Concept explainers

>Continuing Problem

P7-30 Using all journals

This problem continues the Daniels Consulting situation. Daniels Consulting performs systems consulting. Daniels has also begun selling accounting software and uses the perpetual inventory system to account for software inventory. During January 2017, Daniels completed the following transactions:

Jan. 2 Completed a consulting engagement and received cash of $5,700.

2 Prepaid three months office rent, $2,400.

7 Purchased 50 units software inventory on account from Miller Co., $1,050, plus freight in, $50.

18 Sold 40 software units on account to Jason Needle, $2,625 (cost, $880).

19 Consulted with a client, Louis Frank, for a fee of $2,500 on account. (Use general journal.)

20 Paid employee salaries, $1,885, which includes accrued salaries from December of $685. Paid Miller Co. on account, $1,100. There was no discount.

21 Purchased 185 units software inventory on account from Whitestone Co., $4,810. Received bill and paid utilities, $375.

22 Sold 135 units software for cash, $5,265 (cost, $3,470).

24 Recorded the following

- Accrued salaries expense, $775

Depreciation on Equipment, $60; Depreciation on Furniture, $50- Expiration of prepaid rent, $800

- Physical count of software inventory, 50 units, $1,300

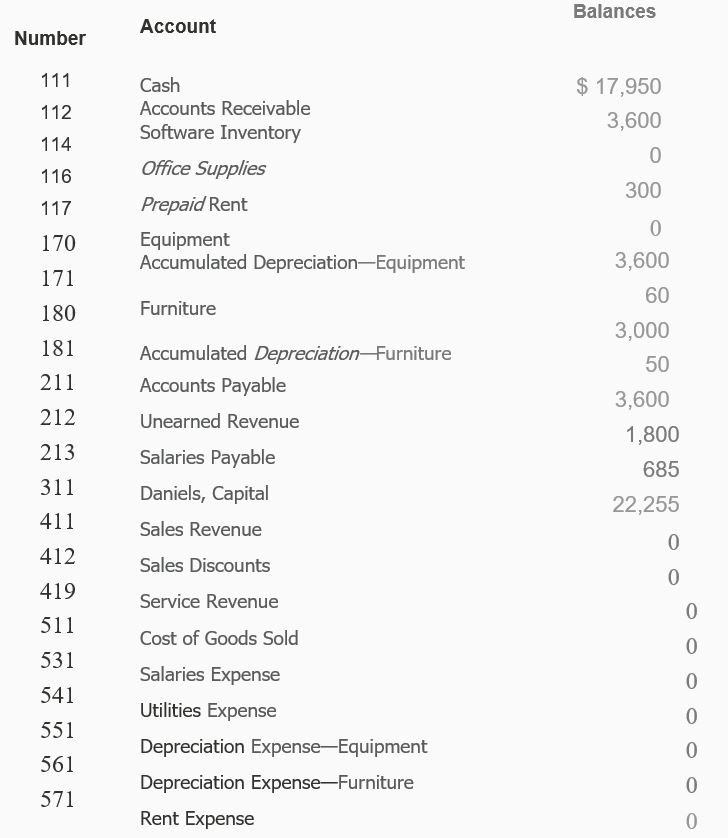

Daniels Consulting had the following

selected accounts with account numbers and normal balances:

Requirements

- Use the appropriate journal to record the preceding transactions in a sales journal (omit the Invoice No. column), a cash receipts journal, a purchases journal, a cash payments journal (omit the Check No. column), and a general journal.

- Total each column of the special journals. Show that total debits equal total credit in each special journal.

- Show how postings would be made from the journals by writing the account numbers and check marks in the appropriate places in the journals.

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Horngren's Accounting, Student Value Edition Plus MyAccountingLab with Pearson eText, Access Card Package

- The industrial enterprise "HUANG S.A." purchased a sorting and packaging machine from a foreign company on 1/4/2017 at a cost of €500,000. The useful life of the machine was estimated by the Management at ten (10) years, while the residual value was estimated at zero. For the transportation of the machine from abroad to the company's factory, the amount of €20,000 was paid on 15/4/2017. As the insurance coverage of the machine during transportation was the responsibility of the selling company, HUANG S.A. proceeded to insure the machine from 16/4/2017 to 15/4/2018, paying the amount of €1,200. The delivery took place on 15/4/2017. As adequate ventilation of the multifunction device is essential for its proper operation, the company fitted an air duct on the multifunction device. The cost of the air duct amounted to €2,000 and was paid on 20/4/2017. On 25/4/2017, an external electrician was paid €5,000 for the electrical connection of the device. The company also paid €5,000 to an…arrow_forwardI need answer typing clear urjent no chatgpt used pls i will give 5 Upvotes.only typing .arrow_forwardCash flow cyclearrow_forward

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegePrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College