CONNECT CODE F/FINANCIAL ACCOUNTING

6th Edition

ISBN: 9781260685978

Author: PHILLIPS

Publisher: MCGRAW-HILL CUSTOM PUBLISHING

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 1PA

Recording

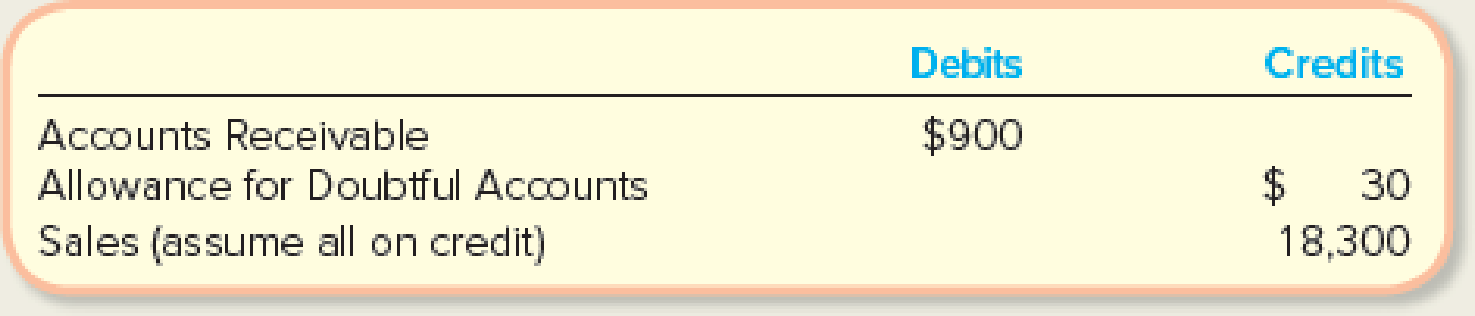

The Kraft Heinz Company was formed in 2015 with the merger of Kraft Foods and H. J. Heinz Corporation. The company reported the following rounded amounts for the year ended January 3, 2016 (all amounts in millions):

Required:

- 1. Assume Kraft Heinz uses %2 of 1 percent of sales to estimate its

Bad Debt Expense for the year. Prepare theadjusting journal entry required for the year (rounded to the nearest million), assuming no Bad Debt Expense has been recorded yet. - 2. Assume instead Kraft Heinz uses the aging of accounts receivable method and estimates that $80 of its Accounts Receivable will be uncollectible. Prepare the adjusting journal entry required at January 3, 2016, for recording Bad Debt Expense.

- 3. Repeat requirement 2, except this time assume the unadjusted balance in Kraft Heinz’s Allowance for Doubtful Accounts at January 3, 2016, was a debit balance of $20.

- 4. If one of Kraft Heinz’s customers declared bankruptcy, what journal entry would be used to write off its $15 balance?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

At the beginning of the year, manufacturing overhead for the year was estimated to be $273,650. At the end of the year, the actual direct labor hours for the year were 27,400 hours, the actual manufacturing overhead for the year was $271,400, and the manufacturing overhead for the year was overapplied by $14,650. If the predetermined overhead rate is based on direct labor hours, then the estimated direct labor hours at the beginning of the year used in the predetermined overhead rate must have been___.

Find out Accounting MCQ

Answer please

Chapter 8 Solutions

CONNECT CODE F/FINANCIAL ACCOUNTING

Ch. 8 - What are the advantages and disadvantages of...Ch. 8 - Prob. 2QCh. 8 - Which basic accounting principles does the...Ch. 8 - Using the allowance method, is Bad Debt Expense...Ch. 8 - What is the effect of the write-off of...Ch. 8 - How does the use of calculated estimates differ...Ch. 8 - A local phone company had a customer who rang up...Ch. 8 - What is the primary difference between accounts...Ch. 8 - What are the three components of the interest...Ch. 8 - As of May 1, 2016, Krispy Kreme Doughnuts had...

