PRIN.OF CORPORATE FINANCE

13th Edition

ISBN: 9781260013900

Author: BREALEY

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 16PS

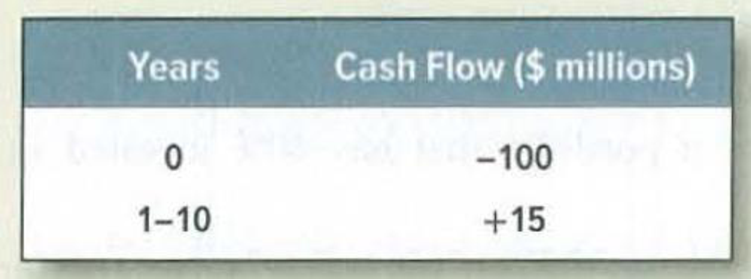

Cost of capital* Epsilon Corp. is evaluating an expansion of its business. The cash-flow

The firm’s existing assets have a beta of 1.4. The risk-free interest rate is 4% and the expected return on the market portfolio is 12%. What is the project’s

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I need correct answer!

Which type of bond offers tax advantages? A) Convertible bonds B) Municipal bonds C) Corporate bonds D) Junk bonds

What is the main purpose of budgeting in a company?

A) To eliminate all expensesB) To forecast and control costsC) To increase revenueD) To reduce taxes

i need correct answer!!

2. A 'competitive advantage' means:A. A company has lower prices than its competitorsB. A company has a unique product or service that gives it an edgeC. A company offers the same product as its competitorsD. A company has the largest market share

Chapter 8 Solutions

PRIN.OF CORPORATE FINANCE

Ch. 8 - Efficient portfolios For each of the following...Ch. 8 - Efficient portfolios Figure 8.11 purports to show...Ch. 8 - Portfolio risk and return Look back at the...Ch. 8 - Portfolio risk and return Mark Harrywitz proposes...Ch. 8 - Portfolio risk and return Ebenezer Scrooge has...Ch. 8 - Portfolio risk and return Here are returns and...Ch. 8 - Portfolio risk and return Percival Hygiene has IO...Ch. 8 - Sharpe ratio Use the long-term data on security...Ch. 8 - Portfolio beta Refer to Table 7.5. a. What is the...Ch. 8 - CAPM True or false? Explain or qualify as...

Ch. 8 - CAPM True or false? a. The CAPM implies that if...Ch. 8 - CAPM Suppose that the Treasury bill rate is 6%...Ch. 8 - CAPM The Treasury bill rate is 4%, and the...Ch. 8 - Cost of capital Epsilon Corp. is evaluating an...Ch. 8 - APT Consider a three-factor APT model. The factors...Ch. 8 - Prob. 18PSCh. 8 - APT Consider the following simplified APT model:...Ch. 8 - Prob. 20PSCh. 8 - Three-factor modelThe following table shows the...Ch. 8 - Efficient portfolios Look again at the set of the...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Which type of bond offers tax advantages? A) Convertible bondsB) Municipal bondsC) Corporate bondsD) Junk bondsneed help!arrow_forwardWhich type of bond offers tax advantages? A) Convertible bondsB) Municipal bondsC) Corporate bondsD) Junk bondsarrow_forwardWhat does "liquidity" refer to in finance? A) The profitability of a companyB) The ease of converting assets to cashC) The value of fixed assetsD) The number of outstanding shares i need answer.arrow_forward

- No chatgpt! What does "liquidity" refer to in finance? A) The profitability of a companyB) The ease of converting assets to cashC) The value of fixed assetsD) The number of outstanding sharesarrow_forwardWhat is the main purpose of budgeting in a company? A) To eliminate all expensesB) To forecast and control costsC) To increase revenueD) To reduce taxesarrow_forwardWhat does "liquidity" refer to in finance? A) The profitability of a companyB) The ease of converting assets to cashC) The value of fixed assetsD) The number of outstanding sharesarrow_forward

- I need answer in this problem quickly. The Weighted Average Cost of Capital (WACC) includes: A) Cost of equity and cost of debtB) Only the cost of equityC) Only the cost of debtD) Total revenue of the companyarrow_forwardHelp me in this question. The Weighted Average Cost of Capital (WACC) includes: A) Cost of equity and cost of debtB) Only the cost of equityC) Only the cost of debtD) Total revenue of the companyarrow_forwardNeed answer! The Weighted Average Cost of Capital (WACC) includes: A) Cost of equity and cost of debtB) Only the cost of equityC) Only the cost of debt D) Total revenue of the companyarrow_forward

- The Weighted Average Cost of Capital (WACC) includes: A) Cost of equity and cost of debtB) Only the cost of equityC) Only the cost of debtD) Total revenue of the companyarrow_forwardWhich of these is NOT part of the 4Ps in marketing but relevant to finance? A) PriceB) PromotionC) PlaceD) Profitabilityarrow_forwardI need correct answer. If a bond’s price increases, its yield will: A) IncreaseB) DecreaseC) Remain the sameD) Be unpredictablearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License