Effect of warranty obligations and payments on financial statements

The Chair Company provides a 120-day parts-and-labor warranty on all merchandise it sells. The Chair Company estimates the warranty expense for the current period to be $2,650. During the period a customer returned a product that cost $1,830 to repair.

Required

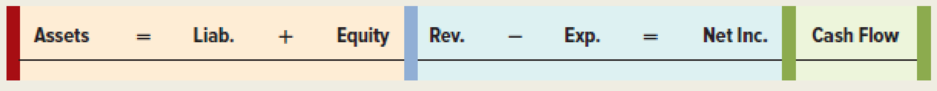

a. Show the effects of these transactions on the financial statements using a horizontal statements model like the example shown here. Use a + to indicate increase, a − for decrease, and NA for not affected. In the

b. Discuss the advantage of estimating the amount of warranty expense.

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

SURVEY OF ACCOUNT.(LL)-W/ACCESS>CUSTOM<

- Can you explain this general accounting question using accurate calculation methods?arrow_forwardI need guidance with this financial accounting problem using the right financial principles.arrow_forwardCan you explain the process for solving this financial accounting problem using valid standards?arrow_forward

- I need assistance with this financial accounting problem using valid financial procedures.arrow_forwardDirect labour cost variance: Northstar Manufacturing produces metal components. It takes 3 hours of direct labor to produce a component. Northstar's standard labor cost is $15 per hour. During August, Northstar produced 8,000 components and used 25,200 hours of direct labor at a total cost of $365,400. What is Northstar's labor rate variance for August?arrow_forwardHow much was Kaiser's net salesarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning