Concept explainers

Variable and Absorption Costing Unit Product Costs and Income Statements L07—1, L07—2, L07—3

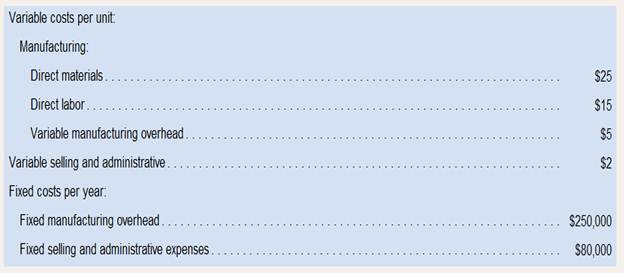

Walsh Company manufactures and sells one product. The following information pertains to each of the company’s first two ears ofoperations:

During its first year of operations, Walsh produced 50,000 units and sold 40,000 units. During its second year of operations, it produced40,000 units and sold 50,000 units. The selling price of the company’s product is $60 per unit.

Required:

1. Assume the company uses variable costing:

a. Compute the unit product cost for Year 1 and Year 2.

b. Prepare an income statement for Year 1 and Year 2.

2. Assume the company uses absorption costing:

a. Compute the unit product cost for Year 1 and Year 2.

b. Prepare an income statement for Year 1 and Year 2.

3. Explain the difference between variable costing and absorption costing net operating income in Year 1. Also, explain why the two netoperating incomes differ in Year 2.

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

BREWER ND LL INTRO MGRL ACTG CON+ AC

- Accounting solutionarrow_forwardJoe and Ethan each own 50% of JH Corporation, a calendar year taxpayer. Distributions from JH are: $750,000 to Joe on April 1 and $250,000 to Ethan on May 1. JH’s current E & P is $300,000 and its accumulated E & P is $600,000. How much of the accumulated E & P is allocated to Ethan’s distribution? a. $0b. $75,000c. $150,000d. $300,000e. None of the above b or c?arrow_forwardPlease provide the accurate answer to this general accounting problem using appropriate methods.arrow_forward

- I need guidance with this general accounting problem using the right accounting principles.arrow_forwardPlease provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forward

- JH Corporation is a calendar year taxpayer formed in 2014 JH’s E & P before distributions for each of the past 5 years is listed below. 2018 $28,000 2017 $40,000 2016 $39,000 2015 $68,000 2014 $16,000 JH Corporation made the following distributions in the previous 5 years. 2017 Land (basis of $70,000, fair market value of $80,000) 2014 $20,000 cash JH’s accumulated E & P as of January 1, 2019 is: a. $91,000.b. $95,000.c. $101,000. d. $105,000.e. None of the above.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease explain the solution to this general accounting problem with accurate explanations.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning