College Accounting - With Quickbooks 2015 CD and Access

12th Edition

ISBN: 9781305790254

Author: Scott

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7, Problem 7E

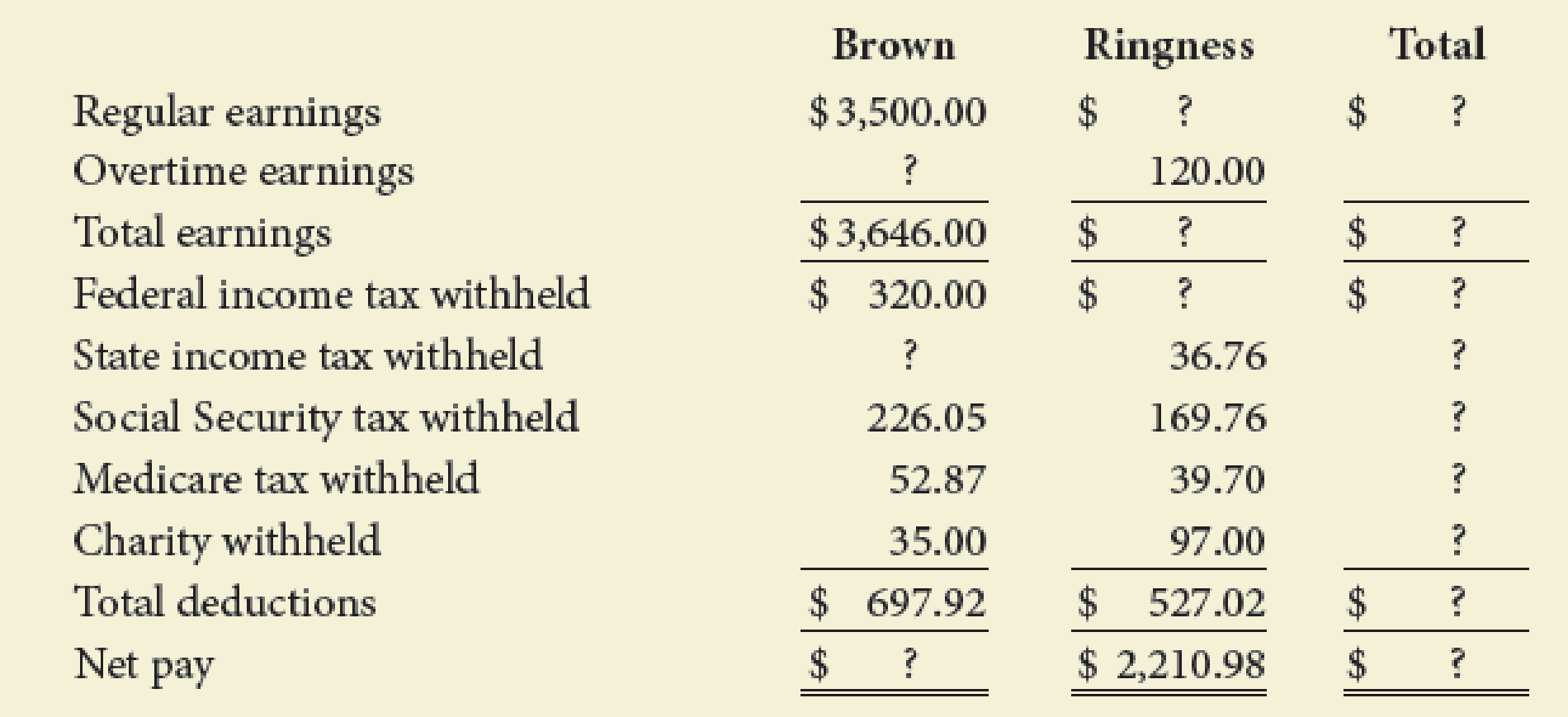

Precision Labs has two employees. The following information was taken from its individual earnings records for the month of September. Determine the missing amounts assuming that the Social Security tax is 6.2 percent, the Medicare tax is 1.45 percent, and the state income tax is 20 percent of the federal income tax. Assume that the employees are married and have one withholding allowance. All earnings are subject to Social Security and Medicare taxes. Round amounts to the nearest penny.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Need help with this question solution general accounting

