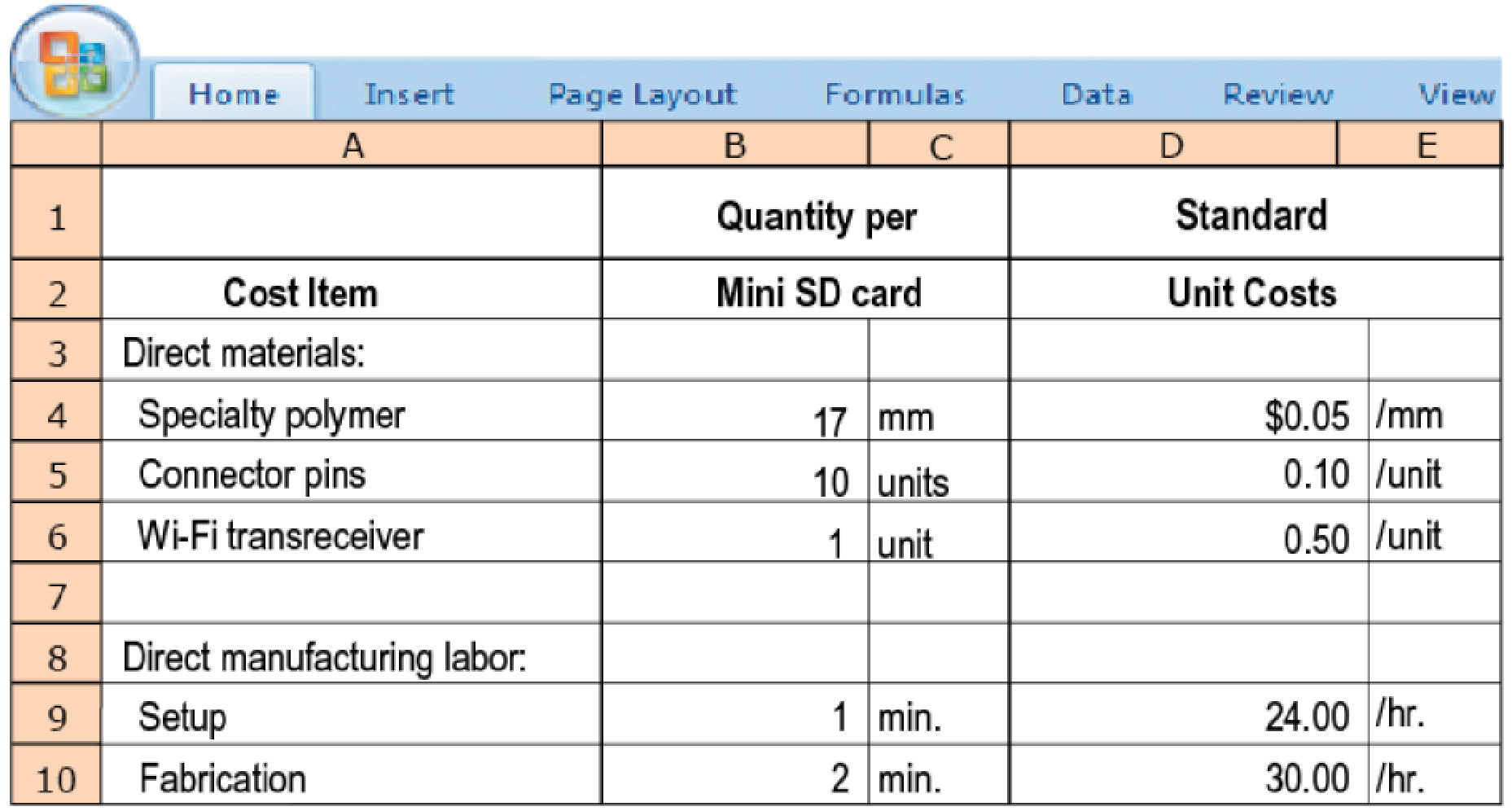

Direct-cost and selling price variances. MicroDisk is the market leader in the Secure Digital (SD) card industry and sells memory cards for use in portable devices such as mobile phones, tablets, and digital cameras. Its most popular card is the Mini SD, which it sells through outlets such as Target and Walmart for an average selling price of $8. MicroDisk has a standard monthly production level of 420,000 Mini SDs in its Taiwan facility. The standard input quantities and prices for direct-cost inputs are as follows:

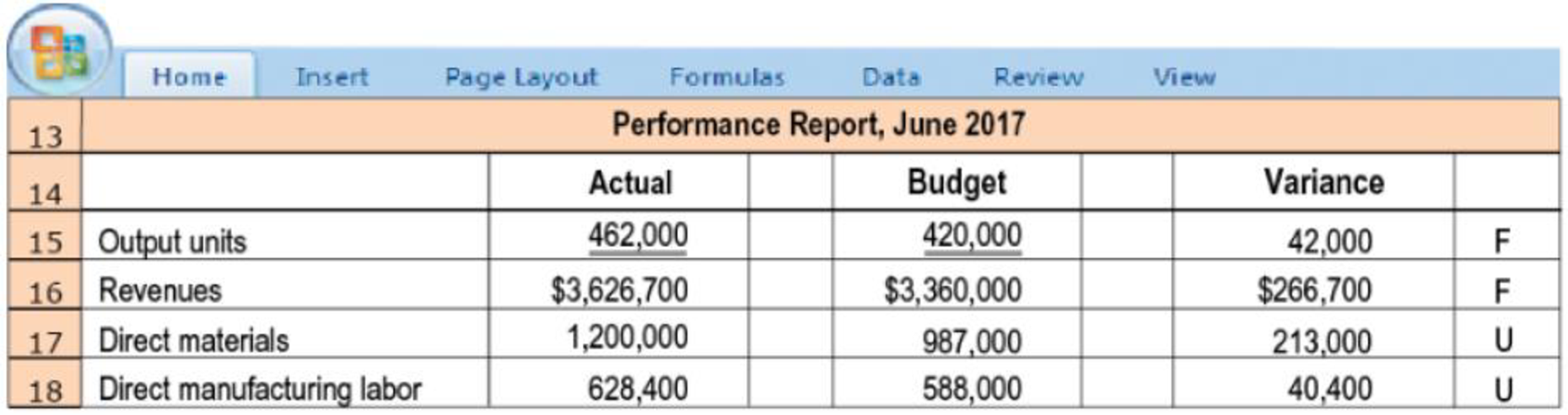

Phoebe King, the CEO, is disappointed with the results for June 2017, especially in comparison to her expectations based on the

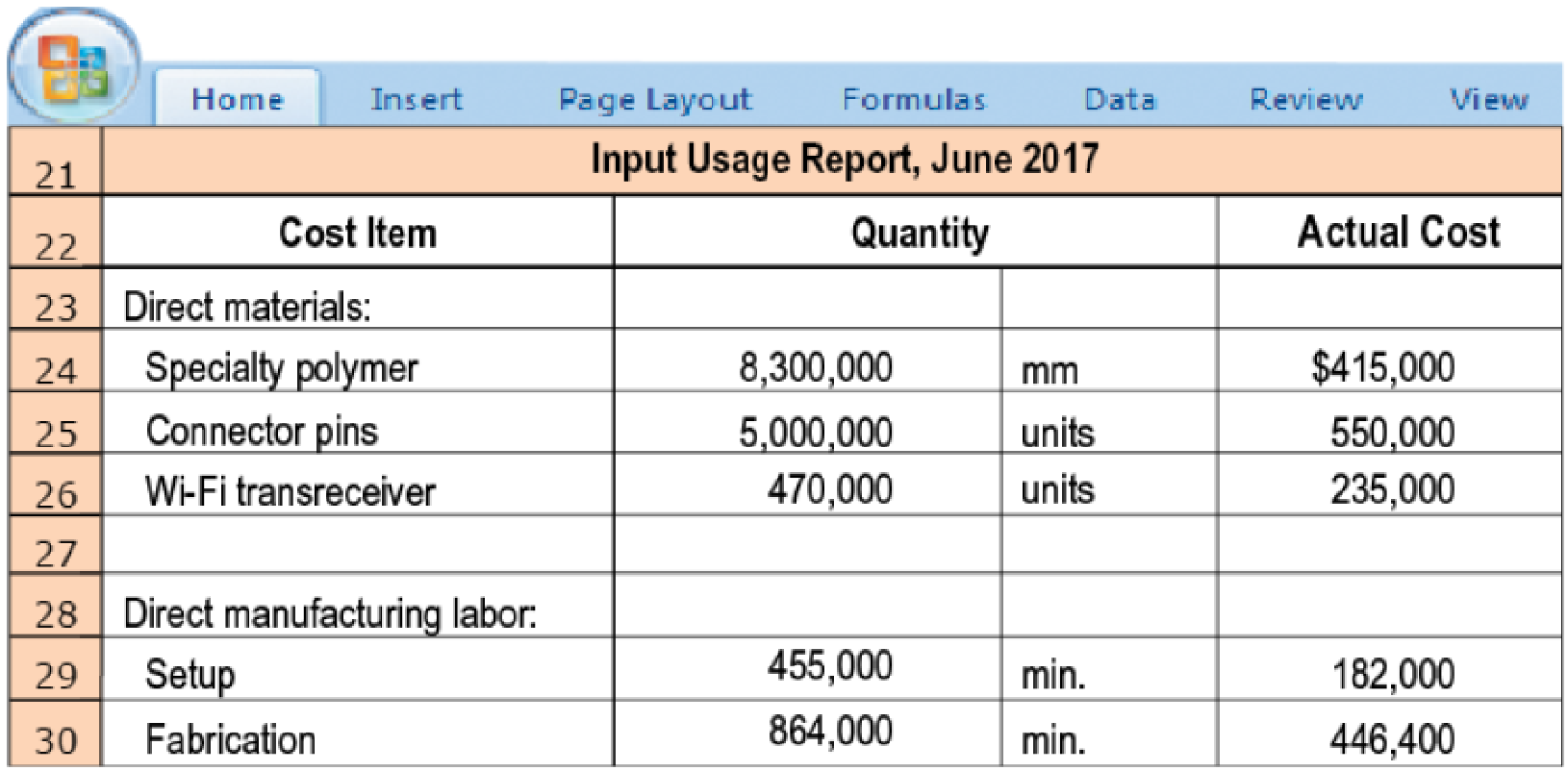

King observes that despite the significant increase in the output of Mini SDs in June, the product’s contribution to the company’s profitability has been lower than expected. She gathers the following information to help analyze the situation:

Calculate the following variances. Comment on the variances and provide potential reasons why they might have arisen, with particular attention to the variances that may be related to one another:

- 1. Selling-price variance

- 2. Direct materials price variance, for each category of materials

- 3. Direct materials efficiency variance, for each category of materials

- 4. Direct manufacturing labor price variance, for setup and fabrication

- 5. Direct manufacturing labor efficiency variance, for setup and fabrication

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

COST ACCOUNTING

- I need a expert not AI Step Amount Category Inventory 1. Beginning Balance, January 1 28,000 Beginning Balance Raw Materials 2. (+) Purchases (RM Purchases) 220,000 Addition Raw Materials 3. (-) Ending Balance 20,000 Ending Balance Raw Materials 4. = Transferred Out (RM used) (228,000) Transferred Out Raw Materials 5. (+) Direct Labor (152,000) Transferred Out Direct Labor 6. (+) Fixed Overhead 300,000 Addition Overhead 7. (+) Variable Overhead - Addition Overhead 8. = Total Factory Overhead (390,000) Transferred Out Overhead 9. Beginning Balance, January 1 40,000 Beginning Balance WIP 10. (+) Additions (RM used) 228,000 Addition WIP 11. (+) Additions (DL used) 152,000 Addition WIP 12. (+) Additions (OH used) 390,000 Addition WIP 13. (-) Ending Balance, December 31 55,000 Ending Balance WIP 14. = Transferred Out (COGM) (755,000)…arrow_forwardStep Amount Category Inventory 1. Beginning Balance, January 1 28,000 Beginning Balance Raw Materials 2. (+) Purchases (RM Purchases) 220,000 Addition Raw Materials 3. (-) Ending Balance 20,000 Ending Balance Raw Materials 4. = Transferred Out (RM used) (228,000) Transferred Out Raw Materials 5. (+) Direct Labor (152,000) Transferred Out Direct Labor 6. (+) Fixed Overhead 300,000 Addition Overhead 7. (+) Variable Overhead - Addition Overhead 8. = Total Factory Overhead (390,000) Transferred Out Overhead 9. Beginning Balance, January 1 40,000 Beginning Balance WIP 10. (+) Additions (RM used) 228,000 Addition WIP 11. (+) Additions (DL used) 152,000 Addition WIP 12. (+) Additions (OH used) 390,000 Addition WIP 13. (-) Ending Balance, December 31 55,000 Ending Balance WIP 14. = Transferred Out (COGM) (755,000) Transferred Out WIP 15.…arrow_forwardIntroduce yourself to your peers by sharing something unique about your background. Explain how you expect this course will help you move forward in your current or future career.arrow_forward

