Using all journals, posting, and balancing the ledgers

Oxford Computer Security uses the perpetual inventory system and makes all credit sales on terms of 2/10, n/30. Oxford completed the following transactions during May:

May 2 Issued invoice no. 913 for sale on account to K. D. Kerwin, $2,900. Oxford's cost of this merchandise inventory was $1,400.

3 Purchased merchandise inventory on credit terms of 3/10, n/60 from Habile Co., $2,800.

5 Sold merchandise inventory for cash, $1,500 (cost, $650).

5 Issued check no. 532 to purchase furniture for cash, $2,550.

8 Collected interest revenue of $1,450.

9 Issued invoice no. 914 for sale on account to Burleson Co., $5,400 (cost, $2,600).

10 Purchased merchandise inventory for cash, $1,250, issuing check no. 533.

12 Received cash from K. D. Kerwin in full settlement of her account receivable from the sale on May 2.

13 Issued check no. 534 to pay Habile Co. the net amount owed from May 3. Round to the nearest dollar.

13 Purchased office supplies on account from Marszalek, Inc., $400. Terms were n/EOM.

15 Sold merchandise inventory on account to M. O. Samson, issuing invoice no. 915 for $900 (cost, $300).

17 Issued credit memo to M. O. Samson for $900 for merchandise inventory returned by Samson. Also accounted for receipt of the merchandise inventory at cost.

18 Issued invoice no. 916 for credit sale to K. D. Kerwin, $600 (cost, $100).

19 Received $5,292 from Burleson Co. in full settlement of its account receivable from May 9. Burleson earned a discount by paying early.

20 Purchased merchandise inventory on credit terms of net 30 from Saari Distributing, $2,350.

22 Purchased furniture on credit terms of 3/10, n/60 from Habile Co., $600.

22 Issued check no. 535 to pay for insurance coverage, debiting Prepaid Insurance for $1,100.

24 Sold office supplies to an employee for cash of $75, which was Oxford's cost.

25 Received bill and issued check no. 536 to pay utilities, $300.

28 Purchased merchandise inventory on credit terms of 2/10, n/30 from Marszalek, Inc., $600.

29 Returned damaged merchandise inventory to Marszalek, Inc., issuing a debit memo for $600.

29 Sold merchandise inventory on account to Burleson Co., issuing invoice no. 917 for $3,300 (cost, $1,200).

30 Issued check no. 537 to pay Marszalek, Inc. in full for May 13 purchase.

31 Received cash in full from K. D. Kerwin on credit sale of May 18. There was no discount.

31 Issued check no. 538 to pay monthly salaries of $2,050.

Requirements

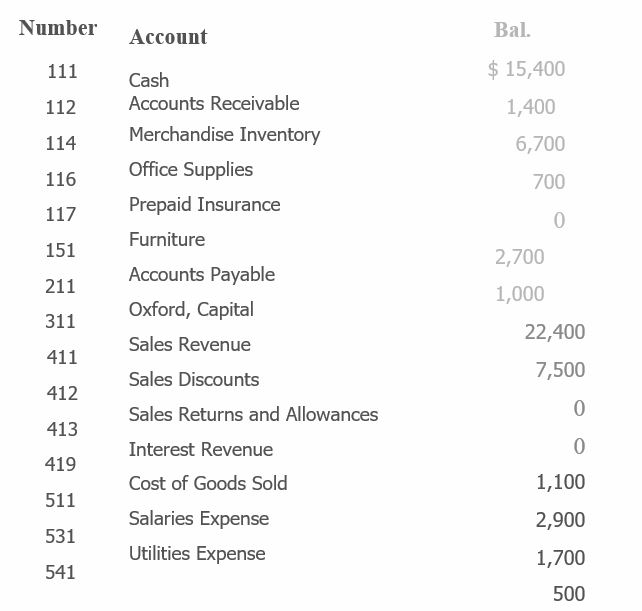

1. Open four-column general ledger accounts using Oxford’s account numbers and balances as of May 1, 2016, that follow. All accounts have normal balances.

2. Open four-column accounts in the subsidiary ledgers with beginning balances as of May 1, if any:

3. Enter the transactions in a sales journal (page 7), a cash receipts journal (page 5), a purchases journal (page 10), a cash payments journal (page 8), and a general journal (page 6), as appropriate.

4. Post daily to the accounts receivable subsidiary ledger and to the accounts payable subsidiary ledger.

5. Total each column of the special journals. Show that total debits equal total credits in each special journal. On May 31, post to the general ledger.

6. Prepare a

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

MyLab Accounting with Pearson eText -- Access Card -- for Horngren's Accounting

- Question 3Footfall Manufacturing Ltd. reports the following financial information at the end of the current year: net sale $100 000 debtor's turnover ration (based on net sales) 2 inventory turnover ration 1.25 fixed assets turnover ratio 0.8 debt to assets ratio 0.6 net profit margin 5% gross profit margin 25% return on investment 2% Use the given information to fill out the templates for income statement and balance sheet given below: Income Statement of Footfall Manufacturing Ltd. for the year ending December 31, 20XX(in $) sales 100,000 cost of goods sold gross profit other expenses earnings before tax tax @50% earnings after tax Balance Sheet of Footfall Manufacturing Ltd. as at December 31, 20XX (in $) liabilities amount assets amount equity net fixed assets long term debt 50, 000 inventory short term debt debtors…arrow_forwardfinal answer.arrow_forwardHow many weeks of supply does summit logistics Inc. Hold ? Accounting questionarrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College