Willow Inc. has $310,000 in accounts receivable on February 1. Budgeted sales for February are $1,050,000. Willow Inc. expects to sell 25% of its merchandise for cash. Of the remaining 75% of sales on account, 80% are expected to be collected in the month of sale and the remainder the following month. The February cash collections from sales are:

Please provide solution this financial accounting question not use ai

Chapter 7 Solutions

College Accounting - With Quickbooks 2015 CD and Access

Ch. 7 - Prob. 1QYCh. 7 - Which of the following taxes are not withheld from...Ch. 7 - Calculate an employees total earnings if the...Ch. 7 - Prob. 4QYCh. 7 - Prob. 5QYCh. 7 - Prob. 6QYCh. 7 - When is the payroll register updated? a. Annually...Ch. 7 - Prob. 1DQCh. 7 - Prob. 2DQCh. 7 - Prob. 3DQ

Ch. 7 - Explain the difference between gross earnings and...Ch. 7 - Prob. 5DQCh. 7 - Prob. 6DQCh. 7 - Prob. 7DQCh. 7 - Prob. 8DQCh. 7 - Prob. 1ECh. 7 - Prob. 2ECh. 7 - Prob. 3ECh. 7 - Prob. 4ECh. 7 - Prob. 5ECh. 7 - On January 21, the column totals of the payroll...Ch. 7 - Precision Labs has two employees. The following...Ch. 7 - Prob. 8ECh. 7 - Prob. 1PACh. 7 - Prob. 2PACh. 7 - Prob. 3PACh. 7 - Prob. 4PACh. 7 - Prob. 5PACh. 7 - Prob. 1PBCh. 7 - Prob. 2PBCh. 7 - Prob. 3PBCh. 7 - Prob. 4PBCh. 7 - Prob. 5PBCh. 7 - Attracting and retaining the best employees is...Ch. 7 - Southern Company pays its employees weekly by...Ch. 7 - Prob. 3A

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Calculate the amount of ending merchandise inventoryarrow_forwardWhat is the average cost per snowmobile with overhead?arrow_forwardI would like to know how these 3 questions are solved, and what the answers are. Based on the following information, calculate the expected return and standard deviation of returns for each of the following stocks. Assume that each state of the economy is equally likely to happen. What are the covariance and correlation between the returns of the two stocks? Economic state Return on stock A Return on stock A Bull 6% 23% Regular 12% 14% Bear 8% -7% Stock T has a beta of 0.75. If the T-bill rate is 4% and market rate of return is 11%, what would be the expected return on stock T? An asset has an expected rate of return of 13%. If the T-bill rate is 7% and the asset’s beta is 1.25, what would be the market rate of return? Assume that there are two portfolios, A and B, having expected returns of 14% and 15%, respectively. If the portfolios betas are 1 and 1.25, respectively what would be the risk-free rate (Rf)?arrow_forward

- Brighton Electronics sold 4,200 units in December at a sales price of $50 per unit. The variable cost is $30 per unit. Calculate the total contribution margin, the contribution margin percentage, and the contribution margin per unit. No AI ANSWERarrow_forwardWhat are some driving forces behind businesses deciding to change entities when new legislation for tax is introduced?arrow_forwardCompute chill spa's net income for 2021arrow_forward

- Determine of the companys inventoryarrow_forwardWhat is the dividend amount of these financial accounting question?arrow_forwardBrighton Electronics sold 4,200 units in December at a sales price of $50 per unit. The variable cost is $30 per unit. Calculate the total contribution margin, the contribution margin percentage, and the contribution margin per unit.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes; Author: Whats Up Dude;https://www.youtube.com/watch?v=fzK3KDDYCQw;License: Standard Youtube License