- Step Amount Category Inventory 1. Beginning Balance, January 1 28,000 Beginning Balance Raw Materials 2. (+) Purchases (RM Purchases) 220,000 Addition Raw Materials 3. (-) Ending Balance 20,000 Ending Balance Raw Materials 4. = Transferred Out (RM used) (228,000) Transferred Out Raw Materials 5. (+) Direct Labor (152,000) Transferred Out Direct Labor 6. (+) Fixed Overhead 300,000 Addition Overhead 7. (+) Variable Overhead - Addition Overhead 8. = Total Factory Overhead (390,000) Transferred Out Overhead 9. Beginning Balance, January 1 40,000 Beginning Balance WIP 10. (+) Additions (RM used) 228,000 Addition WIP 11. (+) Additions (DL used) 152,000 Addition WIP 12. (+) Additions (OH used) 390,000 Addition WIP 13. (-) Ending Balance, December 31 55,000 Ending Balance WIP 14. = Transferred Out (COGM) (755,000) Transferred Out WIP 15.…arrow_forward1. Beginning Balance, January 1 28,000 Beginning Balance Raw Materials 2. (+) Purchases (RM Purchases) 220,000 Addition Raw Materials 3. (-) Ending Balance 20,000 Ending Balance Raw Materials 4. = Transferred Out (RM used) (228,000) Transferred Out Raw Materials 5. (+) Direct Labor (152,000) Transferred Out Direct Labor 6. (+) Fixed Overhead 300,000 Addition Overhead 7. (+) Variable Overhead ? Addition Overhead 8. = Total Factory Overhead (390,000) Transferred Out Overhead 9. Beginning Balance, January 1 40,000 Beginning Balance WIP 10. (+) Additions (RM used) 228,000 Addition WIP 11. (+) Additions (DL used) 152,000 Addition WIP 12. (+) Additions (OH used) 390,000 Addition WIP 13. (-) Ending Balance, December 31 55,000 Ending Balance WIP 14. = Transferred Out (COGM) (755,000) Transferred Out WIP 15. Beginning Balance, January 1…arrow_forwardPalladium, Incorporated recently lost a portion of its records in an office fire. The following information was salvaged from the accounting records. Cost of Goods Sold $ 67,000 Work-in-Process Inventory, Beginning 11,300 Work-in-Process Inventory, Ending 9,400 Selling and Administrative Expense 16,000 Finished Goods Inventory, Ending 16,100 Finished Goods Inventory, Beginning ?question mark Direct Materials Used ?question mark Factory Overhead Applied 12,400 Operating Income 14,220 Direct Materials Inventory, Beginning 11,180 Direct Materials Inventory, Ending 6,140 Cost of Goods Manufactured 61,880 Direct labor cost incurred during the period amounted to 1.5 times the factory overhead. The Chief Financial Officer of Palladium, Incorporated has asked you to recalculate the following accounts and to report to him by the end of the day. What is the amount in the finished goods inventory at the beginning of the year?arrow_forward

- Which of the following statements is incorrect regarding manufacturing overhead? Multiple Choice Manufacturing overhead includes both fixed and variable costs. Manufacturing overhead is an indirect cost to units or products. Actual overhead costs are used in the cost accounting process. Actual overhead costs tend to remain relatively constant over various output levels.arrow_forwardPalladium, Incorporated recently lost a portion of its records in an office fire. The following information was salvaged from the accounting records. Cost of Goods Sold $ 72,500 Work-in-Process Inventory, Beginning 13,500 Work-in-Process Inventory, Ending 10,500 Selling and Administrative Expense 18,750 Finished Goods Inventory, Ending 19,125 Finished Goods Inventory, Beginning ?question mark Direct Materials Used ?question mark Factory Overhead Applied 13,500 Operating Income 14,825 Direct Materials Inventory, Beginning 11,675 Direct Materials Inventory, Ending 6,525 Cost of Goods Manufactured 67,050 Direct labor cost incurred during the period amounted to 1.5 times the factory overhead. The Chief Financial Officer of Palladium, Incorporated has asked you to recalculate the following accounts and to report to him by the end of the day. What is the amount of direct materials purchased?arrow_forwardOn December 31, 2022, Akron, Incorporated, purchased 5 percent of Zip Company's common shares on the open market in exchange for $15,650. On December 31, 2023, Akron, Incorporated, acquires an additional 25 percent of Zip Company's outstanding common stock for $93,500. During the next two years, the following information is available for Zip Company: Year Income Dividends Declared Common Stock Fair Value (12/31) 2022 $ 313,000 2023 $ 70,000 $ 7,800 374,000 2024 90,000 15,100 476,000 At December 31, 2023, Zip reports a net book value of $294,000. Akron attributed any excess of its 30 percent share of Zip's fair over book value to its share of Zip's franchise agreements. The franchise agreements had a remaining life of 10 years at December 31, 2023. Required: Assume Akron applies the equity method to its Investment in Zip account: What amount of equity income should Akron report for 2024? On Akron's December 31, 2024, balance sheet, what amount is reported for the…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education