Concept explainers

Analyzing Keep-or-Drop Decision

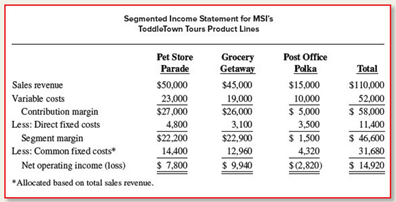

MSI is consider eliminating a product from its ToddleTown Tours collection. This collection is aimed at children one to three years of age and includes “tours” of a hypothetical town. Two products, The Pet Store Parade and The Grocery Getway, have impressive, sales. However, sales for the third CD in the collation. The Post Office Polka, have lagged the others. Several other CDs are planned for this collection, but none is ready for production.

MSI’s information related to the ToddleTown Tours collection follows:

MSI has determined that elimination of the Post Office Polka (POP) program would not impact sales of the two items. The remaining fixed

1. Will MSI’s net operating income increase or decrease if the POP product is eliminated? By how much?

2. Should MSI drop the POP product?

3. Suppose that $3,700 of the common fixed costs could be avoided if the POP product line were eliminated. Would your recommendation to MSI change? Why or why not?

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Managerial Accounting

- What type of account is “Accumulated Depreciation”? A) Contra-assetB) AssetC) ExpenseD) Revenuearrow_forwardI need correct solution with explanation A trial balance is used to: A) Prepare journal entriesB) Record cash transactionsC) Ensure debits equal creditsD) Close temporary accountsarrow_forwardA trial balance is used to: A) Prepare journal entriesB) Record cash transactionsC) Ensure debits equal creditsD) Close temporary accountsarrow_forward

- Get correct answer with accounting questionarrow_forwardIf a business pays rent in advance, what is the correct entry? A) Debit Rent Expense, Credit CashB) Debit Prepaid Rent, Credit CashC) Debit Cash, Credit Prepaid RentD) Debit Rent Payable, Credit Cashneed helparrow_forwardIf a business pays rent in advance, what is the correct entry? A) Debit Rent Expense, Credit CashB) Debit Prepaid Rent, Credit CashC) Debit Cash, Credit Prepaid RentD) Debit Rent Payable, Credit Casharrow_forward

- Information: A detailed market study revealed expected annual revenues of $300,000 for new earphones. Equipment to produce the earphones will cost $320,000. After 5 years, the equipment can be sold for $40,000. In addition to equipment, working capital is expected to increase by $40,000 because of increases in inventories and receivables. The firm expects to recover the investment in working capital at the end of the project's life. Annual cash operating expenses are estimated at $180,000. The required rate of return is 12%. Required: Estimate the annual cash flows, and calculate the NPV.arrow_forwardWhich of the following is not included in owner's equity? A) Retained EarningsB) Common StockC) Accounts PayableD) Additional Paid-in Capitaldont use aiarrow_forwardWhich of the following is not included in owner's equity? A) Retained EarningsB) Common StockC) Accounts PayableD) Additional Paid-in Capital help in tjarrow_forward

- Which of the following is not included in owner's equity? A) Retained EarningsB) Common StockC) Accounts PayableD) Additional Paid-in CapitalNo aiarrow_forwardDear expert dont give wrong answer I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwardWhich of the following is not included in owner's equity? A) Retained EarningsB) Common StockC) Accounts PayableD) Additional Paid-in Capitalcorrarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning