound under terms of 2/10, n/30. The company's policy is to take all available cash discounts. Determine the standard direct materials cost for one container of CropGuard.arrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forward

- Please provide the correct answer to this general accounting problem using valid calculations.arrow_forwardI need help with this financial accounting problem using proper accounting guidelines.arrow_forwardPlease explain the solution to this financial accounting problem with accurate principles.arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage