Connect 1 Semester Access Card for Fundamentals of Financial Accounting

5th Edition

ISBN: 9781259128547

Author: Fred Phillips Associate Professor, Robert Libby, Patricia Libby

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 7, Problem 7.9E

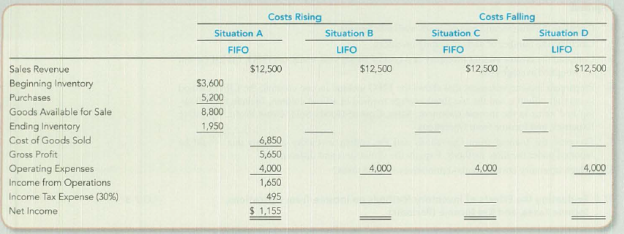

Choosing LIFO versus FIFO When Costs Are Rising and Falling

Use the following information to complete this exercise: sales, 550 units for 512,500; beginning inventory 300 units; purchases, 400 units; ending inventory, 150 units; and operating expenses, $4,000. Begin by setting up the following table and then complete the requirements that follow.

Required:

- 1. Complete the table for each situation. In Situations A and B (costs rising), assume the following: beginning inventory, 300 units at $12 = $3,600; purchases, 400 units at $13 $5,200. In Situations C and D (costs falling), assume the opposite; that is, beginning inventory, 300 units at $13 = $3,900; purchases, 400 units at $12 = $4,800. Use periodic inventory procedures.

- 2. Describe the relative effects on Income from Operations as demonstrated by requirement 1 when costs are rising and when costs are falling.

- 3. Describe the relative effects on Income Tax Expense for each situation.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The company had net sales of $63,000 and ending accounts receivable of $7,200 for the current period. Its days' sales uncollected equals how many days? (Round your answer to nearest number) Solve this

I am looking for help with this general accounting question using proper accounting standards.

I am looking for help with this general accounting question using proper accounting standards.

Chapter 7 Solutions

Connect 1 Semester Access Card for Fundamentals of Financial Accounting

Ch. 7 - What are three goals of inventory management?Ch. 7 - Describe the specific types of inventory reported...Ch. 7 - The chapter discussed four inventory costing...Ch. 7 - Which inventory cost flow method is most similar...Ch. 7 - Where possible, the inventory costing method...Ch. 7 - Contrast the effects of LIFO versus FIFO on ending...Ch. 7 - Contrast the income statement effect of LIFO...Ch. 7 - Several managers in your company are experiencing...Ch. 7 - Explain briefly the application of the LCM rule to...Ch. 7 - Prob. 10Q

Ch. 7 - You work for a made-to-order clothing company,...Ch. 7 - Prob. 12QCh. 7 - (Supplement 7B) Explain why an error in ending...Ch. 7 - Prob. 1MCCh. 7 - The inventory costing method selected by a company...Ch. 7 - Which of the following is not a name for a...Ch. 7 - Which of the following correctly expresses the...Ch. 7 - A New York bridal dress designer that makes...Ch. 7 - If costs are rising, which of the following will...Ch. 7 - Which inventory method provides a better matching...Ch. 7 - Prob. 8MCCh. 7 - An increasing inventory turnover ratio a....Ch. 7 - Prob. 10MCCh. 7 - Matching Inventory Items to Type of Business Match...Ch. 7 - Prob. 7.2MECh. 7 - Reporting Inventory-Related Accounts in the...Ch. 7 - Matching Financial Statement Effects to Inventory...Ch. 7 - Matching Inventory Costing Method Choices to...Ch. 7 - Prob. 7.6MECh. 7 - Prob. 7.7MECh. 7 - Prob. 7.8MECh. 7 - Prob. 7.9MECh. 7 - Prob. 7.10MECh. 7 - Determining the Effects of Inventory Management...Ch. 7 - Interpreting LCM Financial Statement Note...Ch. 7 - Calculating the Inventory Turnover Ratio and Days...Ch. 7 - Prob. 7.14MECh. 7 - Prob. 7.15MECh. 7 - Prob. 7.16MECh. 7 - Prob. 7.17MECh. 7 - Reporting Goods in Transit and Consignment...Ch. 7 - Determining the Correct Inventory Balance Seemore...Ch. 7 - Determining the Correct Inventory Balance Seemore...Ch. 7 - Calculating Cost of Ending Inventory and Cost of...Ch. 7 - Calculating Cost of Ending Inventory and Cost of...Ch. 7 - Prob. 7.6ECh. 7 - Analyzing and Interpreting the Financial Statement...Ch. 7 - Evaluating the Effects of Inventory Methods on...Ch. 7 - Choosing LIFO versus FIFO When Costs Are Rising...Ch. 7 - Prob. 7.10ECh. 7 - Prob. 7.11ECh. 7 - Prob. 7.12ECh. 7 - Prob. 7.13ECh. 7 - Analyzing and Interpreting the Effects of the...Ch. 7 - Prob. 7.15ECh. 7 - Analyzing and Interpreting the Financial Statement...Ch. 7 - Prob. 7.17ECh. 7 - Analyzing the Effects of Four Alternative...Ch. 7 - Evaluating the Income Statement and Income Tax...Ch. 7 - Prob. 7.3CPCh. 7 - Prob. 7.4CPCh. 7 - (Supplement 7B) Analyzing and Interpreting the...Ch. 7 - Analyzing the Effects of Four Alternative...Ch. 7 - Prob. 7.2PACh. 7 - Prob. 7.3PACh. 7 - Prob. 7.4PACh. 7 - Prob. 7.5PACh. 7 - Prob. 7.1PBCh. 7 - Evaluating the income Statement and Income Tax...Ch. 7 - Prob. 7.3PBCh. 7 - Prob. 7.4PBCh. 7 - (Supplement 7B) Analyzing and Interpreting the...Ch. 7 - Prob. 7.1COPCh. 7 - Prob. 7.2COPCh. 7 - Prob. 7.3COPCh. 7 - Prob. 7.1SDCCh. 7 - Prob. 7.2SDCCh. 7 - Critical Thinking: Income Manipulation under the...Ch. 7 - Accounting for Changing Inventory Costs In...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning  Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License