To discuss:

Annual average return and standard deviation.

Introduction:

Return: In financial context, return is seen as percentage that represents the profit in an investment.

Explanation of Solution

The annual average

Using equation (1) the annual average return of Miller’s Fund (MF) is calculated as follows:

The annual average return of Miller’s Fund (MF) is 24.325%..

Using equation (1) the annual average return of S&P is calculated as follows:

The annual average return of S&P is 14.925%.

By the annual average returns, Miller’s Fund performed better than the S&P over the given period of time.

If money investment of $1,000 is made in Miller’s Fund in 2009, the money reaped at the end of 2012 would be $1,243.25

If money investment of $1,000 is made in S&P in 2009, the money reaped at the end of 2012 would be $1,149.25

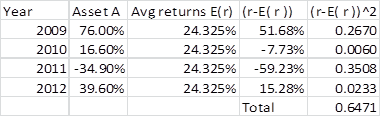

The standard deviation of Miller’s Fund can be calculated as follows using excel functions as in table1.

Table 1

The standard deviation of Miller’s Fund is calculated as follows:

The standard deviation of Miller’s Fund is 46.44%.

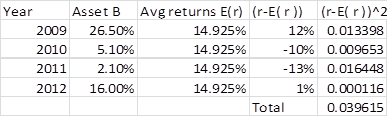

The standard deviation of S&P can be calculated as follows using excel functions as in table 2.

Table 2

The standard deviation of S&P is calculated as follows:

The standard deviation of S&P is 11.5%.

By the value of standard deviation, Millers Fund is more volatile than S&P.

Want to see more full solutions like this?

Chapter 8 Solutions

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

- no aiWhat does beta measure in finance?A. Company’s debt ratioB. Market capitalizationC. Stock volatility relative to the marketD. Earnings per sharearrow_forwardIn capital budgeting, which method considers the time value of money?A. Payback PeriodB. Accounting Rate of ReturnC. Net Present ValueD. Profitability Indexarrow_forwardI need help! In capital budgeting, which method considers the time value of money?A. Payback PeriodB. Accounting Rate of ReturnC. Net Present ValueD. Profitability Indexarrow_forward

- Do not use chatgpt! 3. The time value of money concept suggests that:A. Money today is worth less than the same amount in the futureB. Money today is worth more than the same amount in the futureC. All money has the same value over timeD. Inflation does not impact money valuearrow_forwardDont use AI 3. The time value of money concept suggests that:A. Money today is worth less than the same amount in the futureB. Money today is worth more than the same amount in the futureC. All money has the same value over timeD. Inflation does not impact money valuearrow_forward3. The time value of money concept suggests that:A. Money today is worth less than the same amount in the futureB. Money today is worth more than the same amount in the futureC. All money has the same value over timeD. Inflation does not impact money valuearrow_forward

- Which of the following would typically not be found in a company’s cash flow from operating activities?A. Depreciation expenseB. Sale of equipmentC. Changes in working capitalD. Net incomearrow_forwardWhat does the term “liquidity” refer to in finance?A. The return on investmentB. The volatility of a securityC. The ease of converting assets into cashD. The interest rate charged by banksarrow_forwardWhich of the following is a short-term financial decision?A. Issuing new sharesB. Capital budgetingC. Inventory managementD. Buying new machineryarrow_forward

- I need help in this finance question! What does the term “liquidity” refer to in finance?A. The return on investmentB. The volatility of a securityC. The ease of converting assets into cashD. The interest rate charged by banksarrow_forwardWhich of the following is a characteristic of a bond?A. Ownership in a companyB. Residual claimC. Fixed income investmentD. Unlimited liability Need help urgenarrow_forwardPlease don't solve with incorrect values . i will give unhelpful.arrow_forward

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning