Concept explainers

Variable Costing Unit Product Cost and Income Statement; Break-Even Analysis L07—1, L07—2

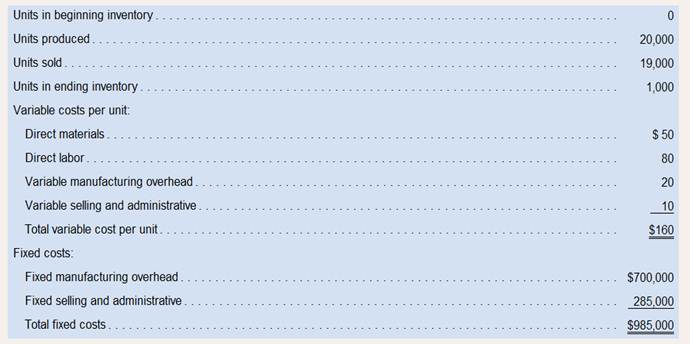

Chuck Wagon Grills, Inc., makes a single product a handmade specialty barbecue grill that it sells for $210. Data for last year's operations follow:

Required:

Assume that the company uses variable costing. Compute the unit product cost for one barbecue grill.

2. Assume that the company uses variable costing. Prepare a contribution format income statement for last year.

3. What is the company’s break-even point in terms of the number of barbecue grills sold?

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

BREWER ND LL INTRO MGRL ACTG CON+ AC

Additional Business Textbook Solutions

Essentials of MIS (13th Edition)

Marketing: An Introduction (13th Edition)

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Management (14th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Intermediate Accounting (2nd Edition)

- helparrow_forwardBansai, age 66, retires and receives a $1,450 per month annuity from his employer's qualified pension plan. Bansai made $87,600 of after-tax contributions to the plan before retirement. Under the simplified method, Bansai's number of anticipated payments is 240. What is the amount includible in income in the first year of withdrawals assuming 12 monthly payments? A. $10,560 B. $12,540 C. $17,400 D. $8,220arrow_forwardWhat is the cost of goods sold?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College