Ch. 8 - Does an increase in the receivables turnover ratio...Ch. 8 - What two approaches can managers take to speed up...Ch. 8 - When customers experience economic difficulties,...Ch. 8 - (Supplement 8A) Describe how (and when) the direct...Ch. 8 - (Supplement 8A) Refer to question 7. What amounts...Ch. 8 - 1. When a company using the allowance method...Ch. 8 - 2. When using the allowance method, as Bad Debt...Ch. 8 - 3. For many years, Carefree Company has estimated...Ch. 8 - 4. Which of the following best describes the...Ch. 8 - 5. If the Allowance for Doubtful Accounts opened...Ch. 8 - 6. When an account receivable is recovered a....Ch. 8 - Prob. 7MCCh. 8 - 8. If the receivables turnover ratio decreased...Ch. 8 - Prob. 9MCCh. 8 - Prob. 10MCCh. 8 - Prob. 1MECh. 8 - Evaluating the Decision to Extend Credit Last...Ch. 8 - Reporting Accounts Receivable and Recording...Ch. 8 - Recording Recoveries Using the Allowance Method...Ch. 8 - Recording Write-Offs and Bad Debt Expense Using...Ch. 8 - Determining Financial Statement Effects of...Ch. 8 - Estimating Bad Debts Using the Percentage of...Ch. 8 - Estimating Bad Debts Using the Aging Method Assume...Ch. 8 - Recording Bad Debt Estimates Using the Two...Ch. 8 - Prob. 10MECh. 8 - Prob. 11MECh. 8 - Recording Note Receivable Transactions RecRoom...Ch. 8 - Prob. 13MECh. 8 - Determining the Effects of Credit Policy Changes...Ch. 8 - Prob. 15MECh. 8 - (Supplement 8A) Recording Write-Offs and Reporting...Ch. 8 - Recording Bad Debt Expense Estimates and...Ch. 8 - Determining Financial Statement Effects of Bad...Ch. 8 - Prob. 3ECh. 8 - Recording Write-Offs and Recoveries Prior to...Ch. 8 - Prob. 5ECh. 8 - Computing Bad Debt Expense Using Aging of Accounts...Ch. 8 - Computing Bad Debt Expense Using Aging of Accounts...Ch. 8 - Recording and Reporting Allowance for Doubtful...Ch. 8 - Recording and Determining the Effects of Write-Off...Ch. 8 - Recording Note Receivable Transactions, Including...Ch. 8 - Recording Note Receivable Transactions, Including...Ch. 8 - Recording Note Receivable Transactions, Including...Ch. 8 - Using Financial Statement Disclosures to Infer...Ch. 8 - Using Financial Statement Disclosures to Infer Bad...Ch. 8 - Prob. 15ECh. 8 - Analyzing and Interpreting Receivables Turnover...Ch. 8 - (Supplement 8A) Recording Write-Offs and Reporting...Ch. 8 - Recording Accounts Receivable Transactions Using...Ch. 8 - Interpreting Disclosure of Allowance for Doubtful...Ch. 8 - Recording Notes Receivable Transactions Jung ...Ch. 8 - Accounting for Accounts and Notes Receivable...Ch. 8 - Analyzing Allowance for Doubtful Accounts,...Ch. 8 - Recording Accounts Receivable Transactions Using...Ch. 8 - Interpreting Disclosure of Allowance for Doubtful...Ch. 8 - Recording Notes Receivable Transactions CS...Ch. 8 - Accounting for Accounts and Notes Receivable...Ch. 8 - Analyzing Allowance for Doubtful Accounts,...Ch. 8 - Recording Accounts Receivable Transactions Using...Ch. 8 - Prob. 2PBCh. 8 - Prob. 3PBCh. 8 - Accounting for Accounts and Notes Receivable...Ch. 8 - Analyzing Allowance for Doubtful Accounts,...Ch. 8 - Recording and Reporting Credit Sales and Bad Debts...Ch. 8 - Prob. 2COPCh. 8 - Recording Daily and Adjusting Entries Using FIFO...Ch. 8 - Prob. 1SDCCh. 8 - Prob. 2SDCCh. 8 - Ethical Decision Making: A Real-Life Example You...Ch. 8 - Critical Thinking: Analyzing the Impact of Credit...Ch. 8 - Using an Aging Schedule to Estimate Bad Debts and...Ch. 8 - Accounting for Receivables and Uncollectible...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Accounts Receivable and Accounts Payable; Author: The Finance Storyteller;https://www.youtube.com/watch?v=x_aUWbQa878;License: Standard Youtube License